Software behemoth Microsoft (MSFT) is getting creative...

Software behemoth Microsoft (MSFT) is getting creative...

The company made waves earlier this month when it announced it was acquiring a 4% stake in the London Stock Exchange (LSEG.L) for $2 billion.

That might seem like an odd way for a tech company to spend a couple billion dollars. It almost sounds as if Microsoft is just putting the money in an investment, hoping the stock will go up.

There's more to it than that, though...

You see, as part of the deal, London Stock Exchange Group ("LSEG") agreed to spend $2.8 billion on Microsoft's cloud services over the next decade.

That's important because Software as a Service ("SaaS") could be in trouble.

Regular readers know that we've been writing about problems in the tech sector for months.

Interest rates are rising above near-zero for the first time in more than a decade. Tech and venture capital aren't the free-for-all they once were. Companies that were able to go "all in" on growth are having to cut spending in order to make ends meet.

That's bad news for the software companies that offer subscription-based SaaS business models... even the big players like Salesforce (CRM) and Microsoft.

As I'll explain today, Microsoft sees the writing on the wall. The LSEG investment is its latest push to keep revenue coming in.

Microsoft essentially paid $2 billion to get a new client...

Microsoft essentially paid $2 billion to get a new client...

And as a bonus, it's making a bet on the exchange's stock. In return, it will get a reliable revenue stream at a time when tech needs a lift.

It's not a bad deal. Stock exchanges are great businesses. At this point, they're almost entirely digital. They process billions of dollars in transactions a day. Plus, unlike most exchanges, LSEG isn't expensive.

We can see this through the price-to-earnings ratio, which compares a company's stock price to its earnings per share. LSEG trades at a 17 times Uniform P/E ratio. That's below the market average of 20 times.

And it's way lower than the New York Stock Exchange's parent company, Intercontinental Exchange (ICE), which trades at a P/E ratio of 29 times.

It's also not that big of an investment for a $1.8 trillion business.

Still, it shows Microsoft might be getting worried...

Still, it shows Microsoft might be getting worried...

It's easier to understand why the company made this investment when we look at investor expectations.

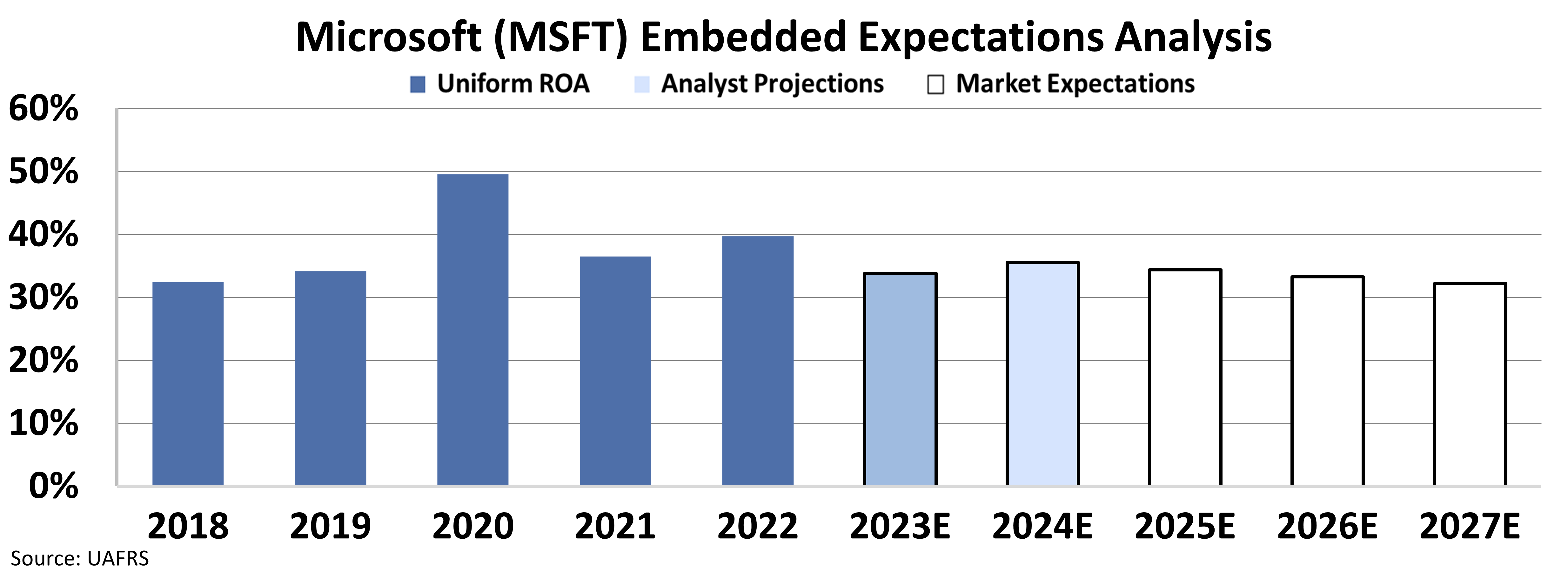

Going forward, investors still expect Microsoft to look like... Microsoft. We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA uses Uniform Accounting to determine what investors expect from a company based on its current stock price.

For the past five years, Microsoft has generated a Uniform return on assets ("ROA") of at least 30%. And our EEA framework shows us that investors expect that number to remain at about 32% through 2027.

Take a look...

This suggests investors don't think Microsoft will feel much pressure from the SaaS implosion. That's just not realistic.

Microsoft's management probably knows it. That's why it's making deals like this one with LSEG. It can afford to fork out the cash now to ensure it gets more business down the line.

However, it shows that Microsoft may not be on the firmest footing. It's a sign that its customers aren't providing enough business to keep up its returns. So it has to turn to outside-the-box measures to keep up with investor expectations.

Microsoft always seems to find a way to come out on top. Still, this news makes it seems like the company isn't in a great position compared with recent history.

If it keeps making desperate moves in the next few quarters, it might be best to watch from the sidelines. Investor expectations could start coming down.

Regards,

Joel Litman

December 22, 2022

Software behemoth Microsoft (MSFT) is getting creative...

Software behemoth Microsoft (MSFT) is getting creative...