As I've mentioned previously, my family and I spent the past few months in Istanbul...

As I've mentioned previously, my family and I spent the past few months in Istanbul...

And during my stay, I trained with a guy named Ramazan in boxing, kickboxing, and muay thai.

I found Ramazan somewhat serendipitously, when I happened to walk by his gym. I was curious about what the gym had in terms of equipment. I wasn't looking for a trainer.

I didn't realize that the gym owner was a European champion kickboxer who later became a world champion kickboxer.

So, when I found out his background, I asked if he would train me.

I think I must be a glutton for pain. Ramazan is the latest on a short list of world champion teachers and martial arts masters with whom I've had the honor of training. If you're going to train at all, there's no reason not to learn from the best in the field.

Here's a picture of me trying to land a punch and stay on my feet...

As a coach, Ramazan is balanced. He pushed me to my personal limits, yet was careful not to push me to the level he does with his champion fighters. (Thank goodness for that! The physical conditioning is great... The bruising, not so much.)

Recently, I asked Ramazan what he did to become one of the world's greatest in his art. He told me three things...

- Training

- Eating right

- Sleeping a lot

He said that the combination of all three made the difference. Many fighters and athletes talk about training and diet. That's common. However, I can't recall hearing or reading about champion fighters talking about how much they sleep.

But Ramazan said he slept a lot.

It sounded like sleep was his secret weapon. It makes sense... Research study after research study has shown that sleep is key to maximum physical and mental healing. This leads to maximum personal growth.

That combination of sleep, training, and diet is something to think about for anyone wanting maximum performance, not just to become a great fighter, but to become great at anything – including an accountant or analyst or developer.

For folks looking for a way to apply Ramazan's first piece of advice, there's an inexpensive option...

For folks looking for a way to apply Ramazan's first piece of advice, there's an inexpensive option...

Many gym memberships are absurdly expensive. With amenities such saunas, personal trainers, and hot towel treatment, they charge a high premium for services most people don't end up using.

One national brand bucks this trend of expensive gym membership fees. In fact, it offers memberships for as little as $10 a month. This is the core idea behind Planet Fitness (PLNT).

Planet Fitness has a robust franchising model powered by rapidly adding new locations and new members. With such cheap fees, many folks were (and are) happy to join... even if they never actually go to the gym.

Since Planet Fitness doesn't need to use its own money to build new stores, it generates sizable revenue from few assets. Franchisees buy equipment from the brand and then divide the revenue of the membership fees.

This attractive business model was just one of the reasons Planet Fitness was one of our top recommendations to our institutional clients a few years ago...

This attractive business model was just one of the reasons Planet Fitness was one of our top recommendations to our institutional clients a few years ago...

From when we first recommended the name in August 2017 to when we finally decided its thesis had run its course in April 2019, PLNT shares saw an impressive 200% gain.

And yet, investors looking at distorted as-reported metrics would be shocked by this massive stock appreciation.

