Wave goodbye to those ugly, old office buildings...

Wave goodbye to those ugly, old office buildings...

There's a reckoning happening in commercial real estate ("CRE") – and it's making its way to the suburbs.

We've been warning you for a month and a half about the terror coming for the CRE world. CRE vacancy rates continue to climb... and almost 50% of CRE debt is floating-rate debt. So the interest rate on that debt is rising to the current market rate.

Declining rents and rising debt is a recipe for disaster in the CRE ecosystem. And yet, for all the doom and gloom, there's a positive side that people aren't talking about.

CRE firms are being forced to give up office spaces that should never have been offices in the first place.

You're probably picturing exactly what I'm talking about already... that fading brick or concrete structure that has been standing since the 1980s, all while a new residential area gets built around it.

It might have made sense 30 years ago. Yet with so much development since then, the building sticks out like a sore thumb.

For decades, it was impossible for anyone to do much about these eyesores. Now, developers are finally able to scoop them up and tear them down.

This could help kick off a wave of more rational investing. In the world of hybrid work, folks are looking for shared workspaces, new apartments, more green spaces, and entertainment options.

As we'll explain, this increased investment in suburban real estate has a hidden benefit... because even in a CRE-driven recession, not every industry tied to real estate will suffer.

Someone is going to have to fix a lot of old design mistakes...

Someone is going to have to fix a lot of old design mistakes...

That's why construction and engineering (C&E) companies may actually benefit in a CRE-driven recession.

Longtime subscribers have heard all about the supply-chain supercycle. We're in the midst of an investment wave in U.S. infrastructure as we bring our supply chains closer to home.

The supply-chain supercycle means a lot of new construction. It also means the revival of American industry. And it means changing ways we use spaces across the U.S... particularly those that have been misused in the past.

Even though CRE investment is slowing, C&E companies – and the companies that supply them – could actually benefit from better-than-expected demand in a recession.

We can see this through the First Trust RBA American Industrial Renaissance Fund (AIRR). AIRR comprises small- and mid-cap industrial companies such as Encore Wire (WIRE), Greenbrier (GBX), and Clean Harbors (CLH).

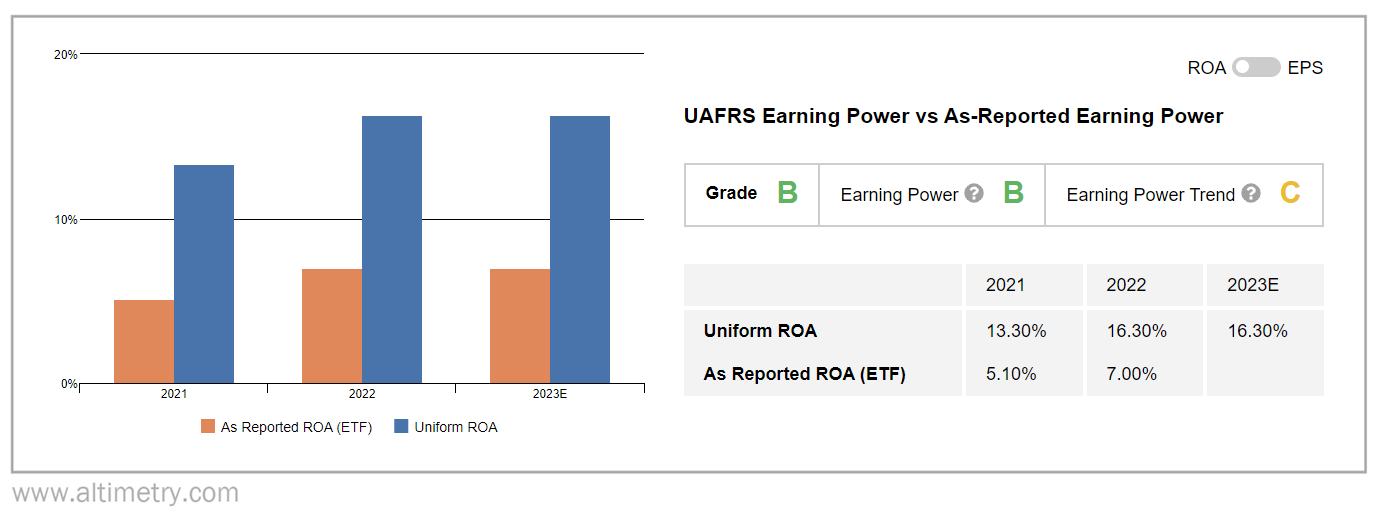

When we look at AIRR's performance using the ETF Analyzer, it's clear that these companies will be able to ride out the recession.

The ETF Analyzer works like the Altimeter – it uses Uniform Accounting data to display easy-to-digest grades across a number of categories. But instead of doing this for individual stocks, it does it for exchange-traded funds and mutual funds.

We're specifically interested in AIRR's Performance metrics. These show us how resilient industrials are today.

AIRR's aggregate Uniform return on assets ("ROA") was 13% in 2021 and 16% in 2022... above the 12% corporate average. Returns are projected to stay robust in 2023.

Take a look...

AIRR gets a "B" Performance grade in the ETF Analyzer. The C&E companies in this fund are holding up well in today's environment.

C&E companies are benefiting from transformational tailwinds...

C&E companies are benefiting from transformational tailwinds...

And as the 2023 Uniform ROA estimate shows, Wall Street analysts recognize this trend.

The pros think C&E will be able to ride out any trouble in commercial real estate. That's partially because these businesses are getting a boost from the supply-chain supercycle.

In short, CRE is suffering... But it doesn't mean every industry that touches real estate will fall apart.

Companies that help fuel new investment will benefit from all that spending. So will the businesses that handle construction.

C&E should be in a strong position... no matter where the economy is headed.

Regards,

Rob Spivey

April 18, 2023

Editor's note: C&E isn't the only area that will benefit as the supply-chain supercycle plays out. A number of other industries are positioned to soar... and if you know what to look for, so could your portfolio.

That's why Rob and Altimetry founder Joel Litman designed the ETF Analyzer. By breaking down Uniform Accounting data into easy-to-digest grades, it can help you identify the most promising sectors in any market environment.

For a limited time, they're offering access to the ETF Analyzer for more than 90% off the regular price. Plus, you can try it risk-free for 30 days... with zero long-term commitments. Learn more here.

Wave goodbye to those ugly, old office buildings...

Wave goodbye to those ugly, old office buildings...