Sometimes the best form of market research is 'just catching up'...

Sometimes the best form of market research is 'just catching up'...

Two weeks ago, my colleague Joel Litman and I (Rob) met with a large asset manager to discuss business, life, and the world at large.

This manager has exposure to emerging markets and is well-versed in global investments. The conversation quickly turned to how the Russia-Ukraine war is hurting the rest of the world.

Specifically, it's changing China's production... and putting pressure on the global supply chain.

China has been hailed for decades as the premier global manufacturer – including in technology. Big Tech companies like Apple (AAPL) and Google parent Alphabet (GOOGL) have docked their factories in China because they provide cheap skilled labor with massive capacity to boot.

But the war in Ukraine has reminded countries of the delicate nature of global supply chains. China has continued to support the Russian government. With Russia's support, China could invade neighboring Taiwan, which it views as a part of its territory. If that happens, the U.S. might look to sanction China as well.

That's why a lot of U.S. companies are rethinking offshore manufacturing. Southeast Asian countries could benefit from both an industrial and a technological supply-chain shift.

Two weeks after our client discussion, the mainstream media caught on...

Two weeks after our client discussion, the mainstream media caught on...

On September 1, the New York Times released an article about this exact topic. It explained that, in addition to China, Apple and Google will start producing smartphones in Vietnam and India.

China's saber rattling caused a supply-chain shift that will benefit other countries in Southeast Asia.

You see, as labor costs in China rose with the growth of its middle class, labor became comparatively cheaper elsewhere. That's why this is the perfect opportunity for companies to leave China and bring manufacturing back onshore or to other nearby countries.

Manufacturing companies in these countries could make massive profits – like Jabil (JBL).

Jabil is a contract manufacturer that focuses on the same tech as bigger players like Foxconn Technology (2354.TW), which makes iPhones and other products in China.

But unlike its better-known counterparts, most of Jabil's business isn't in China. In 2021, 40% of the company's revenue came from Singapore, Malaysia, and Hungary. China comprised only 15%.

Jabil is perfectly positioned to capitalize as companies move operations to other Southeast Asian countries. It has the same focus and business model as its counterparts in China. But it's already operating in these rising Southeast Asian countries.

But based on as-reported metrics, the market has no idea about the opportunity in Jabil...

But based on as-reported metrics, the market has no idea about the opportunity in Jabil...

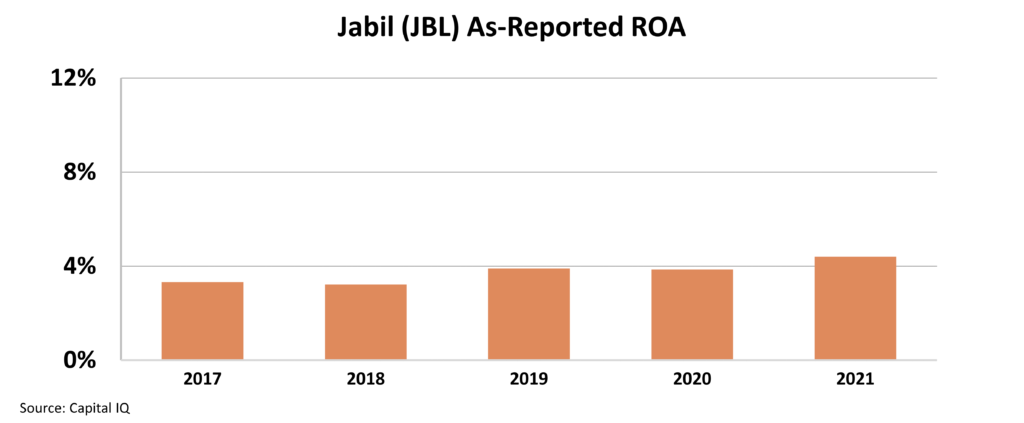

Even though Jabil is set up to gain market share, Wall Street metrics look weak. As-reported return on assets ("ROA") has largely been between 3% and 4% since 2017.

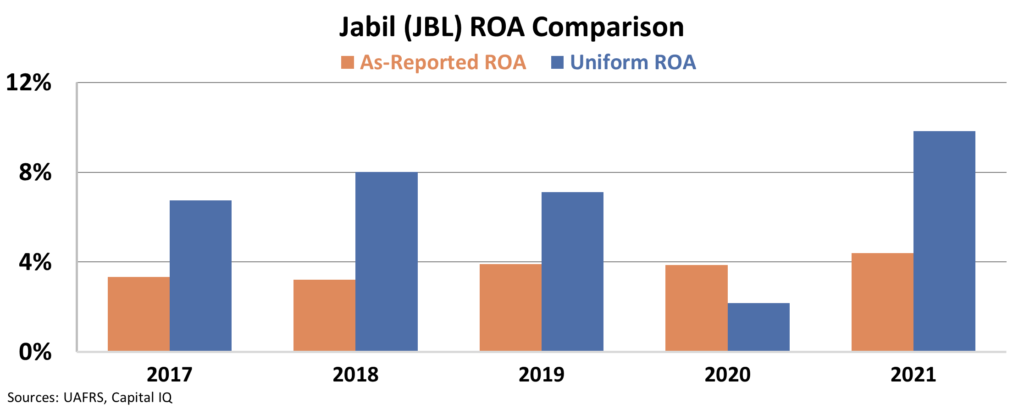

But when we use Uniform Accounting to scrub Jabil's finances, we can see the real strength of the business.

Based on Uniform ROA, Jabil has seen a huge recent boost in profitability. Uniform ROA dipped in 2020 due to the pandemic and supply-chain issues. But it climbed to nearly 10% in 2021. Take a look...

As more manufacturing leaves China, this trend is likely to continue. If Jabil capitalizes on these strong tailwinds, its returns could soar even higher.

Regards,

Rob Spivey

September 13, 2022

Sometimes the best form of market research is 'just catching up'...

Sometimes the best form of market research is 'just catching up'...