It looks like more bad news for the airline industry...

It looks like more bad news for the airline industry...

The COVID-19 pandemic brought travel to a standstill. We've written before about how, even as airlines bounce back, folks are still being forced to deal with flight cancellations and long delays.

Now, it looks like SAS (SAS.ST) – the owner of Scandinavian Airlines – is the latest victim of the beaten-down travel industry.

SAS recently filed for Chapter 11 bankruptcy protection. It's trying to reorganize its business and return to profitability.

The company primarily services Denmark, Norway, and Sweden. Like its peers, it's struggling with surging fuel prices and staffing issues. Even though demand for flights is high, SAS can't take advantage of the surge.

The company said the recent pilot strike was the last straw. It was forced to cancel nearly 80% of flights as a result.

SAS has been unable to raise wages in line with surging inflation. Now, it's losing $10 million to $13 million per day from pilots refusing to fly.

SAS might claim that pilot strikes are to blame for its bankruptcy. But using Uniform Accounting, we can see that this bankruptcy was a long time coming.

All the warning signs were there for SAS...

All the warning signs were there for SAS...

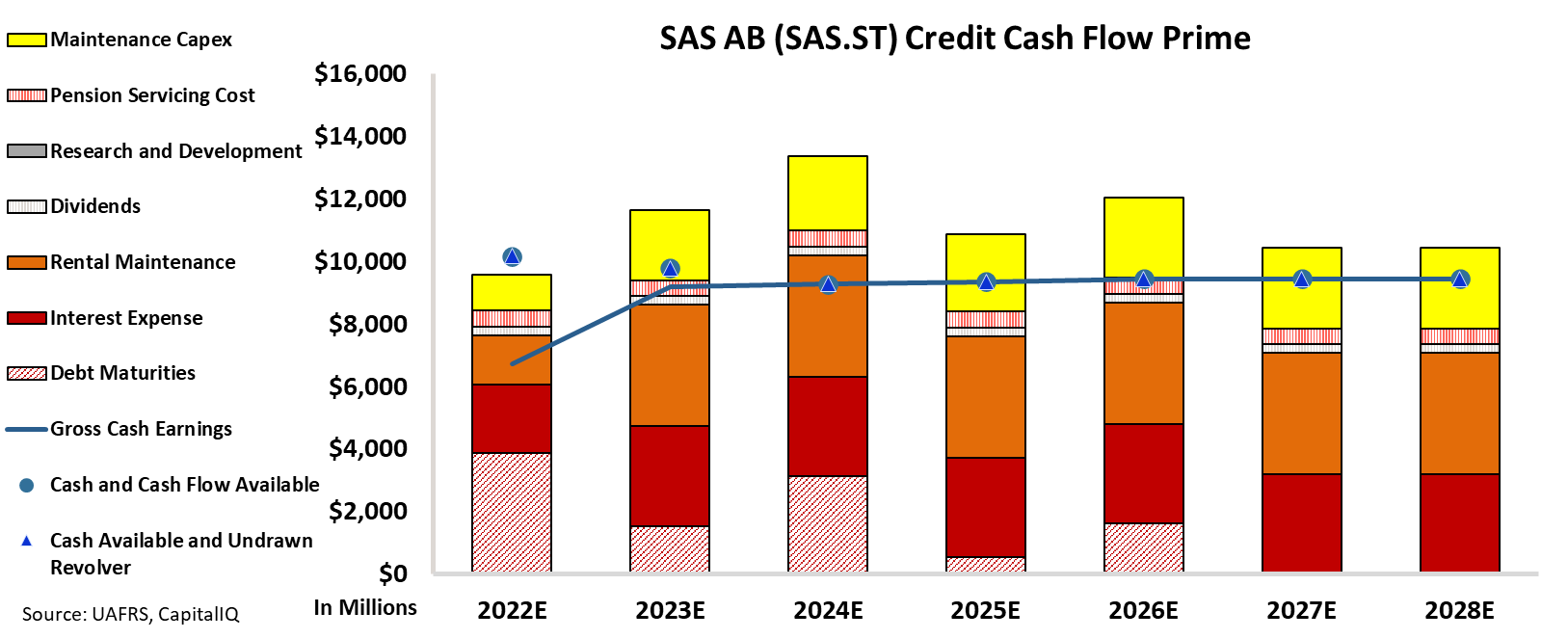

It's easy for the company to point fingers at the strikes. However, using our Credit Cash Flow Prime ("CCFP") model, we can see what really led to the bankruptcy.

Wall Street loves to use simple ratio analysis to understand if a company is underwater (and by how much). Investors will look at ratios like debt-to-equity or earnings-to-interest.

These are helpful... But they don't tell the full story.

At Altimetry, we have a different, clearer method. The CCFP shows us cash flows and all obligations together so we can see how strong corporate balance sheets really are.

In the following chart, the stacked bars represent SAS's obligations each year through 2028. Then, we compare these obligations to its cash flow (the blue line), as well as the cash on hand at the beginning of each period (the blue dots) and available cash and undrawn revolver (the blue triangles).

The CCFP analysis shows that SAS won't be able to meet its obligations starting next year.

Even this year, cash flows fall short. SAS is using the last of its cash to cover its costs. It's no wonder the company fought so hard against raising salaries...

It's clear that SAS has tremendous debt coming due over the next few years. Compounding this issue is the fact that SAS has no way of servicing these obligations with cash flow or cash on hand.

Investors should have seen this coming. It's a perfect recipe for bankruptcy.

The COVID-19 pandemic was devastating for airlines. SAS's cash flows dried up and its cash reserves began to bleed. It was only a matter of time until its debt would reach maturity.

SAS's fate will undoubtedly serve as a warning to the rest of the airline industry. Despite the return of air travel, airlines can't get complacent. They must take steps to generate enough cash flow to cover future obligations.

Those that don't will follow SAS into bankruptcy.

Regards,

Joel Litman

July 20, 2022

It looks like more bad news for the airline industry...

It looks like more bad news for the airline industry...