Storage solutions on the power grid become essential in times of crisis...

Storage solutions on the power grid become essential in times of crisis...

In February, most of Texas lost power when its independent electrical grid failed during winter storms. In the aftermath of the chaos, one story failed to gain traction amidst the reporting on the political scandals and costs of the disaster...

Battery storage systems helped some utilities fair better than other solutions in dealing with the low temperatures and massive grid failures.

Regular Altimetry Daily Authority readers will remember our March 4 discussion of Vistra (VST) – one of Texas' independent power providers. Thanks to its battery and storage systems, the company was able to keep power flowing... and emerged as a winner from the crisis.

Electric-vehicle ("EV") maker Tesla (TSLA) also recognizes how important grid power storage solutions are. Through its Gambit Energy Storage subsidiary, Tesla is building its own battery- and energy-storage site in Texas. According to Bloomberg, this massive facility could power roughly 20,000 homes.

The move shows how Tesla is increasingly moving beyond just sleek EVs and into power storage.

As grid power storage and EVs become more prevalent in our society, investors are trying to figure out ways to gain exposure to battery investments...

As grid power storage and EVs become more prevalent in our society, investors are trying to figure out ways to gain exposure to battery investments...

One popular method is through exchange-traded funds ("ETFs"), which hold a basket of assets related to specific sectors.

Specifically, the Global X Lithium & Battery Tech Fund (LIT) has become popular due to these larger trends in the industry. Lithium is used in batteries, and the fund holds assets related to mining and refining the metal as well as battery production.

Keep in mind that the fund doesn't give investors total exposure to batteries, EVs, or many of the other drivers that excite investors about in the space.

The most popular lithium batteries right now aren't made of just lithium. They also include cobalt, nickel, graphite, and copper for various components.

And lithium batteries aren't even the only game in town. Looking at grid-based power storage, other solutions include complex devices like Zebra batteries and PbSb liquid metal batteries.

With all of the battery options in the space, an investment strategy that only looks at LIT misses a lot of potential players who can also benefit from the big EV and power storage trends.

But even though investors shouldn't only buy lithium, a major player in the space should be a big part of a battery-focused portfolio...

But even though investors shouldn't only buy lithium, a major player in the space should be a big part of a battery-focused portfolio...

Albemarle (ALB) is one of the largest lithium producers in the world. It's also the largest holding in the LIT fund.

Albemarle is a lithium miner, but that doesn't mean it digs giant holes in the ground. The company takes salt from the Salar de Atacama salt flat in Chile and extracts the lithium.

While lithium production only makes up less than half of the company's revenue, Albemarle's exposure to the metal has an outsized effect on profits.

However, looking at the GAAP metrics, investors may be wondering if exposure to lithium with the rise of the battery technology has even benefited Albemarle...

However, looking at the GAAP metrics, investors may be wondering if exposure to lithium with the rise of the battery technology has even benefited Albemarle...

