An exchange-traded fund ('ETF') alternative to 'Your Home, Your Castle'? Or just an adjusted cybersecurity fund?

An exchange-traded fund ('ETF') alternative to 'Your Home, Your Castle'? Or just an adjusted cybersecurity fund?

Here at Altimetry Daily Authority, we've highlighted several times that the current world of work from home ("WFH") will have long-lasting effects on how people across the world will live their lives after we move past the coronavirus pandemic.

It won't just change how we work, but also how we live our lives in general. Certain businesses will collapse... while others will boom. We specifically devoted the May issue of our Altimetry's Hidden Alpha newsletter to a handful of names that will likely benefit from how people will be spending more time and money at home going forward, in every facet of their lives.

(It's all part of our "Your Home, Your Castle" theme... And you can get instant access with a Hidden Alpha subscription right here.)

It seems that we're not the only ones that have had this idea...

In fact, an ETF is coming out soon that appears to be specifically focused on the WFH theme. To drive the point home, its ticker is WFH.

It's being created by fund provider Direxion, and will be mirrored off an index the firm is developing with Solactive – the Remote Work Index – which just launched last week.

Just from the name alone, the index is likely to be popular with investors interested in getting exposure to the trend. But a deeper look highlights that many of the holdings are cybersecurity companies that one might find in a more appropriate ETF like the ETFMG Prime Cyber Security Fund (HACK), as opposed to businesses directly exposed to the WFH theme.

Companies like CrowdStrike (CRWD), FireEye (FEYE), Fortinet (FTNT), and Palo Alto Networks (PANW) don't exactly have specific exposure to the WFH trend... but they do fill out an ETF like this to help give a better back test.

Similarly, Indian outsourcing firm Infosys (INFY) and digital consulting company Perficient (PRFT) don't exactly have much to do with the world of WFH.

This serves as a good reminder that even though an ETF might sound like a fit for a trend you're interested in, it's always important to look deeper into the holdings to make sure those companies actually match up with the theme you had in mind.

In the investment world, countless metrics are used in valuation...

In the investment world, countless metrics are used in valuation...

Here at Altimetry, we use common metrics such as a company's return on assets ("ROA") and asset growth to understand business trends. Together, these metrics can effectively show how a company has improved or declined over time.

Using only ROA or asset growth individually can sometimes paint an incomplete picture of a firm's performance. Back in December, we talked about this exact phenomenon with e-commerce giant Amazon (AMZN).

For Amazon, it would appear when looking at only the company's ROA, the stock was a poor investment. However, this is because we also must understand Amazon's ability to grow its asset base, and how that means operating earnings can grow even if its ROA isn't rising.

Amazon has generated massive shareholder returns despite a falling ROA over the past 10 years because its asset base has grown immensely during the same period.

Between 2010 and today, Amazon has grown its asset base between 34% and 114% every year. Its 149% return in 2010 on $4 billion in assets is significantly less impressive than its 15% ROA on an $85 billion asset base.

And this phenomenon isn't restricted to Amazon...

Large tech companies with sizable growth have seen similar contractions in ROA as they have scaled, including Microsoft (MSFT) and Google's parent company Alphabet (GOOGL). This is especially true for the $1.3 billion elephant in the room: iPhone maker Apple (AAPL).

