The greatest investors know this first step is essential to beating the market...

The greatest investors know this first step is essential to beating the market...

And they know it's one that most other folks skip.

It's critical for legends like Bill Miller, who outstripped the S&P 500 Index for 15 years in a row... and Seth Klarman, whose Baupost fund has trounced the market for the past 30-plus years.

This step is how they can identify a surefire winner before almost anyone else catches on. And it all comes down to expectations.

In short, the first step to stock picking isn't deciding what you think the company can do. It's understanding what the market expects the company to do... and deciding if you agree.

Yesterday, we covered part one of our stock analysis "refresher course." We introduced hedge fund Engaged Capital, which is pushing for improvements at burger chain Shake Shack (SHAK). And through our Embedded Expectations Analysis ("EEA") framework, we explained where the market thought Shake Shack was headed before Engaged got involved.

Today, we'll discuss how to interpret and apply the EEA as an investor... and how to tell if the market has the right (or wrong) idea.

We're diving into the next set of in-depth questions, courtesy of astute subscriber Anthony H. from New York City...

We're diving into the next set of in-depth questions, courtesy of astute subscriber Anthony H. from New York City...

Anthony didn't just want to understand how our EEA worked, as we detailed yesterday. He wanted to know how we decide if a stock is undervalued after we figure out what investors are forecasting.

We look at a lot of things when predicting future results... including the company's outlook, changes in the industry, and broader macro trends. Our EEA charts help speed up the process. They allow us to quickly decide whether it's worth spending time on a company in the first place.

We've been applying these methods of stock analysis for decades. So we've come up with something of a "short list" for the best indicators of future performance. It includes...

- Historical profitability range.

- Wall Street's near-term expectations. (After all, these people are paid to be smart about the company's performance.)

- Comparable peer profitability.

That's why the EEA includes the company's performance history and often the next two years of analyst forecasts. It gives us a sense of whether market expectations are reasonable.

Looking at Shake Shack again, it's easy to see how this data speeds up the research process...

Looking at Shake Shack again, it's easy to see how this data speeds up the research process...

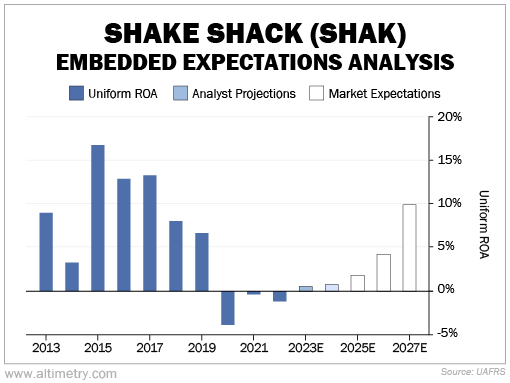

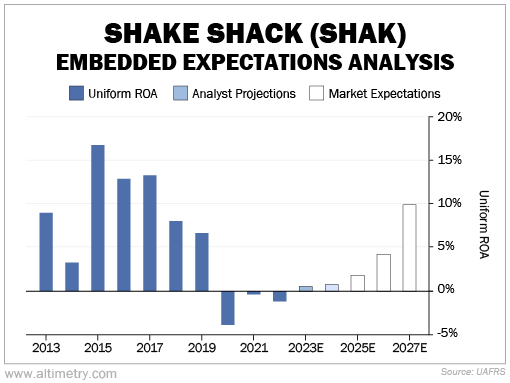

In 2015, Shake Shack's Uniform return on assets ("ROA") got as high as 17%. It spent three straight years above the 12% corporate average.

Take a look...

As a reminder, current market expectations (the white bars) are for Uniform ROA to recover to 10% by 2027. Shake Shack has done that and more in the past, so those expectations aren't unreasonable... if the company can return to previous profitability levels.

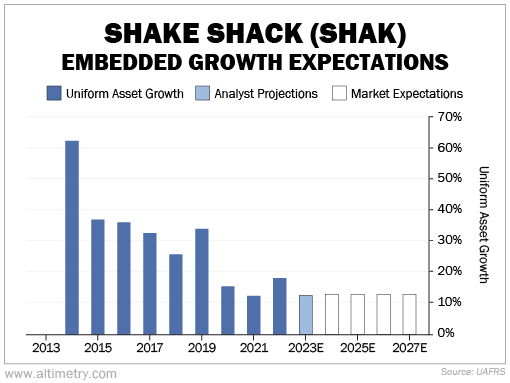

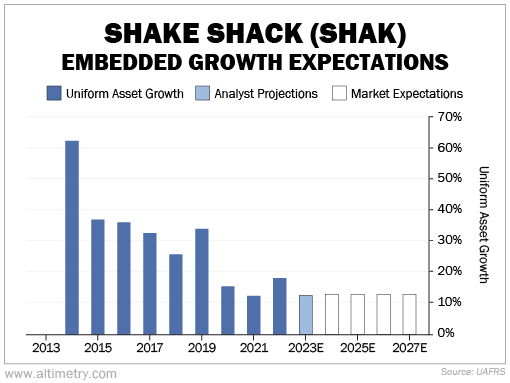

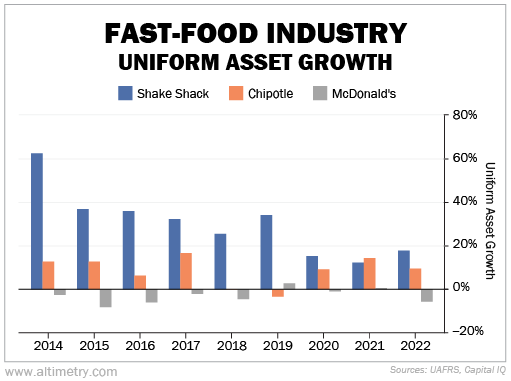

The company largely grew by more than 30% per year before the pandemic. The market expects future asset growth to be around pandemic-era rates.

