Blue Owl Capital (OWL) wasn't trying to take advantage of a fad...

Blue Owl Capital (OWL) wasn't trying to take advantage of a fad...

You can't say the same for many of its peers, though.

As an asset manager, Blue Owl does everything from helping hedge funds raise money to investing in sports teams like the Phoenix Suns and the Sacramento Kings. And since it's in the investment industry, the company knows a good deal when it sees it.

When Blue Owl chose to go public in 2021, it could have done so via the traditional initial public offering ("IPO") route. However, it knew a special purpose acquisition company ("SPAC") would be faster and cheaper.

It soon joined the ranks of the pandemic-era SPAC bubble... alongside unprofitable electric-vehicle maker Nikola (NKLA) and infamous co-working "unicorn" WeWork (WEWKQ).

Nikola and WeWork are prime examples of why investors should treat SPACs with caution. Plenty of companies use this method to go public because they don't have any other options.

That said, not all SPACs are destined to fail. Today, we'll take a closer look at Blue Owl – an example of a SPAC done well – and cover how to tell the difference.

While the concept of SPACs has been around for years, it only really took off during the pandemic...

While the concept of SPACs has been around for years, it only really took off during the pandemic...

SPACs are a way for a company to go public without going through the typical IPO process. Instead, a "blank check" SPAC acquires the business in question... and it starts trading under that company's name.

It only takes a few months versus a few years for a traditional IPO. And because the shell company is already public, the regulatory process is far less strict.

This quick "back door" route became popular during COVID-19... rising from 59 SPACs in 2019 to more than 600 in 2021.

And last year, 21 former SPACs went bankrupt. They wiped out $46 billion in equity value in the process.

Plenty of fad businesses were looking for fast, easy money... and it came back to bite investors in the end. Yet for every Nikola and WeWork, there's a company that chose the SPAC path for the right reasons.

Blue Owl is a well-run business. Its Uniform return on assets ("ROA") was 57% in 2022, more than quadruple the 12% corporate average. And it's expected to surpass 100% over the next two fiscal years.

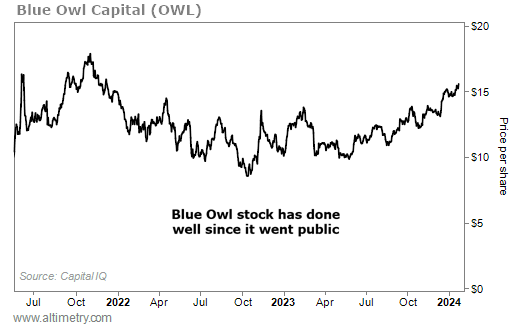

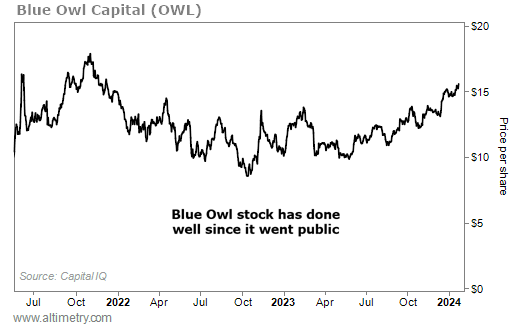

So far, that respectable business model has paid off for investors. Blue Owl stock is up more than 50% since going public...

Since SPACs aren't as heavily regulated as IPOs, you have to do much of that research yourself...

Since SPACs aren't as heavily regulated as IPOs, you have to do much of that research yourself...

Unlike Nikola and WeWork, Blue Owl ticks a lot of important boxes. For starters, it has a strong management team with a respectable background in the investment industry.

The co-CEOs have years of experience in private equity ("PE") and private credit. Marc Lipschultz spent more than 20 years at PE giant KKR (KKR), and Doug Ostrover founded Blackstone's (BX) alternative credit platform.

Both co-CEOs also have spotless records in the finance industry.

Compare that with Nikola... whose founder, Trevor Milton, had a history of misleading investors that landed him in jail.

The company has grappled with a revolving door of executive departures since then. And shares are down almost 100% from their peak.

And as we mentioned, Blue Owl actually makes money. Nikola still generates negative returns, and WeWork went bankrupt because it couldn't pay its bills.

Plenty of SPACs don't pass the fundamental red-flag test...

Plenty of SPACs don't pass the fundamental red-flag test...

And that's why it's important to do the research every time.

Make sure no members of management are "bad actors," meaning they have prior allegations of fraud or other crime. Double check that the company's headquarters is where it says it is... and that it doesn't change constantly.

And keep an eye out for related-party transactions – deals made by companies with preexisting connections – that might be taking money away from other shareholders.

Even well-known startups like WeWork wouldn't have had a clean result. Its founder, Adam Neumann, tried selling his other company the rights to the name "We"... That's a textbook related-party transaction.

For every Blue Owl Capital, there are a lot of future bankruptcies and frauds located in the SPAC world. You could save yourself a lot of pain (and a lot of money) if you pay attention to the warning signs.

Regards,

Joel Litman

January 25, 2024

Blue Owl Capital (OWL) wasn't trying to take advantage of a fad...

Blue Owl Capital (OWL) wasn't trying to take advantage of a fad...