Here's an attainable New Year's resolution...

Here's an attainable New Year's resolution...

As we open to the New Year, many folks will be making those same New Year's resolutions... "New year, new me."

In reality, we all understand change is hard. That's why resolution failure rates are so high – most searchable statistics say around 80% of resolution commitments end up failing. Expecting to make a major change to your life because of an arbitrary roll of the calendar year is unrealistic.

Committing to go to the gym an hour a day when you always find yourself with a full day on your calendar, or to start eating salads when you're a red meat and fast-food person is a massive change.

So today, I want to talk about promoting your health and wellness in a way that doesn't blow up your calendar.

In recent Altimetry Daily Authority issues, I've talked about my journey to find the "Fountain of Youth"... how intermittent fasting ("IF") has been revolutionary to my health... and I also answered some incremental questions about my diet and how I implemented it.

Through IF, I was able to change my diet and make more time in my day because less of it revolved around eating. I'm always trying to find ways to reclaim part of my day to achieve more.

I also stumbled upon a similar way to reclaim part of my day that I used to dedicate to exercise. It's called Peak 8 training (there's plenty of other research on it, but that article gives a good overview).

I travel a lot and spend plenty of time in hotels. Anyone who has tried to keep a workout regimen while traveling knows how challenging that can be because of the intermittent quality of hotel gyms and how variable a travel schedule can be.

The idea behind Peak 8 training is to work out in 30-second bursts of aerobic exercise eight times in a 20-minute period, combined with 90 seconds of rest between each burst.

It can be via stationary bike, elliptical, burpees, or whatever you choose... but you need to do it flat out for 30 seconds. You should be gasping for breath at the end of the burst.

By pushing your body to the limit for those 30 seconds, you maximize your heart rate. You literally want to "peak out" your heart rate – exceeding your maximum rate (220 beats per minute – your age is a general rule of thumb for your maximum heart rate) by five to 10 beats per minute.

The cardiac and metabolic benefits have been widely reported. Also, many people have highlighted that combining Peak 8 training with IF can act as a force multiplier for each other.

Obviously, as with any strenuous exercise routine or lifestyle change, be aware of the health impacts and make sure it's suitable for you... and consider consulting your doctor first.

But I hope you find this to be a potential New Year's resolution that isn't time consuming and is health positive, meaning it can be one of the 20% of resolutions that can be kept for the year.

Thank you for taking this journey with us at here Altimetry in 2019. We're excited for everything we have planned for Altimetry and our readers in the coming year.

And most importantly, we're also excited for everything else you have to look forward to in 2020. We wish you great health and wealth in the new year.

We often write – at least indirectly – about mergers and acquisitions ('M&A')...

We often write – at least indirectly – about mergers and acquisitions ('M&A')...

One of our first issues back in September talked about Big Pharma giant AbbVie (ABBV) acquiring competitor Allergan (AGN) for more than $60 billion – one of the largest pharma acquisitions ever.

In that article, we talked about the "winner's curse" – the idea that the winner in a bidding war often overpays.

This concept has led to some historically bad deals. For instance, Time Warner and AOL merged for $164 billion during the height of the dot-com bubble. As the bubble burst, the combined company was forced to write down nearly $100 billion of the transaction value.

Likewise, Microsoft (MSFT) acquired Nokia's devices and services unit in 2013 for $7.2 billion as it tried to gain market share in the smartphone space. Within two years, Microsoft had written off $7.6 billion – more than the value of the deal itself.

More recently, Verizon Communications (VZ) acquired the struggling Yahoo for nearly $4.5 billion just two years ago. We'll have to see if this one works out, but the odds seem high.

Academic research on the topic suggests that 70% to 90% of M&A deals destroy value.

Whether or not that's completely accurate is up for debate... but it has implications for the market's reaction to M&A. When the chances of a deal destroying value are better than a coinflip, investors tend to react poorly.

However, there are plenty of deals that have been wildly successful. For instance, the AbbVie-Allergan merger has the potential to generate a lot of value.

Additionally, Procter & Gamble's (PG) 2005 acquisition of Gillette proved to be massively successful, as the company managed to dominate the shaving market.

While some acquisitions may just be "OK," many seem to be either boom or bust.

That said, there's a serious misconception about which M&A deals lead to a bust and which ones end up generating significant value. With the majority of deals failing to create value, investors often immediately react negatively to a merger.

