Warren Buffett's annual shareholder letter reminds everyone about the problems of as-reported accounting...

Warren Buffett's annual shareholder letter reminds everyone about the problems of as-reported accounting...

Berkshire Hathaway (BRK-B) earned $81.4 billion last year, but Buffett still didn't sound satisfied in his recent 2019 annual letter...

It isn't that the legendary investor doesn't think $81.4 billion is enough... It's that he thinks that this number is deceiving, created by bad GAAP accounting rules that distort Berkshire's real performance.

Buffett has often railed against as-reported GAAP accounting. And in the 2019 letter, he coined a new phrase: these metrics the performance of his company in "accounting land," which he believes has nothing to do with Berkshire's "real world" performance.

It's not surprising that one of the greatest investors in the world doesn't believe in as-reported numbers and thinks they need to be fixed. GAAP accounting leads to garbage-in, garbage-out analysis.

It's exactly why we focus on Uniform Accounting here at Altimetry. We want to see through the noise that as-reported metrics create for every company – including Berkshire.

And with our powerful Altimeter tool, we can do just that...

Using Uniform Accounting, we can determine the real numbers... and grade a firm accordingly in our database. In the case of Berkshire, it's no surprise that the company earns an "A" grade.

You can see grades for more than 1,860 companies for yourself with a subscription to The Altimeter... click here for more details.

We traditionally look for companies that keep growing in order to generate value...

We traditionally look for companies that keep growing in order to generate value...

There's perhaps no better example of this than e-commerce giant Amazon (AMZN).

And as we explained in the December 4 Altimetry Daily Authority, the company's transformation over the past decade shows the power of growth...

In 2011, Amazon had $4 billion in assets and a 40% Uniform return on assets ("ROA") – good for a profit of $1.6 billion. Over the next several years, the company's ROA fell by more than half – dropping to just 19% in 2018. This would likely be a cause for concern were it not for Amazon's growth...

The company grew its asset base by 30% to 70% annually, leaving it with nearly $85 billion in assets in 2018.

Doing the same math as in 2011, this means Amazon generated roughly $16 billion in profits in 2018 – substantially higher than seven years before.

This is how we usually think about growth here at the Altimetry offices. However, not all growth is productive...

A trend in the consulting industry regarding growth can be traced back to a 2005 report published by consulting firm Bain called "Shrinking to Grow." The authors argue that for some mature companies, it actually makes sense to sell low-return assets to free up capital and pursue more profitable ventures.

But this idea itself has been around much longer than the "shrinking to grow" term...

It's exactly what the late Jack Welch did at General Electric (GE) when he sold 71 business units within his first two years as CEO. Louis Gerstner employed a similar strategy at IBM (IBM) during the 1990s and early 2000s.

By exiting stagnant businesses that weren't generating returns like they used to, these larger companies were able to grow by shrinking – short-term asset reduction led to long-term earnings and earning power (Uniform ROA) growth.

In the original Bain report, the authors discussed two consumer-products companies as case studies. Both Nestlé (NSRGY) and H.J. Heinz – now Kraft Heinz (KHC) – were able to prime their businesses for longer-term growth by reducing costs and streamlining certain businesses.

Nestlé transformed Buitoni from a stagnant dry-pasta maker into an innovative brand offering ready-made ravioli and sauce.

Heinz, on the other hand, sold market-leading StarKist tuna and used the capital to innovate in its core brands – including the invention of the upside-down, easy-squeeze ketchup bottle.

Another consumer-goods company has been recently attempting the "shrink to grow" strategy, but this doesn't appear to be yielding the desired effect...

Colgate-Palmolive (CL) has focused on right-sizing its business by shrinking underperforming assets.

