Millionaires are no longer feeling like millionaires...

Millionaires are no longer feeling like millionaires...

Back in the 1970s and '80s, the term was synonymous with success. A millionaire was a part of the stratified elite... an untouchable social class. This image was reinforced by landmark pieces of media such as the film Wall Street and the book The Bonfire of the Vanities – in 1987.

But today, millions of Americans can call themselves millionaires. In 2019, the Global Wealth Report calculated that the U.S. is home to around 18.6 million folks worth $1 million – 40% of the world's total.

Furthermore, from 2018 to 2019, the U.S. added 675,000 millionaires to the total, showing this trend has no sign of slowing down. In comparison, China only added 158,000 new millionaires over the same period.

As millionaires become a sizable minority in the U.S., their hopes and fears can be measured on a statistical basis. Just recently, a colleague shared an interesting report that the brokerage firm Fidelity had completed late last year. The study of 1,100 millionaire households was attempting to understand investment patterns and concerns for this group.

When asked about their outlook regarding the state of the economy in 2019, millionaires reported their lowest levels of confidence since 2006. As surprising as it sounds for those of us without a net worth to match, this concern translates to feelings of financial insecurity.

The first reason for this insecurity is due to concerns about their health and health care costs. As the average age of millionaires is in the 60s, the rising cost of health care is a primary concern.

The other large concern is the cost of living. Millionaires congregate in large cities such as New York, Honolulu, San Francisco, and Washington D.C. The cost of living in these cities can be as much as 250% higher than the national average.

This means the "millionaire hurdle" is higher than it used to be in the '80s. Through the study, Fidelity identified a new benchmark of $7.5 million which millionaires would need to surpass to feel rich once again.

As demographics change across the U.S. and the group of wealthy Americans grows larger, cultural perceptions of wealth will begin to shift as well. However, it may take the next wave of media responding to the American Dream before we think differently about millionaires.

We're regularly seeing the power of the 'At-Home Revolution' across different sectors...

We're regularly seeing the power of the 'At-Home Revolution' across different sectors...

And one industry seeing a huge benefit from this trend is home improvement. People are spending more time at home, and thus investing directly into where they spend most of their day.

For example, Home Depot's (HD) revenue is forecasted to grow by $5 billion, or by 5% this year. This growth comes during a time when many other businesses are struggling as consumers tighten their spending.

Home Depot also benefited from being classified as an "essential business" during the shutdown. Consumers with stimulus money to spend simply had less options to choose from when shopping. All of these factors have led to an explosion of home-improvement projects.

For these projects, people generally aren't taking on huge improvements like redoing a bathroom or adding a new wing. These do-it-yourself ("DIY") tasks typically involve painting the walls, fixing doors, or cleaning gutters... at least to start.

Businesses that supply tools and products for these types of projects have stood to gain the most. In particular, paint companies have been huge beneficiaries of this part of the At-Home Revolution.

And the biggest company in the paint industry is Sherwin-Williams (SHW). This household name sells paint products to professional, industrial, commercial, and retail customers.

Sherwin-Williams has a long history of growth through acquisitions. In 1984, it bought Mobil chemical coating for $100 million. In 2007, it acquired Columbia Paint... and in 2011, it completed the acquisition of Leighs Paints.

In 2017, Sherwin-Williams acquired competitor Valspar in a roughly $11.5 billion deal. This vaulted the company to the top of the global paint market, with around a 13% market share.

