Before the coronavirus pandemic, AMC Entertainment (AMC) was mostly known for its movie theaters...

Before the coronavirus pandemic, AMC Entertainment (AMC) was mostly known for its movie theaters...

With more than 900 locations, AMC is the largest movie theater chain globally.

In May 2021, AMC joined video game retailer GameStop (GME) as a meme stock when retail investors jumped in on the struggling theater.

Many investors – including big hedge funds – held short positions in AMC due to the company's high debt load and inability to secure cash during the recession. AMC was on the verge of bankruptcy as the pandemic forced the company to close the doors of its theaters.

So when AMC shares skyrocketed from a low around $2 in December 2020 to a high of around $60 in June 2021, short positions were closed with incredible losses... while buyers saw massive returns.

The surge in AMC's stock price also allowed management to issue equity for much-needed cash.

But now, AMC is perhaps using that cash for frivolous purposes instead of turning the business around.

A few weeks ago, the company announced that it acquired a 22% stake in Hycroft Mining (HYMC) for $28 million – not a cryptocurrency miner but an actual gold and silver miner.

This leaves analysts – and many investors – wondering why AMC hasn't spent the money to save its dying business...

This leaves analysts – and many investors – wondering why AMC hasn't spent the money to save its dying business...

AMC could be upgrading its key theater facilities or growing its business. It could even pay some of the debt it has, which is why the stock plummeted in the first place.

Hycroft is seemingly unrelated to AMC's once-thriving theater business, so many analysts are left scratching their heads.

AMC's management claims that the mining company faces severe and immediate liquidity issues but has rock-solid assets. It views Hycroft as an opportunity to diversify AMC and turn around a company, which is in a similar tough position that AMC found itself in about a year ago.

Considering AMC was on the brink of bankruptcy at this time last year, this statement doesn't provide much relief for investors, and it seems many aren't buying it.

But Uniform Accounting helps us understand why management is reluctant to put money back into its business...

But Uniform Accounting helps us understand why management is reluctant to put money back into its business...

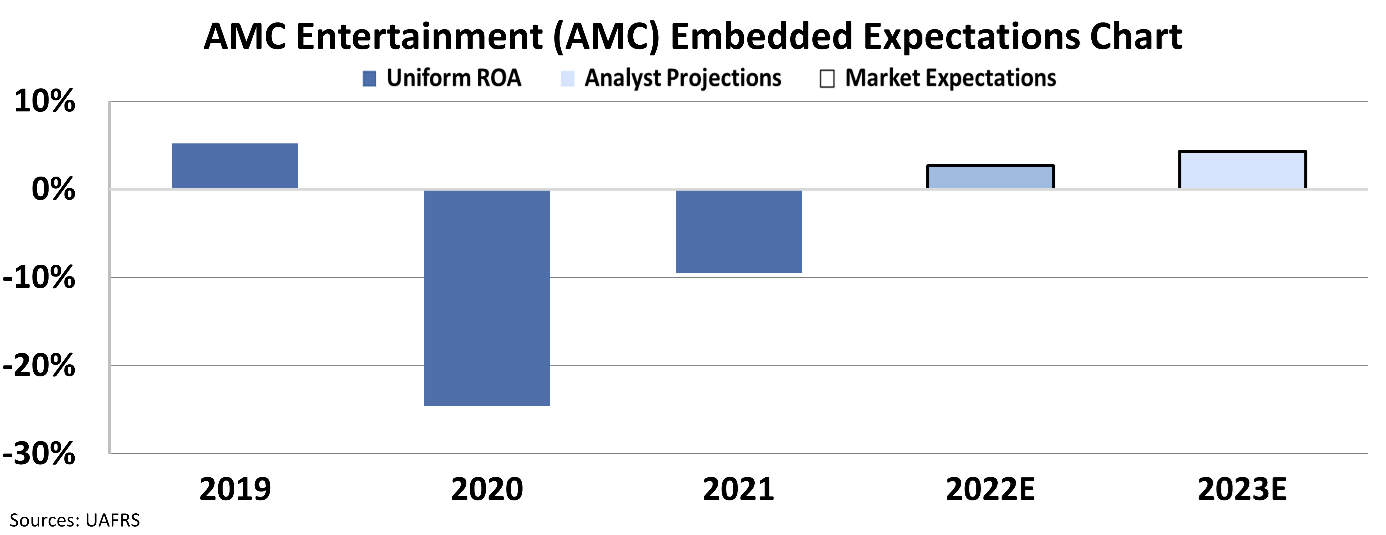

Even before the pandemic, Uniform metrics show that the theater chain struggled. The company only saw a Uniform return on assets ("ROA") around cost-of-capital levels – failing to earn an economic return for investors.

On top of that, the pandemic was a massive hit to the business, with AMC's Uniform ROA dropping to negative 25% in 2020. This figure increased slightly in 2021 but remained at negative levels – sitting at negative 10%.

Wall Street forecasts aren't that relieving, either...

AMC's ROA is expected to be under the cost of capital for the next two years, barely reaching 5%, even as we exit the pandemic and theaters open back up. Take a look...

Using Uniform Accounting, we can see that ACM's management believes that it's better to invest in other businesses besides its own for profitability as the best way to keep investors happy.

AMC was already struggling even before it got crushed by the pandemic, which explains management's reluctance to spend its excess capital on itself. Instead, the company is turning to outside companies to help generate some profitability for investors.

In reality, a move like buying a mine feels more like a "Hail Mary" than a real business strategy... and now AMC has to worry about the dreaded conglomerate discount.

While gold and silver mining has nothing to do with a movie theater, AMC's management is using Hycroft as a chance to turn AMC around. We'll have to wait and see if this is the beginning of a larger trend.

Regards,

Rob Spivey

April 12, 2022

Before the coronavirus pandemic, AMC Entertainment (AMC) was mostly known for its movie theaters...

Before the coronavirus pandemic, AMC Entertainment (AMC) was mostly known for its movie theaters...