Check it out...

Unless we think Shake Shack has saturated its markets, these expectations are reasonable at worst... and may be too pessimistic based on history.

Here's the issue – Wall Street analysts think Shake Shack will keep struggling.

These folks are paid to have a good handle on their coverage group's near-term outlook. And they believe Uniform ROA will hover around 0% for the next two years.

As we explained yesterday, the team at Engaged Capital almost certainly did a similar analysis before getting involved with Shake Shack. They can see analysts aren't confident in the company's ability to recover its returns.

If Wall Street analysts are right, Shake Shack will underperform the market's expectations. That would push shares lower.

However, expectations alone are only one piece of the puzzle...

We suspect Engaged is focusing more on comparable peer profitability...

We suspect Engaged is focusing more on comparable peer profitability...

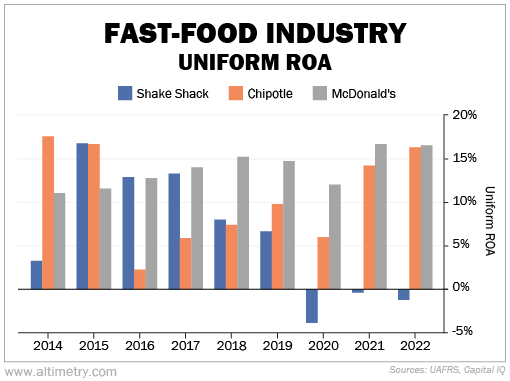

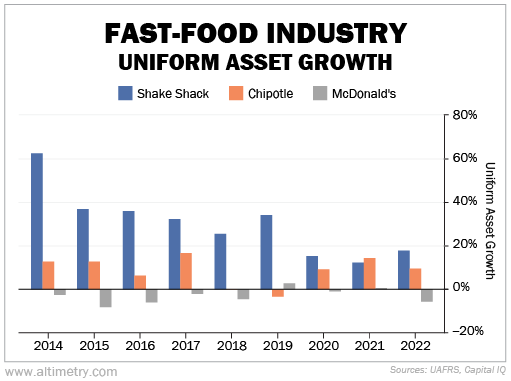

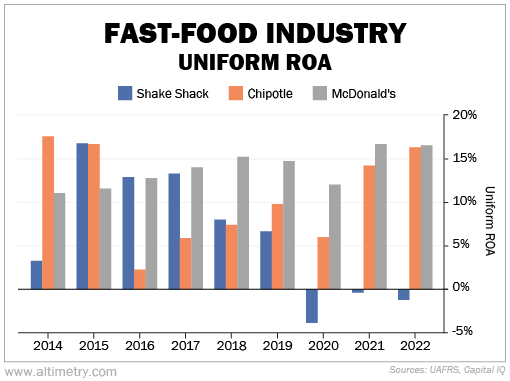

Shake Shack is a bit of an oddity when you compare it with peers like Chipotle Mexican Grill (CMG) and McDonald's (MCD). Around half of its stores are fully owned, and the other half are franchises.

Almost all of Shake Shack's peers have chosen only one model. They're either fully owned stores like Chipotle, or almost entirely franchises like McDonald's (and pretty much everyone else).

Either model can be successful. Chipotle's Uniform ROA was 16% last year and is expected to hit 18% in 2023. It still grows assets around 10% per year.

Over the past two years, McDonald's has averaged a Uniform ROA of 17%, although it's not growing much.

Take a look...

We've already established that if Shake Shack can just get back to prior Uniform ROA levels, it would be fairly valued at worst.

If Shake Shack starts to operate like its peers, it could significantly exceed market expectations. We wouldn't be surprised if Engaged starts pushing for the company to choose one ownership model going forward.

Shake Shack management knows that Wall Street analysts have little faith in the company as it stands. So the team may be more open to listening to Engaged than usual.

Of course, as everyday investors, we don't have the power to drastically change a company's operating strategy...

Of course, as everyday investors, we don't have the power to drastically change a company's operating strategy...

If anything, that makes this type of quick-and-dirty analysis even more valuable to us.

As investors, we now have an idea of why Engaged is interested in Shake Shack. It knows that the market is undervaluing the burger chain, and it thinks it can help improve returns.

Tomorrow, we'll wrap up our three-part "refresher course" with a deep dive into Uniform ROA. We'll explain why we tend to favor it over other metrics... and the key insights it gives us.

For now, it's clear that Shake Shack has hit hard times. It's performing worse than its peers. And it's hurting itself with its inability to pick an operating model. Engaged thinks that if the company can turn things around, it might turn out to be undervalued.

Using Uniform ROA and asset growth data, we can draw all these insights with limited research into the company. We gain context into where things are headed versus what the market believes will happen.

And we have more time to research the sorts of changes the company may or may not be making in the future.

Regards,

Joel Litman

May 24, 2023

The greatest investors know this first step is essential to beating the market...

The greatest investors know this first step is essential to beating the market...