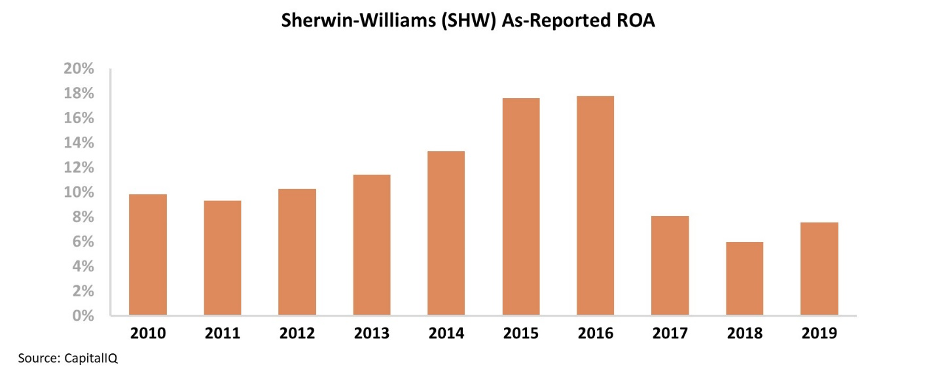

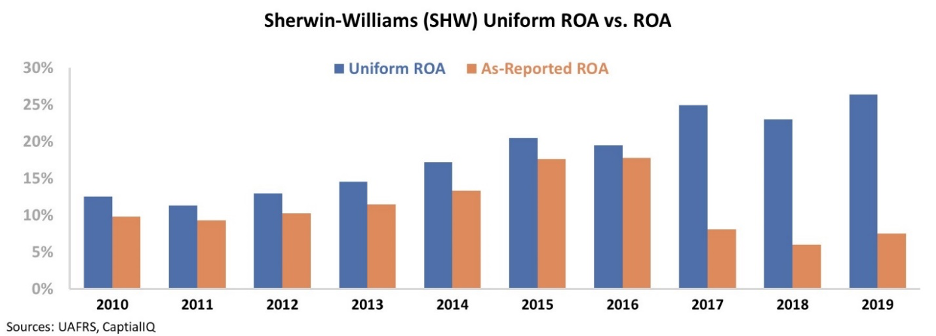

However, investors looking at the as-reported numbers would think that this acquisition has tanked Sherwin-Williams' profitability. After the acquisition, the company's as-reported return on assets ("ROA") fell from 18% in 2016 to 6% in 2018 – barely above cost-of-capital levels...

However, this picture of Sherwin-Williams' performance is inaccurate, pulled down by distortions in as-reported accounting. Due to the GAAP treatment of goodwill, along with other distortions, the market has missed the mark on this firm's success.

Sherwin-Williams has managed to successfully integrate Valspar and turn itself into a dominant market leader, capable of weathering economic downturns.

Sherwin-Williams' Uniform ROA has actually improved since the deal with Valspar... It has grown from 20% in 2016, the year before the merger, to 26% in 2019.

And thanks to the At-Home Revolution, demand in the painting segment is only getting stronger... As a result, Sherwin-Williams grew net income in the second quarter by more than 20% year over year.

This was despite the overall global headwinds due to the coronavirus pandemic and overall earnings misses by most companies.

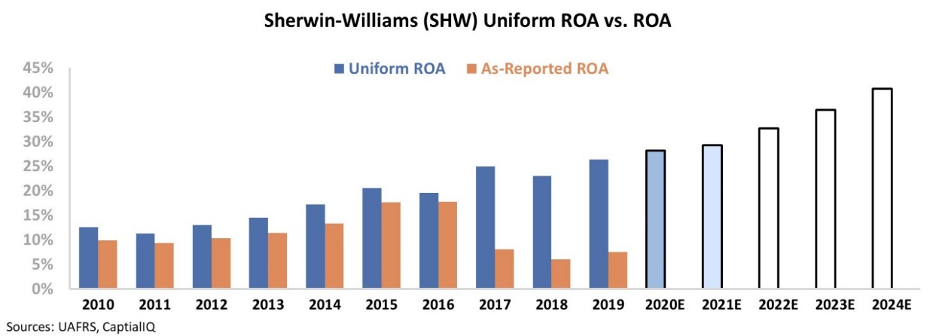

To understand if the market thinks Sherwin-Williams can continue to create this value for shareholders, we can use the Embedded Expectations framework to easily understand market valuations.

The chart below explains the company's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, despite the broad economic uncertainty, both analysts and the market expect Sherwin-Williams' returns to grow beyond current levels...

Ultimately, Uniform Accounting shows the true strength of Sherwin-Williams' business and the market's bullish outlook for the company.

Sherwin-Williams has been incredibly resilient during the pandemic, and is forecast to continue improving returns as a result of increased DIY spending.

Investors paying attention to the GAAP numbers might be scratching their heads as to why the market and Wall Street analysts expect this company to improve... but those following the real numbers can understand why expectations are so high.

Regards,

Rob Spivey

August 18, 2020

P.S. Have you been doing any home-improvement work since the pandemic started? Have you found yourself spending money you might have spent travelling or on other things on your home since March? Let us know at [email protected].

Millionaires are no longer feeling like millionaires...

Millionaires are no longer feeling like millionaires...