But Uniform metrics can help us understand why that may not be a reasonable reaction.

Take strategic research and advisory firm Gartner (IT), for example...

The company offers services like subscription-based market research, networking events, and customized consulting solutions.

In 2017, Gartner acquired CEB for $3.3 billion. CEB has similar offerings – it provides data analytics, talent and strategy assessments, and numerous tech- and data-driven advisory services.

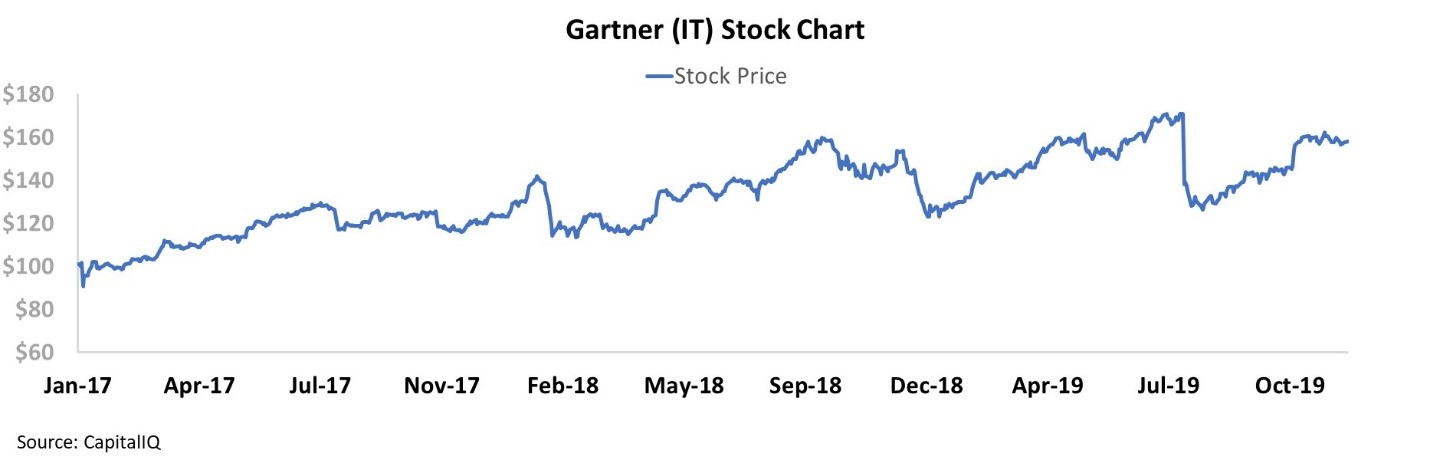

The two companies seemed like a natural fit together. And since the deal closed in April 2017, the market has rewarded Gartner on its vision... with shares moving steadily higher.

