Trey Parker and Matt Stone are desperate...

Trey Parker and Matt Stone are desperate...

The duo is best known for their hit TV show South Park and their Tony Award-winning musical The Book of Mormon.

And though they have tremendously valuable intellectual property – including the iconic Colorado theme restaurant Casa Bonita – the two are in serious need of cash.

You see, their production company, Park County, took out a $600 million debt facility back in 2021. The loan was supposed to help Parker and Stone invest in new projects ranging from a documentary series to a South Park video game. However, it appears that the loan wasn't enough to keep the content flowing...

Park County is now looking to borrow $800 million from private-equity ("PE") giant Carlyle (CG) to refinance the existing credit facility and fund a cash payout.

The terms of the loan can best be described as highway robbery. Parker and Stone are even discussing putting their TV show and other related assets up as collateral.

Today, we'll discuss just how good of a deal Carlyle is getting... and why, despite its exposure to private equity, this could mark a major turning point for the company.

The PE industry is in distress...

The PE industry is in distress...

You may recall that we've talked before about how PE players are headed for a reckoning.

As we've covered, these firms get their funding from external investors – usually through pension funds, endowments, and sovereign wealth funds.

When conditions are favorable, there's no harm in depending on investors. There are massive potential returns in PE, which generally attracts investors.

Unfortunately, current conditions are creating a tougher environment...

With today's high interest rates, it's harder to justify PE investments. These firms often rely on significant amounts of debt to fund their acquisitions. And the more expensive that debt is, the more it diminishes the potential profits.

As a result, their investors need additional incentives to stick around...

That's why many prominent PE firms now offer substantial discounts to their investors, including lower management fees.

However, while these tactics may keep money coming in the door, it ultimately means lower revenue and reduced profitability.

Other PE firms, like Carlyle, are turning to private lending...

Other PE firms, like Carlyle, are turning to private lending...

As we've seen, traditional bank loan standards are getting tighter and tighter. And companies in need of cash are getting desperate.

That seems to be the case with Park County... given the terms of its deal with Carlyle.

Park County is looking to secure a loan of $800 million. As we mentioned, the loan would be collateralized by South Park and other related intellectual property, including the Casa Bonita restaurant and The Book of Mormon Broadway musical.

The $800 million loan is being priced at 6.75 percentage points above the Secured Overnight Financing Rate ("SOFR"). That's incredibly expensive.

SOFR is a daily interest rate that reflects the cost of borrowing cash overnight using U.S. Treasury securities as collateral. It's used as a benchmark for setting the rates on various financial products, like loans and derivatives.

Right now, the SOFR is 5.32%. That means Park County will be paying more than 12% in interest on this loan.

A 12% interest rate is typically reserved for incredibly risky debt.

However, as of 2021, Park County's intellectual-property library was valued at almost $1 billion... meaning nearly the entire loan should be covered by the content it's putting up as collateral.

This is a fantastic deal for Carlyle...

This is a fantastic deal for Carlyle...

Yet, the market is still pricing in a punishing crash in profitability for the business going forward.

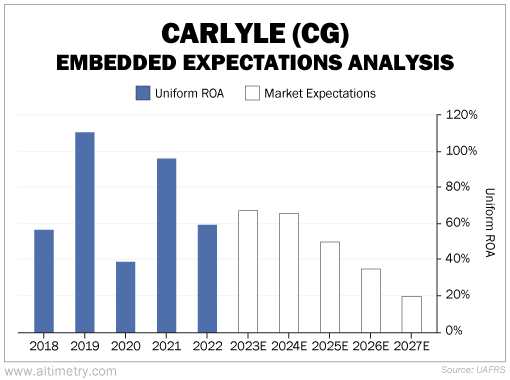

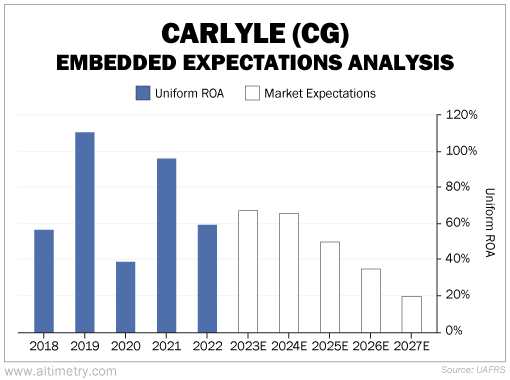

We can see this by looking at Carlyle's Embedded Expectations Analysis ("EEA").

The EEA starts by examining a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects Carlyle's Uniform return on assets ("ROA") to fall below 20% by 2027. However, the company's Uniform ROA has only fallen below 40% once over the past five years... during the pandemic in 2020.

Take a look...

While we don't love the PE market right now, this seems excessive...

Yes, PE firms are certainly going to have a tough time keeping up the massive returns they enjoyed when interest rates were near zero. However, the biggest companies like Carlyle aren't going to take that sitting down.

As we covered today, Carlyle has found a way to make high interest rates work for it with private credit. While other companies are reducing their fees to try and keep investors around, Carlyle is pulling in high interest payments from its borrowers.

If Carlyle can make more loans like it did with Park County, it should be able to offset the current turbulence in PE.

And with the market's expectations for Carlyle already so low, the company has plenty of room to impress.

Regards,

Joel Litman

November 21, 2023

Trey Parker and Matt Stone are desperate...

Trey Parker and Matt Stone are desperate...