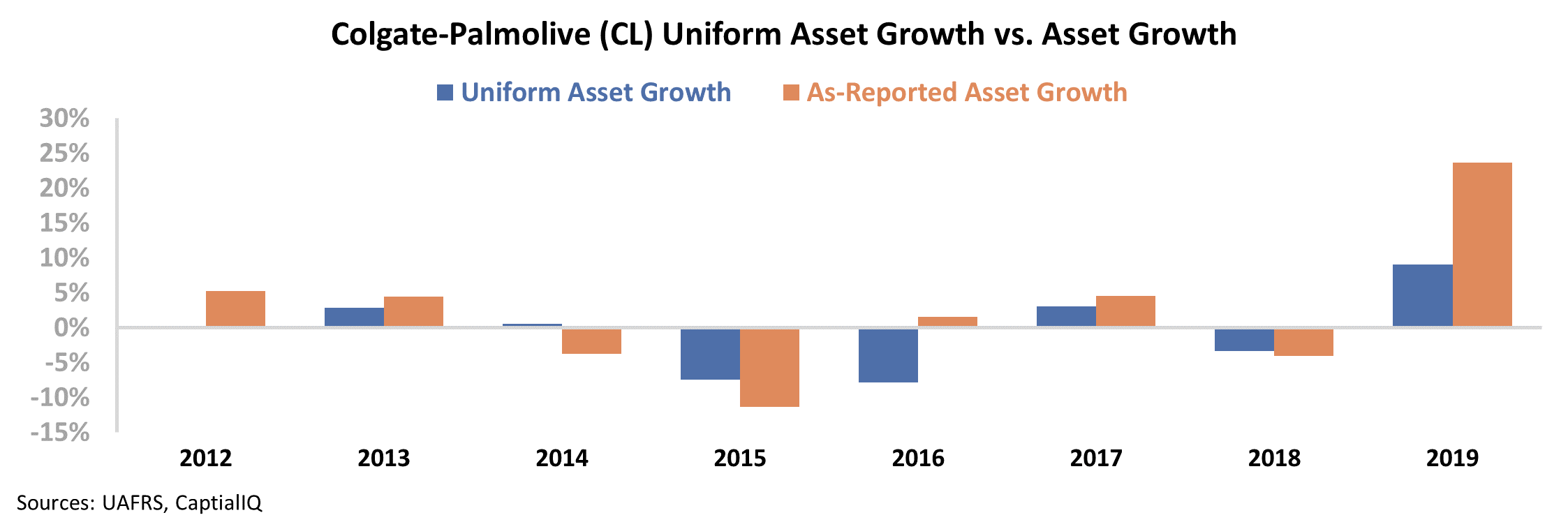

From 2014 through 2018, the company reduced its balance sheet in three years while barely growing in the other two. Asset growth jumped last year, but still remains low – with the Uniform number significantly lower than the as-reported number. This came from a combination of smart divestitures in its laundry business and significantly lower investment rates.

