It's possible that hacking may become much harder than it currently is...

It's possible that hacking may become much harder than it currently is...

Hackers are a big problem in today's Internet-powered society. Criminals are able to break into computer systems or decrypt messages and data packages sent across the web and cause widespread destruction.

Just this July, social media site Twitter (TWTR) saw a massive breach, with high-profile accounts including those of Joe Biden, Bill Gates, and Warren Buffett all hacked in a bitcoin scam. In recent years, the Equifax (EFX) data breach and multiple WikiLeaks-related events have made front-page news. And each year, many municipalities pay hackers hundreds of thousands (if not millions) of dollars in the wake of ransomware attacks.

However, as we mentioned on Tuesday, quantum cryptography is gaining traction... It has the potential to create a whole new Internet.

Previously, quantum cryptography has been an exclusively premium offering that was mostly used for sensitive government information. Now, people are proposing the idea of improving the entire Internet with the technology... which could make Internet communication much safer.

However, as our colleagues at cybersecurity advisory firm Starman Cybersecurity noted, the only issue is the people using the technology. Quantum cryptography is extremely safe because it uses photons, which are theoretically impossible to duplicate. However, the user sometimes can inadvertently make the system riskier with simple passwords or loose lips.

Therefore, the companies helping to manage the login security risk stand to benefit if the Internet begins to widely adopt quantum cryptography.

'Families are always rising and falling in America'...

'Families are always rising and falling in America'...

This is a famous quote attributed to writer Nathaniel Hawthorne back in the 19th century... And today, this dynamic can still be used to talk about competing businesses as well as the cycle of wealth and prestige in U.S. families. For example, the entire smartphone market saw shifting growth and demand from the mid-2000s to a few years ago, even in the midst of strong overall growth.

Although the sector as a whole won, certain smartphone manufacturers performed much better than others. Apple (AAPL) is one of the obvious winners... The company's iPhone has become the product that many Americans think of when asked about smartphones.

However, both Palm and Blackberry (BB) failed even in the face of a booming market. Both obtained market share towards the beginning of the demand surge. And yet, neither was able to adapt... and eventually both lost much of their market shares.

Even in the Android family, some companies weren't able to hold onto their initial success. The most widely used phone operating system in the world created winners like Alphabet's (GOOGL) Google, as well as Korea-based Samsung. However, Nokia (NOK) and Motorola Solutions (MSI) were unable to sustain their initial market share strength.

Analyzing industries isn't just about looking at macroeconomic trends... It's also about competitive trends. The smartphone industry proves that not all boats are lifted by a rising tide.

For instance, in cybersecurity, both SailPoint Technologies (SAIL) and Okta (OKTA) – two companies requested by Altimetry Daily Authority readers James and Gary – are identity authentication platforms.

This is a major area of focus for large enterprises... SailPoint and Okta enable users to access applications in simplified ways without remembering multiple passwords. Even with the streamlined process, the two companies' platforms still preserve security features.

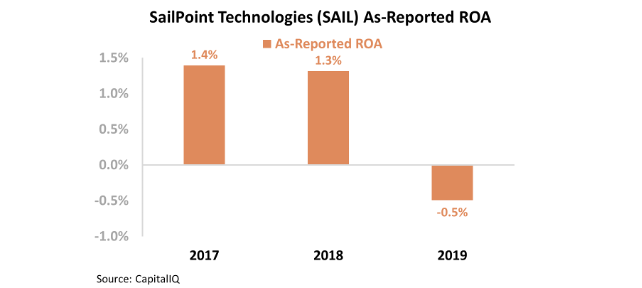

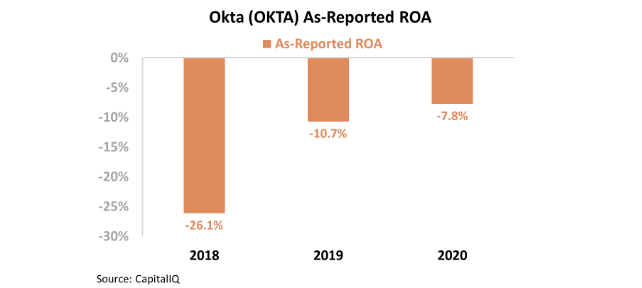

Looking at as-reported profitability metrics show that while SailPoint offers a valuable service, it has seen its financial fortunes decline recently. The company's return on assets ("ROA") has stayed below cost-of-capital levels, and shifted negative last year.

