We received some great reader feedback on the economic outlook for 2020...

We received some great reader feedback on the economic outlook for 2020...

In Thursday's Altimetry Daily Authority, we highlighted that a significant amount of asset management firm AllianceBernstein's (AB) outlook for the market lines up with our own. And in that essay, we touched on the continued health of the credit markets.

As a follow-up to the article, reader Kenneth asked:

How do you feel about the Fed's interventions in the overnight repurchase market? Is this making the credit market appear more healthy than it really is?

He also went on to ask about what we thought about the Federal Reserve's balance sheet growing again in relation to these actions.

It's a great question, Kenneth. But to respond, it's worthwhile to first take a step back and focus on what the Fed's goal is: fulfill its dual mandate of maintaining low inflation and low unemployment.

Everything the Fed does should be focused on making sure its policy decisions to achieve the dual mandate actually make it into the market. That's where the latest intervention comes in...

If short-term mismatches in the overnight repo market cause interest rates to rise, this would disrupt the Fed's goal of low interest rates to keep unemployment low and the economy growing.

Kenneth's question was whether we thought that intervention was masking issues with the credit markets... because why else would the intervention be needed? For this, it's worth looking at bank balance sheets and bad debt levels...

If banks were dealing with bad debts and weren't lending to other banks because none of them trusted each other not to go bankrupt the next day... then it might be a sign that the Fed's intervention was hiding a bigger issue. The Fed was propping up the banks again, and if that was reality, the market shouldn't be sitting just off all-time highs.

In reality, that's not the case. If you look at just about any metric for U.S. bank health, they all show the same fact – U.S. banks are healthy today.

The repo market has just gotten much more complex since 2008. It isn't a boring market that just banks play in... Many more diverse players are in the market now – from hedge funds to market makers to sovereign wealth.

And as the market gets more complex, the short-term needs of different market participants can cause short-term volatility. Because of this, it makes sense for the Fed to pay closer attention to this market – and be more involved in it – than the central bank was when this was just a conduit for banks managing their balance sheets.

As any system gets more complex, the regulators of that system need to react.

In terms of concerns over the growth of the Fed's balance sheet, this is certainly something to monitor. But the fact of the matter is that the balance sheet is now one of the tools the central bank uses to control monetary policy.

The Fed showed inconsistency by cutting rates for much of the back half of 2019 while also still shrinking its balance sheet until September... Shrinking the balance sheet was tightening credit, while rate-cutting was aimed at loosening access to credit.

Discussing the philosophy of whether the Fed should be using its balance sheet – or if that could lead to massive inflation – are discussions for another day. But touching on the repo market and the Fed's balance sheet should help clarify some of the questions about the health of the credit market.

During times of economic recession, all stocks tend to move in the same direction...

During times of economic recession, all stocks tend to move in the same direction...

When we discuss correlation as it relates to stocks, we're talking about the likelihood that all stocks will move in the same direction at any given time – in either a bull or bear market.

Researchers have concluded that correlations are fairly low during bull markets.

Practically speaking, this means that stock-picking is more important when the market is doing well – because it's possible to pick both winners and losers.

On the other hand, stock market correlations spike during recessions. Put another way, just about every stock goes down during a bear market... especially during a severe one paired with a recession.

At these times, individual stock-picking is far less important because most stocks will fall – regardless of fundamentals.

There are, of course, exceptions to this rule... Different sectors and industries have different sensitivities to economic decline. One of the best examples of this can be seen in the difference between two sectors: Consumer Staples and Consumer Discretionary.

While the names are fairly self-explanatory, consumer staples are companies that produce essential goods like food and medical supplies... while consumer discretionary businesses deal with non-essential goods like travel and entertainment.

Though both sectors declined during the Great Recession, consumer staples stocks fared much better – falling by only 15% in 2008 compared to a 34% drop in consumer discretionary stocks.

There are a number of "defensive" industries and sectors that tend to hold up better during recessions, and these segments of the market usually have fewer fluctuations in demand. Sectors like Utilities, Real Estate, and Consumer Staples are considered defensive, and specific industries include discount retailers and defense contractors.

However, even within these industries, not all stocks performed equally during the Great Recession...

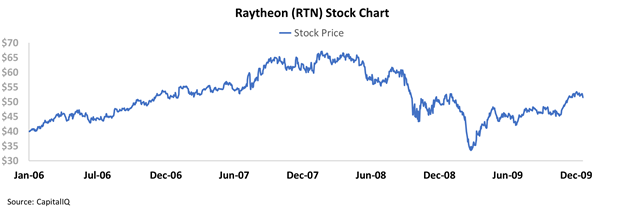

Among the big U.S defense contractors, we saw a wide range of stock performances in 2008. For instance, Raytheon (RTN) was one of the best performers, losing a maximum of 45% but recovering to a more modest 20% loss by the end of 2009. Take a look...

