It's been an interesting week for prominent hedge fund activists...

It's been an interesting week for prominent hedge fund activists...

In an amusing twist of fate, we're talking about two activist investors this week.

On Tuesday, we talked about Carl Icahn and how he has been targeting McDonald's (MCD) for the mistreatment of farm animals.

Those familiar with the history between these two activists might find it amusing that Bill Ackman will be featured in Altimetry Daily Authority during the same week.

The two hedge fund billionaires have a long history of antagonism, and it has ended in big losses on both sides several times.

The most infamous moment between the two was their major fallout live on CNBC in early 2013. Bill Ackman was short on Herbalife Nutrition (HLF), and Carl Icahn decided to take the opposite side of the bet.

As a result of Icahn's trade, he made nearly $1 billion in profit, while Ackman lost close to a billion dollars on the other side.

While this was a public spat, they have significantly more history than that...

Not all of Ackman's trades have poor results...

Not all of Ackman's trades have poor results...

It can be fun to recount dramatic moments between legendary investors, but the reason we are talking about Ackman today isn't to revisit that lost battle.

Rather, we want to highlight Ackman's past bet on another company, which was much more successful than his Herbalife bet.

Going back to the early 2010s, Ackman's fund Pershing Square made more than $2.6 billion in profit with its Canadian Pacific Railway (CP) position.

The key part of Ackman's strategy after buying a large position in the company was to convince Hunter Harrison, one of the great railroad operators, to come out of retirement. Harrison is well-known for building up efficient railroad companies in the transportation industry.

Harrison was crucial in turning Canadian Pacific around with his operating prowess. By tightening timetables and improving freight efficiency, he was able to see returns grow throughout his tenure, making Ackman richer in the process.

Now, it appears that Pershing Square is going back to the well. According to an announcement earlier this month, the fund has once again built a sizable $220 million stake in CP stock.

Let's look at The Altimeter to evaluate Pershing Square's position...

Let's look at The Altimeter to evaluate Pershing Square's position...

Last time around, Ackman's vision was that Harrison could make significant operational improvements in the business.

While the stock is the same, the story seems to be different this time around.

Instead of looking for a turnaround story, he is just looking to see the company continue its steady pace of improvement.

When he brought in Harrison for the original turnaround story, Canadian Pacific's return on assets ("ROA") improved from 4% in 2011 to 11% in 2020, an impressive rally.

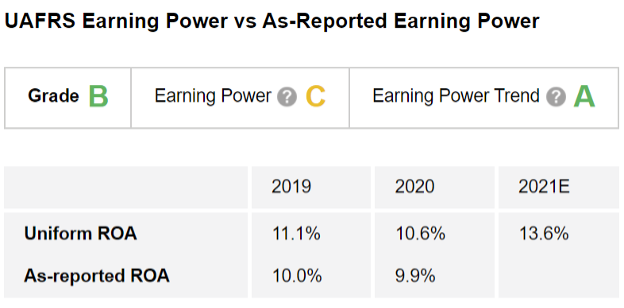

As The Altimeter shows, it doesn't look like the company is done yet. Let's look at The Altimeter grades for Canadian Pacific.

The company's Uniform ROA is forecast to jump even further in 2021, up to nearly 14%. For that reason, the company gets an "A" Earning Power Trend grade. As 11% returns in 2020 only give the company a "C" for Earning Power, this earns the name an overall "B" Performance grade.

Altogether, it shows that the company still has strong fundamental momentum.

Of course, if you were to follow Ackman on this trade, you'll need to know if it is another winning trade like Canadian Pacific the last time he bought in or a big loser like the Herbalife bet he lost to Icahn. To know this, we'll also need to understand the company's valuation.

To see the valuation grades for Canadian Pacific, you can click here as an Altimeter subscriber.

Regards,

Rob Spivey

March 24, 2022

It's been an interesting week for prominent hedge fund activists...

It's been an interesting week for prominent hedge fund activists...