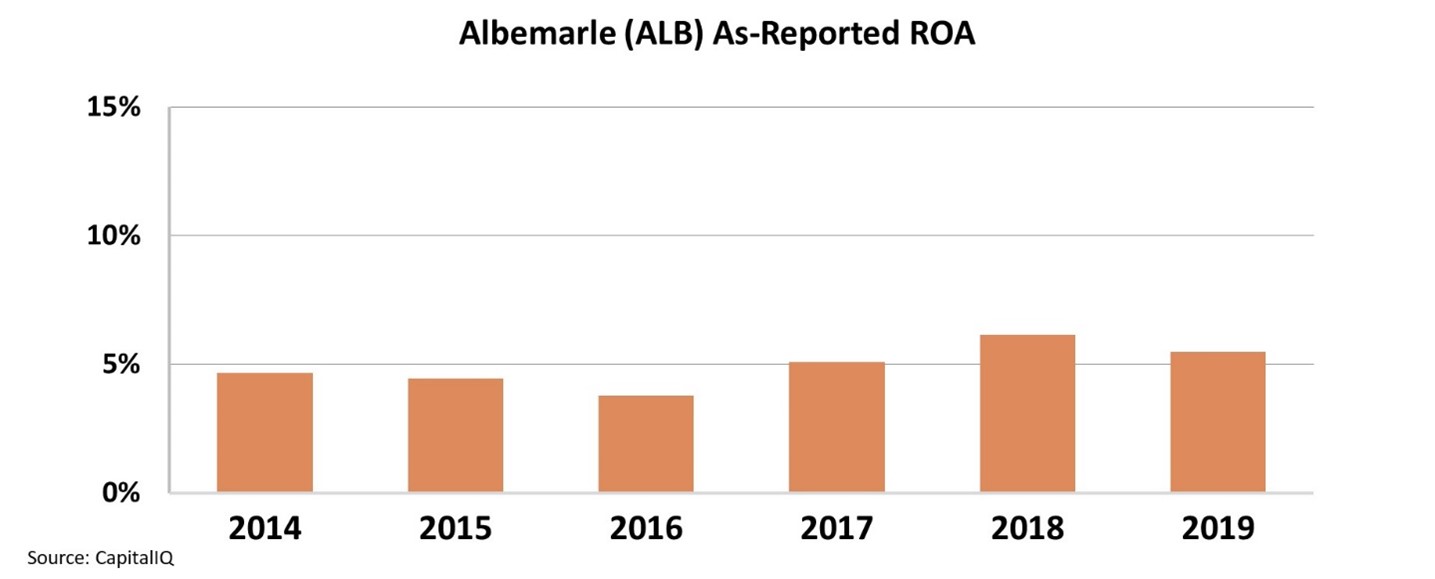

Specifically, since 2014, Albemarle's as-reported return-on-asset ("ROA") levels have been weak.

The company's ROA has barely held 5%, which would indicate that being exposed to the boom in lithium in recent years has done nothing for profitability. Take a look...

In reality, bad accounting is creating these seemingly weak ROA levels.

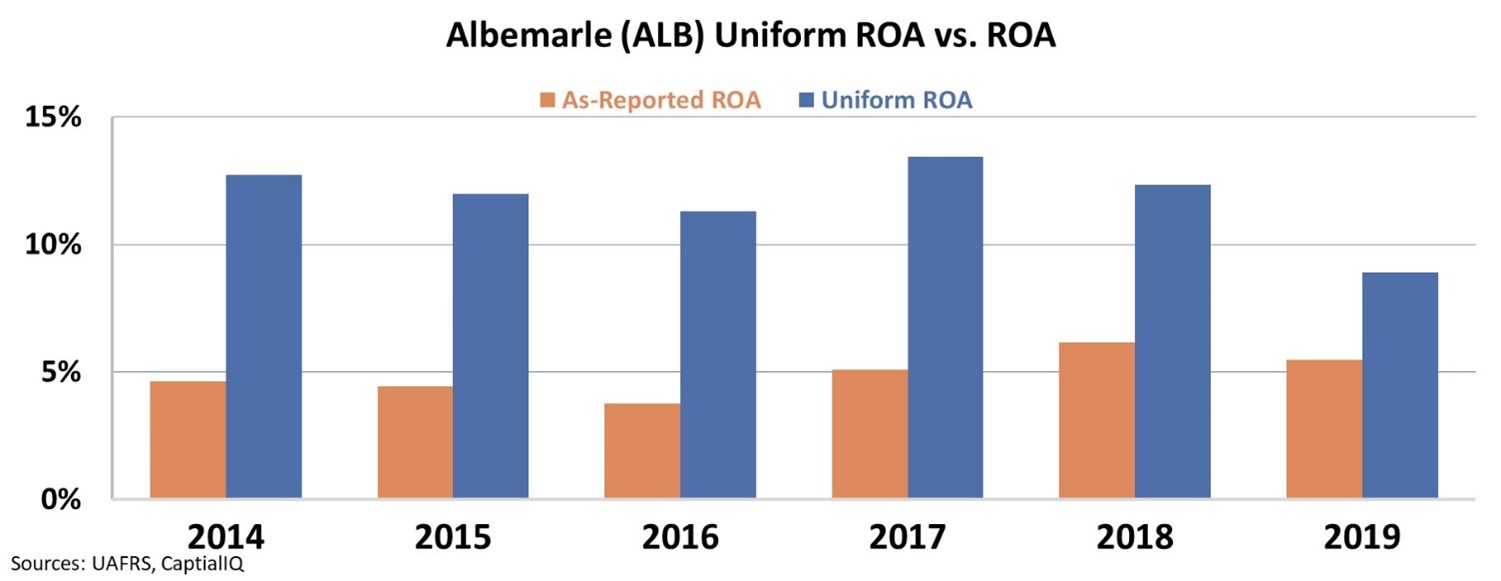

Through Uniform Accounting, we can clean up the financial statements. After adjusting for distortions such as special items and excess cash, we can see the real story...

Since 2014, Albemarle's Uniform ROAs have been robust. As you can see in the chart below, instead of continued weakness in profitability, the company has seen returns consistently greater than 8%.

By looking at the right data, we can see how Albemarle's exposure to the supercycle in lithium has translated into stronger returns than Wall Street would have you believe.

The company is supplying a high-demand market... and Uniform Accounting proves that this is paying off.

Regards,

Rob Spivey

March 30, 2021

Storage solutions on the power grid become essential in times of crisis...

Storage solutions on the power grid become essential in times of crisis...