The U.S. power grid wasn't built for the green movement...

The U.S. power grid wasn't built for the green movement...

Renewables are on the rise as a powerful alternative energy source. And the support systems they run on are coming under scrutiny.

You see, America's energy infrastructure was originally designed with coal, natural gas, and nuclear plants in mind. So it has to adjust rapidly to a power source with new quirks and features.

Renewable energy isn't always reliable. That causes headaches for consumers. After all, solar power isn't useful when the sun sets. And wind power relies on the weather to generate electricity.

That's why energy storage is becoming so important as the U.S. moves toward a greener future. Without huge batteries to store captured energy from the day, the average American home would be dark at night.

Energy storage has the power to handle excess production, intermittent availability, and power-grid failures. That means a more stable supply for both consumers and businesses.

As we'll explain today, we're already seeing soaring demand for energy storage... And that trend isn't going anywhere. One battery company in particular stands to gain a lot from the future of green energy.

2023 will be a massive year for energy storage...

2023 will be a massive year for energy storage...

In the U.S., stored-energy solutions for the energy grid are taking off. Energy companies and the government have noticed.

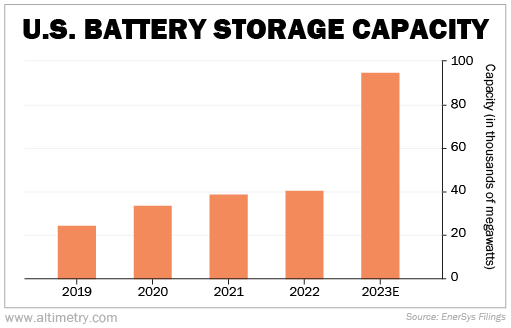

Since 2016, energy-storage capacity has grown an average of 15% per year. This year, planned growth for energy storage sits at an astonishing 134% higher than in 2022.

Take a look...

This trend is going nowhere but up. All signs point to further surges as the U.S. and other countries transition to renewables.

You're probably wondering how you can gain exposure to the energy-storage trend...

You're probably wondering how you can gain exposure to the energy-storage trend...

Buying utilities isn't the way to go. Utility companies will have to pour a massive amount of money into modernizing their systems. These huge batteries aren't cheap yet.

The smart choice is to dig a little deeper... and invest in the "arms dealers" for batteries. The folks who actually sell energy-storage solutions will be the big winners from this record growth.

That's where EnerSys (ENS) comes in...

EnerSys sells all types of battery solutions across all segments of the market. Its products range from batteries for databases and telecommunications to energy solutions for mining and energy companies.

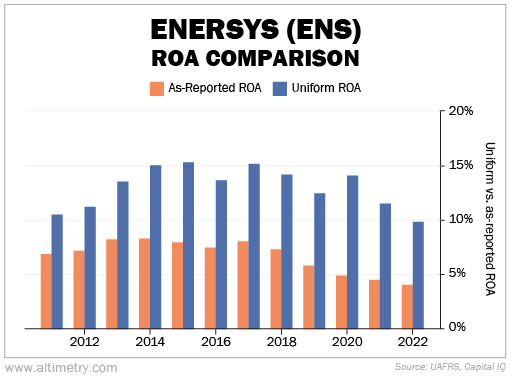

Demand has been surging. However, EnerSys' as-reported return on assets ("ROA") has been weak. It was only 4% in 2022... far less than the 12% corporate average. This has been scaring investors away.

When we strip out all the inconsistencies from generally accepted accounting principles ("GAAP"), we see a different story. Uniform accounting shows that EnerSys is earning strong returns. Uniform ROA was 10% last year.

Take a look...

It's worth noting that Uniform ROA has declined a bit recently. This is mostly due to growth as EnerSys ramps up new capacity to take advantage of future demand.

All the same, the company remains profitable.

This profitability isn't limited to last year, either...

This profitability isn't limited to last year, either...

EnerSys' Uniform ROA has averaged more than 13% in the past decade.

This positive cash flow gives EnerSys the chance to invest in more research, development, and production.

It also positions the company as a stable player in the energy-solutions market.

The recent energy surge further compounds this advantage. Investors should keep an eye on EnerSys. It could become a truly powerful force behind green-energy infrastructure.

Regards,

Joel Litman

February 7, 2023

The U.S. power grid wasn't built for the green movement...

The U.S. power grid wasn't built for the green movement...