Hotels are getting creative...

Hotels are getting creative...

In the November 11 Altimetry Daily Authority, we explained how "staycations" are helping keep the industry afloat. These are local trips, where travelers stay closer to home.

But capitalizing off staycations isn't the only way hotels are fighting headwinds from the coronavirus pandemic. As Bloomberg recently discussed, hotels are turning to some other innovative tactics...

Marriott (MAR) is focusing on servicing "digital nomads" by allowing guests to book rooms just for the day, without any overnight stays. This gives folks working remotely a change of scenery during work hours. Other programs involve child care solutions while parents are at work.

Competitors Hilton (HLT) and Hyatt Hotels (H) are marketing rooms as makeshift offices for businesses. They also offer cheap lodging to college students, first responders, and medical personnel.

It's been a brutal year for the hotel industry... so these businesses have to adapt to make up for lost travel revenue. This involves thinking outside the box and targeting these newly minted nomads looking for an escape from the home.

Here at Altimetry, one of our own employees, Kyle, is taking on the role of digital nomad. With his apartment lease in Chicago having expired, he's spending this month living in western Massachusetts to get a change of scenery. Next month, he'll decide on a new place to live and work... and take it from there.

Hotels adjusting to cater to staycations and digital nomads are better positioned to survive the current environment and might end up creating an entirely new revenue sources after the pandemic to boost profitability.

One of these companies could be Wyndham Hotels & Resorts (WH)...

One of these companies could be Wyndham Hotels & Resorts (WH)...

Wyndham has always been a chain focused on quick, overnight stays compared to long "destination" stays. Some of the company's brands include Baymont, Ramada, La Quinta, Super 8, and Days Inn.

Wyndham generally focuses on domestic leisure travelers. More than 87% of its hotels in the U.S. are in "drivable" locations, which has insulated the company from some pandemic risk thanks to more staycations.

Additionally, Wyndham provides the ideal place for people to work if they lack a home office or similar arrangement. The lack of dependency on air travel means consumers can easily drive to a Wyndham hotel for the workday.

And as a franchisor, Wyndham owns just two of its 9,280 hotels. Franchising means it allows others to build hotels under the Wyndham brands in exchange for a small percentage of the profits.

Wyndham provides the brand name, marketing, and technical know-how in running the business. The franchisee puts up all of the capital and runs the day-to-day operations.

By making a smaller upfront investment and limiting direct exposure to fluctuations in demand, Wyndham is able to reduce its risk.

Therefore, investors might expect an "asset light" franchising business such as Wyndham to have high returns... but GAAP metrics tell a different story.

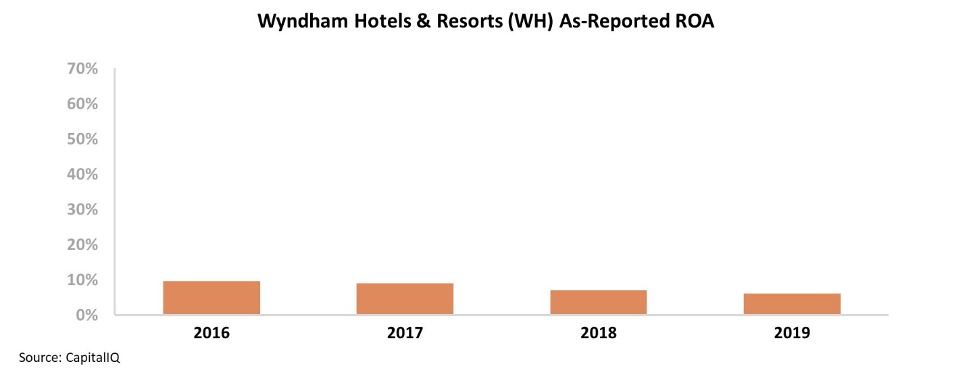

Wyndham's as-reported return on assets ("ROA") has been declining from 10% levels in 2016 to just 6% last year – right around cost-of-capital levels. Take a look...

Wyndham appears unable to capitalize on its asset-light business strategy to drive high returns... and that's before the pandemic even hit. These low returns have come under greater pressure in recent months. This year, Wyndham's ROA is forecasted to drop to 1%.

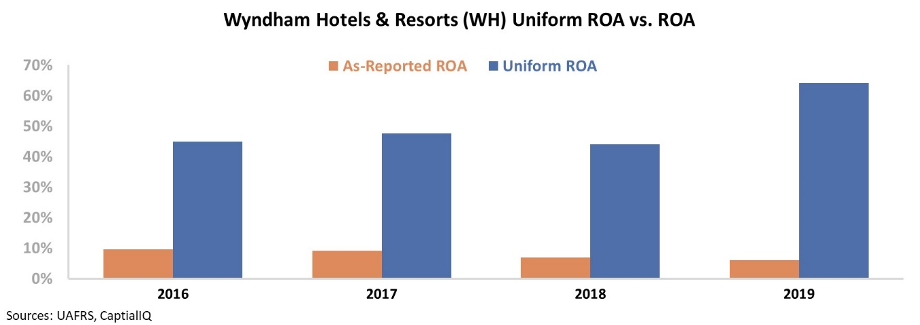

However, this picture of Wyndham's performance isn't accurate... and it's due to distortions in as-reported accounting, such as the treatment of goodwill. Wall Street is looking at bad numbers, so it has missed Wyndham's true profitability.

Uniform Accounting shows that, since 2016, Wyndham's real returns have been at least four times higher than the as-reported numbers indicate. Just last year, Wyndham's Uniform ROA was a robust 64% – more than 10 times its incorrect as-reported ROA of 6%. Additionally, the company's Uniform ROA has moved higher from 2016's 41% figure.

Wyndham has been able to capitalize on the low-cost structure and high growth business of franchising. Additionally, its Wyndham Rewards program has created brand loyalty for its hotels.

And today, a focus on drivable and affordable hotels should position the company to survive the pandemic.

But without Uniform Accounting, investors would miss the real story. They might see Wyndham as a firm with below-average returns instead of robust profitability.

Ultimately, the franchising business model and loyalty program has positioned Wyndham for success. As consumers look for alternative vacations and work environments, Wyndham's cheap and accessible hotels are set to benefit.

Regards,

Rob Spivey

December 9, 2020

Hotels are getting creative...

Hotels are getting creative...