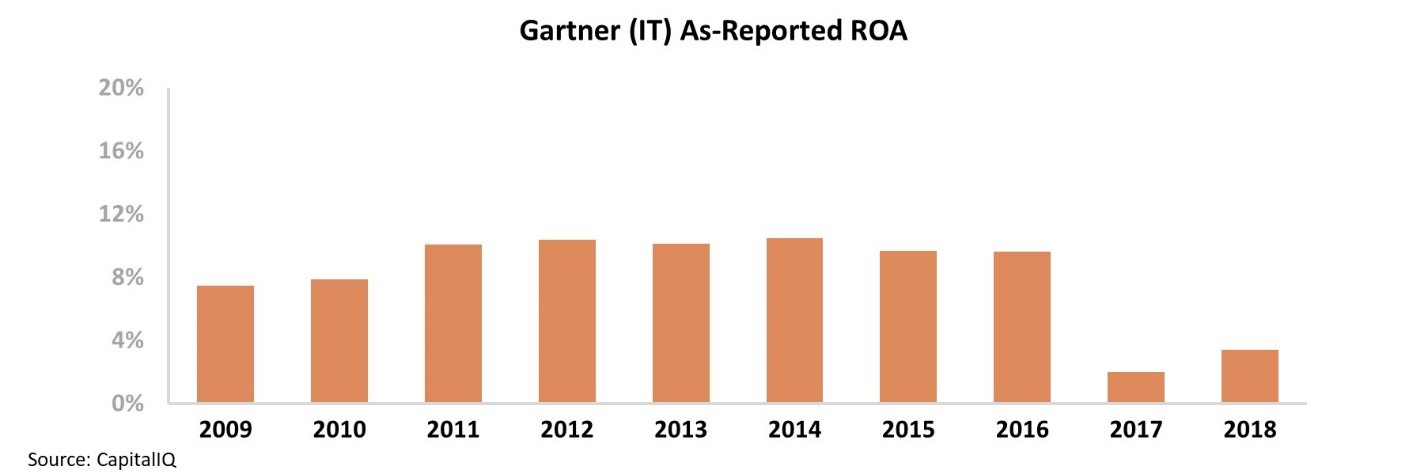

But when looking at Gartner's returns since closing the acquisition, it appears the market's optimism isn't justified. Gartner's as-reported return on assets ("ROA") has cratered since the acquisition, falling from market-average 10% levels to just 2% to 3% in the past few years...

This result seems to agree with the academic research... but there's a problem. This analysis is based on as-reported data, which can often lead to misleading conclusions.

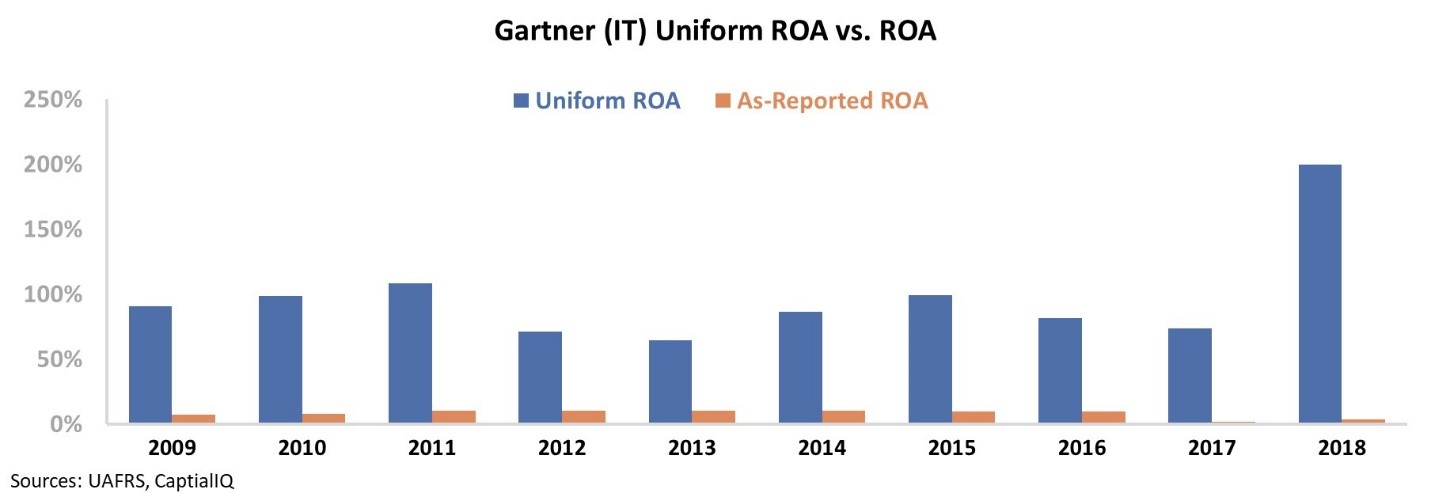

Once we apply our Uniform Accounting framework to Gartner's financials, we can see the actual result of its acquisition of CEB. Once we adjust for the misleading impact of as-reported M&A accounting – including the treatment of items like goodwill, stock option expenses, and capitalizing versus expensing operating leases– it's clear why the acquisition has been rewarded by investors...

Not only is Gartner far more profitable than the as-reported metrics suggest – with its Uniform ROA typically in the 70% to 100% range – but we can see that after a full year of integration with CEB, the company has reached a new level of profitability. Gartner's Uniform ROA reached as high as 200% last year. Take a look...

Rather than destroying value, this acquisition brought Gartner to a higher plane of performance and fundamentally improved the business.

Investors looking at the as-reported numbers might think Gartner is a short after its post-merger run... but they would be wrong.

While we can't say for sure whether 70% to 90% of mergers truly destroy value, we can certainly say that looking at as-reported financials won't give you an accurate answer.

Regards,

Joel Litman

January 2, 2020

Here's an attainable New Year's resolution...

Here's an attainable New Year's resolution...