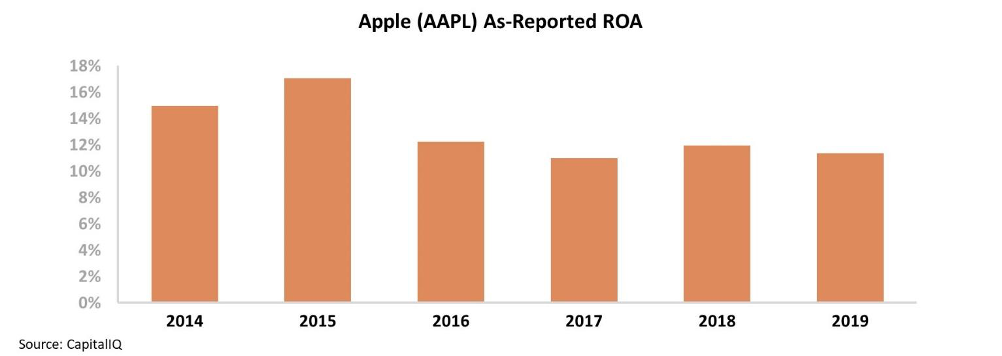

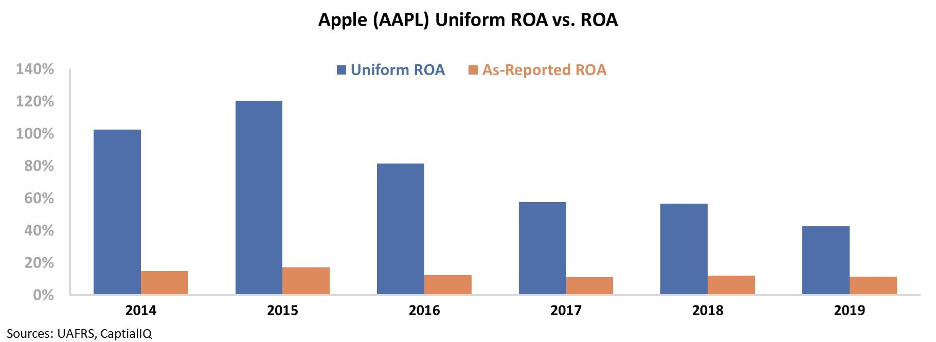

In the 2010s, Apple underwent a second renaissance because of the iPhone. It was the quintessential example of a company creating a market for its products out of thin air. However, this economic reality doesn't line up with Apple's as-reported returns between only 12% to 17%.

This view is distorted by GAAP accounting standards that mistreat excess cash, research and development (R&D) costs, and other line items. But through Uniform Accounting, we can see how Apple has seen substantial – but declining – returns.

In realty, in 2015 Apple saw returns reach a whopping 120%. The company clearly benefitted from dominating the smartphone market.

However, by 2019, returns had shrunk significantly to 43%. Take a look...

After the smartphone market reached saturation, it's easy to write off Apple as a company past its prime. To compensate for iPhone sales, it has moved into iPad, Apple Watches, and streaming markets... and those are lower-return businesses than the iPhone.

It appears from the company's Uniform ROA that lightning can't strike twice for CEO Tim Cook.

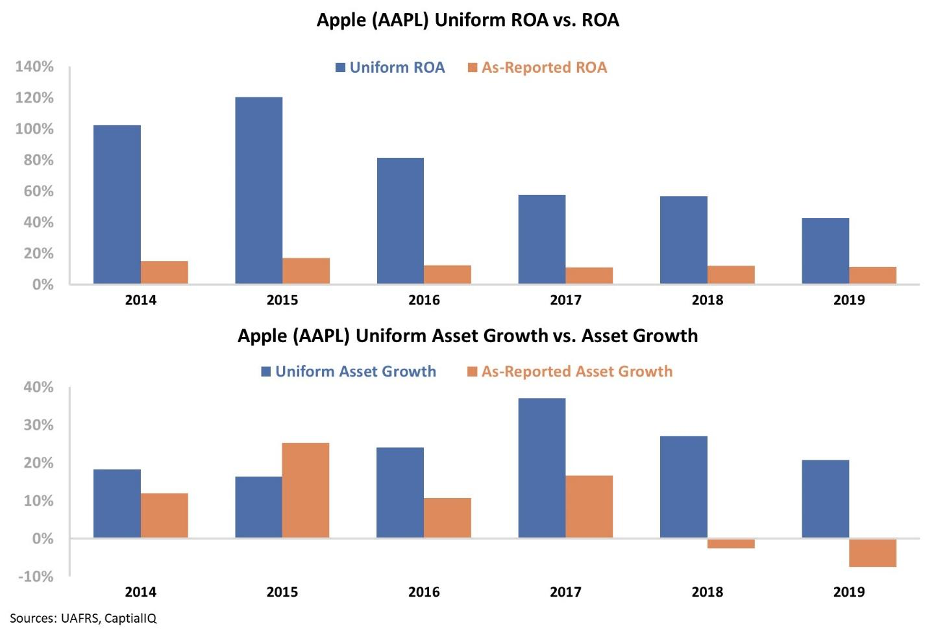

But rather than bad business decisions, these moves have reflected Apple's new dominant market strategy. The company has always profited from its interconnected "ecosystem," and adding new products has unlocked significant shareholder value... through asset growth rather than ROA.

As you can see in the chart below, Apple has grown its asset base between 16% and 37% over the past few years. The company has more than tripled its asset base over the past five years.

With this sizable year-over-year growth, Apple's new strategy has expanded its reach well beyond the world of phones.

By looking at ROA alongside asset growth, we can see how – similar to Amazon – Apple has consistently unlocked value in its business. While returns have shrunk from 2015 highs, the company has continued to drive shareholder value by expanding its assets.

So... what does this all translate to?

In 2014, Apple generated $54 billion in Uniform earnings... while in 2019, the company generated $89 billion in earnings. This clearly made shareholders happy.

Without a holistic understanding of both ROA and asset growth, it would be impossible to understand that Apple's recent stock gains are rooted in real value creation, rather than irrational exuberance.

Regards,

Joel Litman

May 8, 2020

An exchange-traded fund ('ETF') alternative to 'Your Home, Your Castle'? Or just an adjusted cybersecurity fund?

An exchange-traded fund ('ETF') alternative to 'Your Home, Your Castle'? Or just an adjusted cybersecurity fund?