The oil industry is in trouble...

The oil industry is in trouble...

Oil demand is under growing pressure from alternative sources of energy. As an example, just think of the rise of electric vehicles... Tesla's (TSLA) cars tend to dominate the headlines.

Adding fuel to the fire, global trade has slowed during the coronavirus pandemic. This has significantly slashed oil demand.

It's no wonder the International Energy Agency ("IEA") is calling for oil demand to flatten in 2030. As Bloomberg reports...

Long-term growth in oil demand will be tamed by the switch to more efficient or electric vehicles, the IEA forecast. Consumption will increase by about 750,000 barrels a day each year to reach 103.2 million a day in 2030. That’s about 2 million a day less than predicted in last year's report.

Additionally, the agency estimated that oil demand won't return to pre-crisis levels until 2023. Almost all the growth will be from developing nations, with usage focused on feedstock for plastics and petrochemicals.

Despite future demand shortfalls, the global oil industry must also ramp up its investment for finding new supplies to offset aging oilfields. The IEA estimates this figure to be $390 billion in investments yearly after 2030.

Recently, many Altimetry Daily Authority readers have asked why we haven't highlighted oil companies as part of our "Survive and Thrive" theme. These dire industry statistics are a big reason why...

With Survive and Thrive, we're focused on companies operating in industries that have been impaired in the short term. In the long run, the winners of these sectors will be in a powerful position to dominate their markets.

In the oil industry, these companies are unlikely to recover to the peak levels they saw in the early 2010s... so these expectations for continued struggles are reasonable.

The 'Oil Majors' are trying to fight back against this secular decline...

The 'Oil Majors' are trying to fight back against this secular decline...

These are the largest publicly traded oil and gas companies. They wield large amounts of economic and political influence.

Yet while the equity markets have punished their stocks for these worrying industry trends, the credit markets appear oblivious...

For example, ExxonMobil's (XOM) credit default swaps ("CDSs") trade at just 40 basis points. This means it only costs 0.4% more for management to borrow than it costs the U.S. government.

Some of Exxon's bonds even have negative yields, which means investors pay for Exxon to hold their money. Investors need to go out to 2027 bonds before the interest rates are greater than 1%.

Furthermore, the credit-ratings agencies are asleep at the wheel. Moody's (MCO) rates Exxon as an "Aa1" credit – its second-highest available rating.

By using Uniform Accounting, we can see that this rating is a real issue...

By using Uniform Accounting, we can see that this rating is a real issue...

We can also see how at-odds the equity and credit markets are for Exxon.

Last October, we explained how the company can be considered a "mill on the hill." This means Exxon's assets – its massive stockpile of oil reserves – are the real value of the company. Thus, when valuing Exxon, investors must look at the value of those assets.

When looking at asset values, it's rare for a company to trade at a large discount to its assets. It generally tells us the equity markets believe a company is distressed.

Right now, Exxon is trading at 0.6 times its book asset values. In other words, every dollar Exxon has put into its business is only worth $0.60.

Yet even at these low interest rates, credit investors appear to believe in the strength of Exxon's balance sheet.

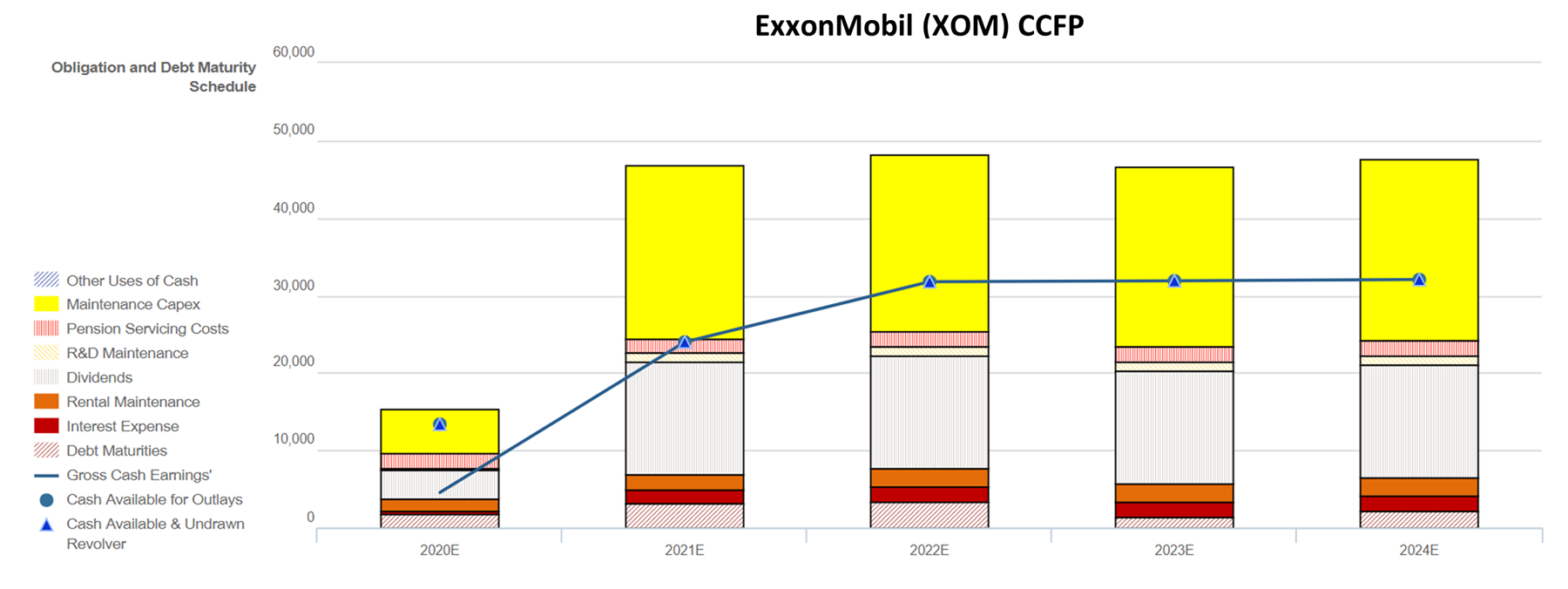

To get a better sense of the company's credit risk, we can look at Exxon's Credit Cash Flow Prime ("CCFP")...

In the chart below, we break it down. The stacked bars are Exxon's obligations each year for the next five years. We compare this to the company's cash flow (blue line) and cash on hand at the beginning of each period (blue dots).

The bottom bars are the hardest obligations for Exxon to "push off" – costs such as debt maturities and interest expense. The higher bars are more flexible obligations, like maintenance capital expenditures ("capex") and share buybacks.

As the CCFP shows, Exxon's capex and dividends are unsustainable. Cash falls below obligations in every year going forward (click on the image below for a larger version)...

Exxon is currently trapped between credit and equity investors. If management cuts the dividend, equity investors will hit the "sell" button. Meanwhile, if Exxon limits its capex, this restricts its ability to find future oil reserves. Credit investors are concerned with the company's ability to generate steady cash flows to pay them back.

Due to its consistent cash shortfalls, we give Exxon an Altimetry credit rating of "IG4+." This is at the bottom of our investment-grade ratings, which the company still fits into because of its large market cap and significant asset backing.

However, the current Moody's credit rating is far too optimistic. When looking at Exxon from a Uniform Accounting perspective, we can see that the company is at greater risk... and that investors should stay away.

Regards,

Rob Spivey

November 12, 2020

P.S. What other industries do you think will be permanently affected by the pandemic? Let us know at [email protected] and we might take a closer look at one of the sector's companies through a Uniform Accounting perspective.

The oil industry is in trouble...

The oil industry is in trouble...