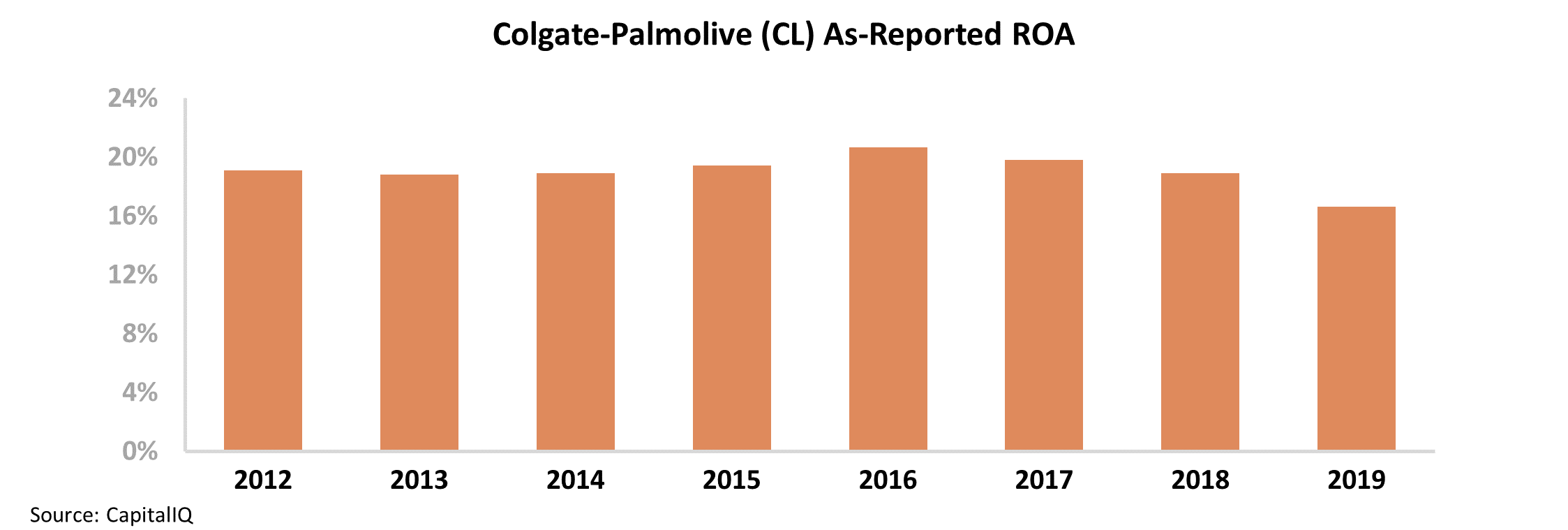

Unfortunately, the strategy looks like it hasn't played out well for Colgate-Palmolive. Since 2015, the company's as-reported ROA has declined to an eight-year low. Take a look...

Thinking back to the Amazon analogy, this means that Colgate-Palmolive is generating the same level of returns on a smaller asset base... which means earnings are falling.

This isn't the type of impact investors were hoping for.

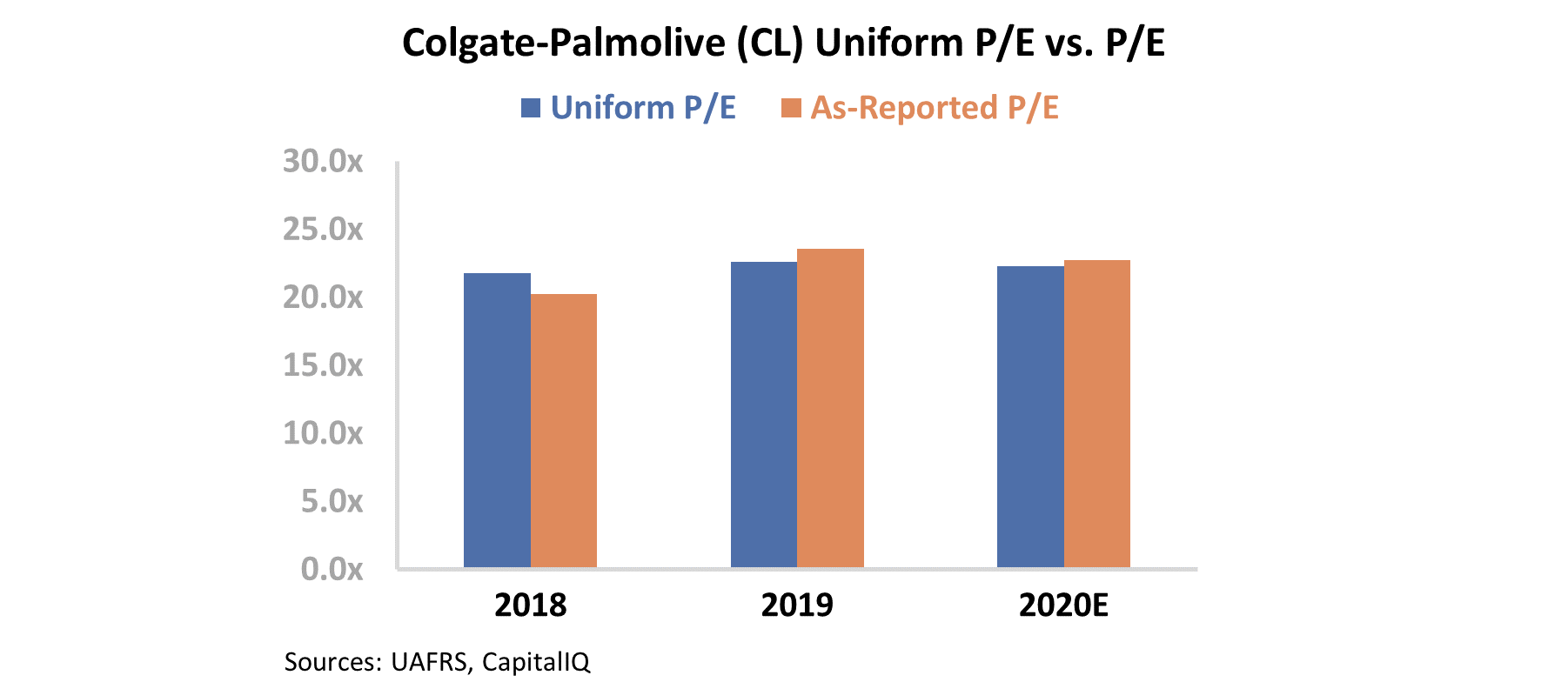

That said, valuations for the company remain high on both a traditional and Uniform basis. Colgate-Palmolive is currently trading at a price-to-earnings (P/E) ratio of roughly 23 – above market-average levels around 20.