On the other hand, Okta has negative-but-improving returns. Okta's as-reported ROA was negative 26% in 2018 and rose all the way to negative 8% this year. If the company continues its pace, it could soon have positive returns.

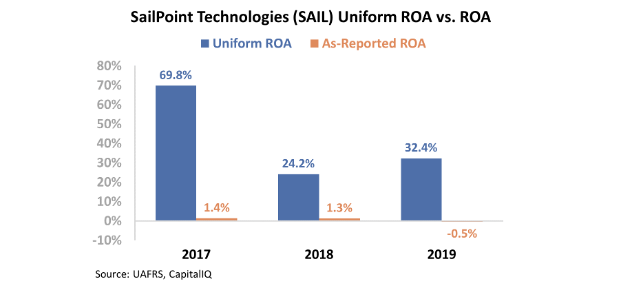

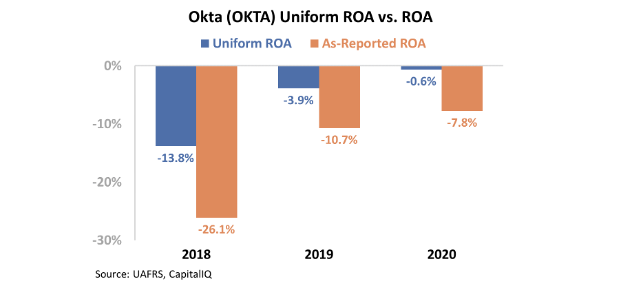

However, as-reported accounting is distorting profitability metrics for SailPoint and Okta. Stock option expenses – among other GAAP distortions – are artificially lowering these companies' ROAs.

But Uniform Accounting shows a much different picture...

SailPoint's profitability levels have decreased from all-time highs, falling from 70% in 2018 to 32% last year. However, the company's ROA is falling from a much higher level than the as-reported numbers suggest. SailPoint is well above cost-of-capital levels and corporate averages. Additionally, the company improved its Uniform ROA last year from 2018 levels. Take a look below...

Uniform Accounting also depicts more accurate profitability metrics for Okta. In this case, the company's Uniform ROA is much closer to positive territory than its as-reported ROA is. Okta's real returns rose to negative 1% this year, possibly putting the firm on track to reach a positive ROA as soon as next year.

Next, for a deeper look at both stocks, we must look at their valuations. To do this, we can use the Embedded Expectations Framework...

The charts below explain SailPoint and Okta's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the companies are going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

Both have similar expectations. Sell-side analysts are projecting both companies to see muted profitability over the next two years due to coronavirus-induced headwinds. Then, the market is pricing in both SailPoint and Okta to grow profitability substantially over the following three years.

SailPoint's expectations are for its Uniform ROA to rebound from 0% levels in 2020 and 2021 and reach 19% in 2024. This would be well below the firm's historical results, but a strong recovery nonetheless.

Meanwhile, Okta is expected to reach 30% returns by 2025. This is a large improvement from historical levels... but it's roughly in line with the trend the company has shown in recent years.

Both SailPoint and Okta have innovative products that benefit from increased demand for security. However, GAAP metrics are distorting the historical profitability of both companies.

Using as-reported ROA numbers, SailPoint looks like a failing company and Okta seems to be rapidly growing. But Uniform Accounting is able to show that SailPoint is successful and Okta is growing... although the market is pricing in Okta's growth to continue to all-time highs.

Only using as-reported metrics, investors would be unable to compare these two competitors against each other due to distorted operating profitability. With Uniform Accounting, however, investors can quickly get a sense of the returns and valuations of both firms against each other.

Regards,

Rob Spivey

September 18, 2020

It's possible that hacking may become much harder than it currently is...

It's possible that hacking may become much harder than it currently is...