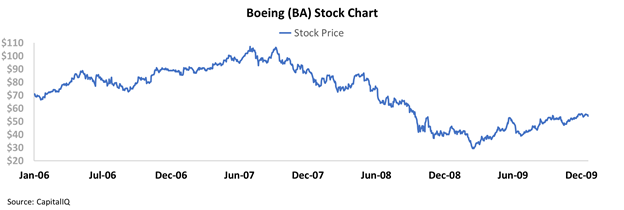

Meanwhile, Boeing (BA) was the worst-performing defense contractor, falling by 67% and only recovering to a 46% drop from its pre-recession highs by the end of 2009...

At these levels, Boeing reacted more like a Consumer Discretionary stock than a defense contractor. Despite being the second-largest defense contractor in the country by revenue, Boeing only gets 29% of its revenue from its "Defense" segment – the vast majority comes from its commercial aerospace business, which was under pressure because of its reliance on the travel industry.

For comparison, 94% of Raytheon's revenue comes from its defense business.

Surprisingly, the second-worst-performing defense contractor was the fifth-largest in the U.S. industry by revenue. It produces the M1 Abrams tank, and it's one of the two largest U.S. Navy shipbuilders...

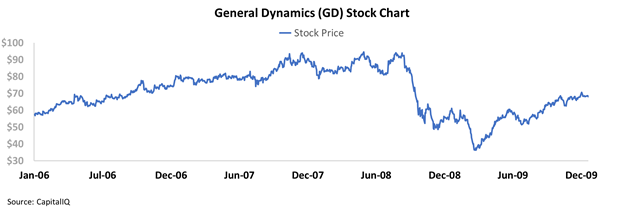

We're talking about General Dynamics (GD). The company's stock fell by 59% during the Great Recession – similar to Boeing's massive collapse – before recovering to a 26% drop...

But this wasn't due to General Dynamics' defense business...

In 1999, the company bought jet maker Gulfstream. For many years, Gulfstream has been General Dynamics' biggest profit center... and this concerned investors back in 2008 with the pressure on corporate and high net worth individuals' budgets.

Since the end of the recession, not much has changed at General Dynamics. Gulfstream is still a main revenue driver, and the company continues to unveil new private jets. Over the past several years, General Dynamics has released the G600 and G700, continuing its focus on its commercial business.

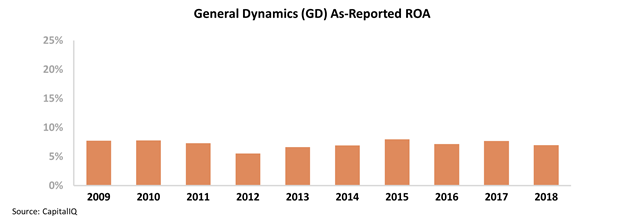

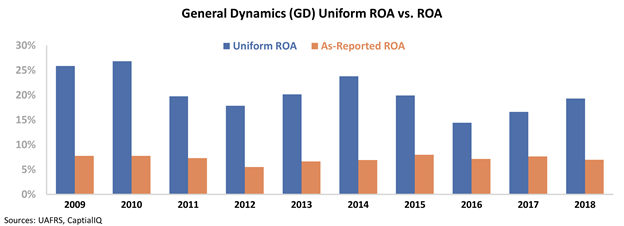

Over this time, the company's return on assets ("ROA") has stayed mostly flat – never improving above corporate average 10% levels...

With stagnant profitability over the past three fiscal years, investors may be concerned about the impact of General Dynamics' new jet releases... especially as fears of another recession grow stronger.

However, there may be less to worry about with the company than investors think...

Once we apply our Uniform Accounting metrics, we can see a fundamentally different trend. Not only has General Dynamics begun accelerating the production of its newest jets... it has also been able to grow deliveries since 2016.

On a Uniform basis, this has markedly improved the company's ROA over the last three years. Take a look...

General Dynamics is not a modest, flat-return business... The company is instead seeing fundamentals accelerate. And in the context of recessionary concerns, in 2009 to 2010 General Dynamics saw healthy returns of more than 25%... despite weakness in the corporate-jet market.

Gulfstream doesn't look like a risk for General Dynamics if the economy sours in that context – it looks like this supplement to the company's core defense business helps returns.

Based on as-reported metrics, it's hard to blame investors for not seeing any benefit from General Dynamics' new Gulfstream product launches. However, using Uniform Accounting, we can understand the company's real profitability trends and see how investors are missing the bigger picture.

Regards,

Joel Litman

January 28, 2020

We received some great reader feedback on the economic outlook for 2020...

We received some great reader feedback on the economic outlook for 2020...