This implies that the market expects Colgate-Palmolive's ROA or growth to accelerate in the coming year.

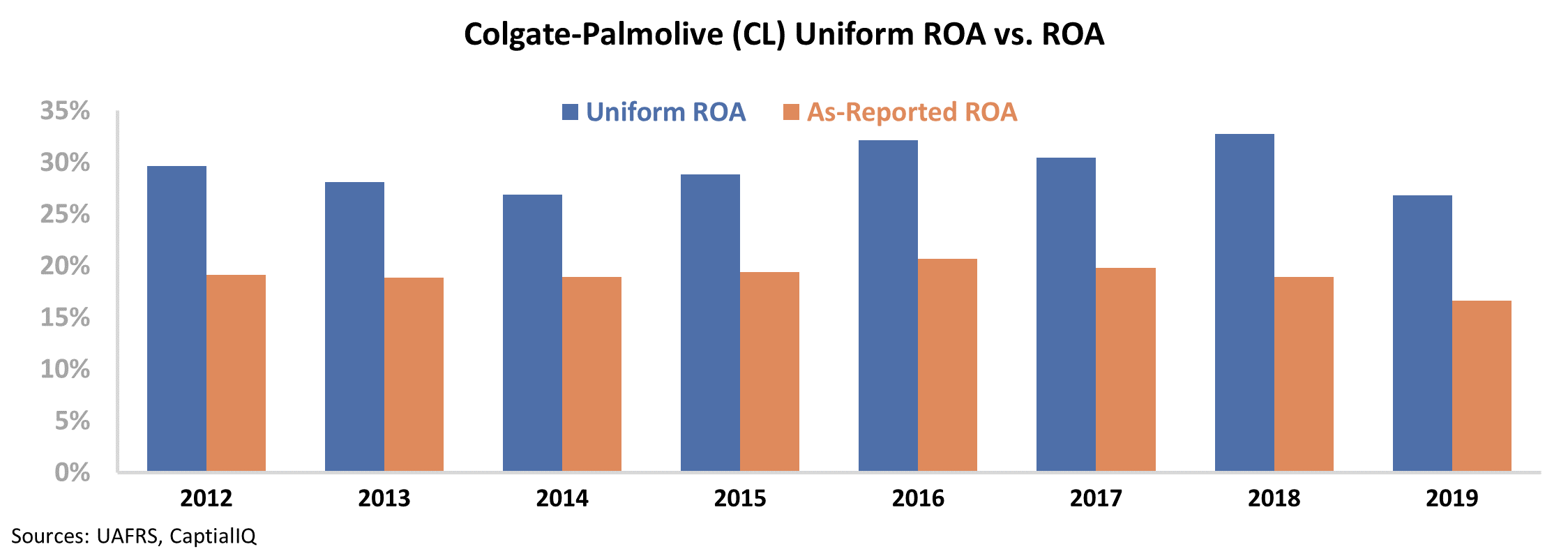

Looking at the as-reported numbers alone, this doesn't look like another successful example of the shrink-to-grow strategy. That said, Uniform Accounting metrics say differently...

Once we make the proper adjustments to the as-reported financial statements – adjusting for misleading practices like the treatment of goodwill, operating leases, and stock option expenses – we can see that Colgate-Palmolive has seen success from its recent strategy. Not only is the company's ROA higher than investors realize, but it has either improved or remained stable in each year since 2014...

Based on the Uniform figures, Colgate-Palmolive has been able to offset its declining asset base with higher returns – shrinking to grow.

The company finally grew its assets by 9% in 2019. Its ROA fell back to 2014 levels... But as Colgate-Palmolive continues focusing on growing into more profitable ventures, we can expect its profit generation to begin accelerating – which will justify its above-average valuations.

Without Uniform Accounting, it's not clear how to analyze the success of corporate strategies like shrinking to grow. Make sure you're looking at the best data possible.

Regards,

Joel Litman

March 11, 2020

Warren Buffett's annual shareholder letter reminds everyone about the problems of as-reported accounting...

Warren Buffett's annual shareholder letter reminds everyone about the problems of as-reported accounting...