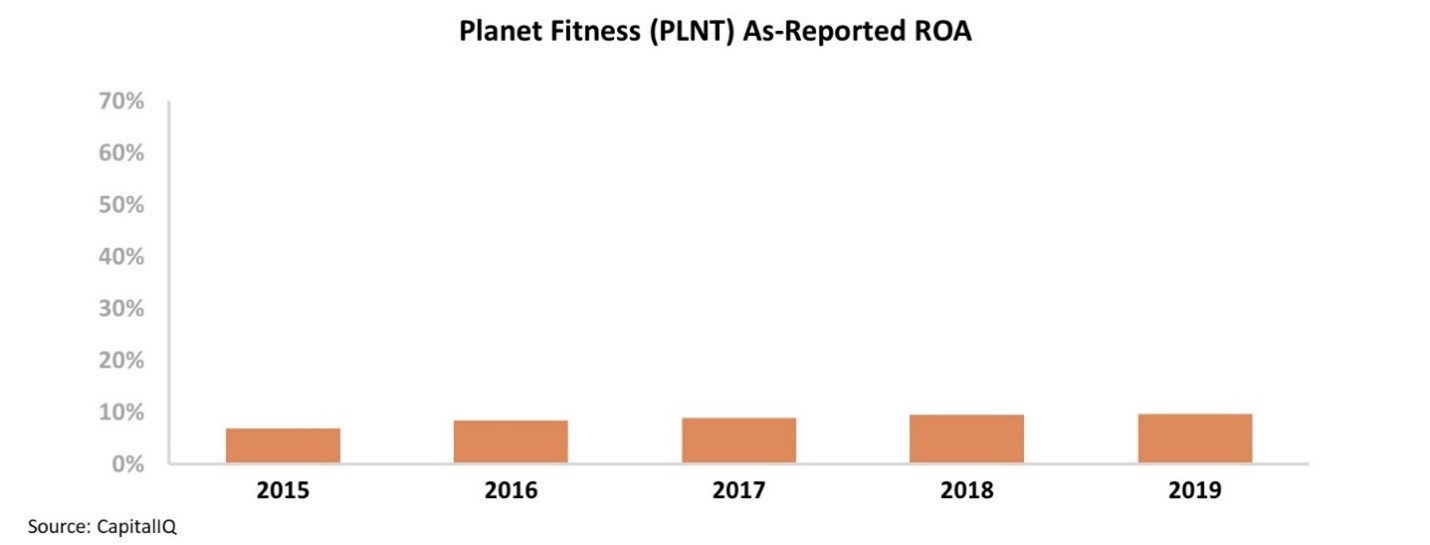

Planet Fitness' as-reported profitability has remained fairly stable over time. The company has maintained below-average returns on assets ("ROAs") around 10% for the past five years. Take a look...

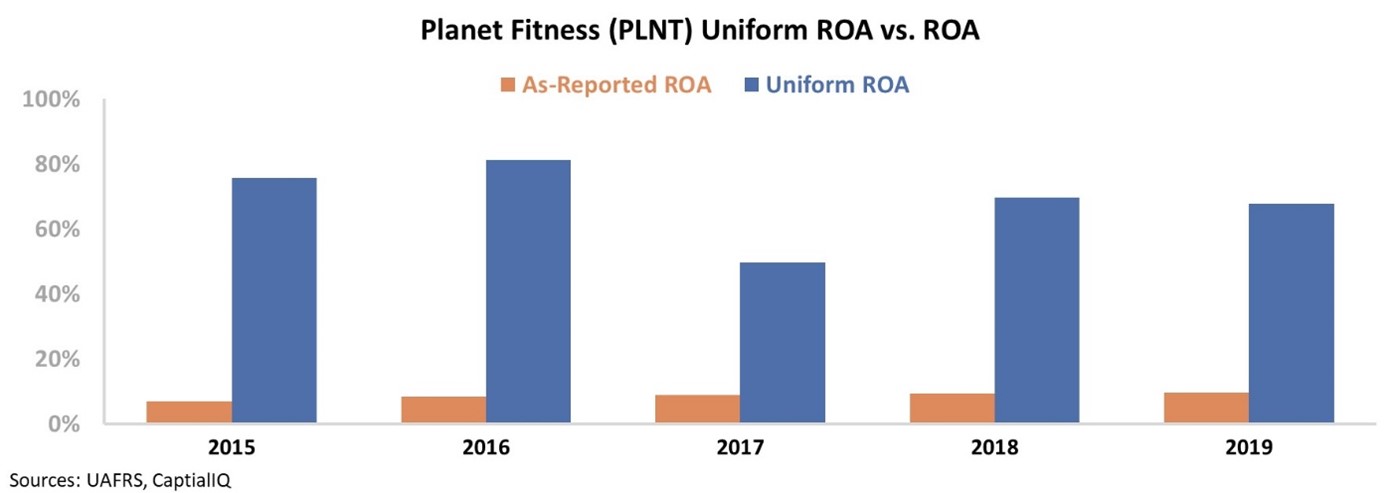

However, when we remove as-reported distortions, the power of Planet Fitness' franchise model becomes clearer. It has a phenomenal business, with great profitability to go along with its growth opportunities.

In reality, Planet Fitness' Uniform ROA has been above 50% over the past five years. The market was clearly right in rewarding such an impressive money-making machine.

And that ability to print money was why we thought Planet Fitness was so compelling.

Only through Uniform Accounting could we see the true strength of Planet Fitness... while investors stuck using distorted as-reported metrics believe the company has much weaker profitability than in reality.

Regards,

Joel Litman

January 19, 2021

As I've

As I've