What is LIBOR... and what is it used for?

What is LIBOR... and what is it used for?

The London Interbank Offered Rate, known as LIBOR, often appears in the media to explain sweeping economic shifts.

It comes across as a complex concept that only bankers and Wall Street-types understand. But in reality, it's not difficult to understand.

Banks, like any other for-profit business, operate to make money.

These financial institutions take in deposits, for which they pay interest – say 0.5%. The banks then make loans, for which they can charge a slightly higher interest, say 2%.

The gap, or spread, between what the banks pay on deposits versus what they charge on loans becomes a source of revenue.

However, sometimes banks don't lend out all of the money that they receive in deposits, leaving them with unused funds earning no interest.

And that creates space for a market – the interbank market – where banks can lend to or borrow from one another to make use of spare cash.

In London, the British Bankers' Association historically asks the world's major banks – deemed to be of prime creditworthiness – each day what they're charging one another in this market.

The index is intended to reflect a benchmark interest rate by taking an average of bank responses.

As everyone borrows money from banks, the rate at which banks borrow from each other is crucial, serving as a prime rate.

This benchmark is then used to set interest rates for various financial products, ranging from variable-rate mortgages to auto and credit card loans.

Why is LIBOR going away... and should we care about its replacement?

Why is LIBOR going away... and should we care about its replacement?

For several reasons – including how some banks can manipulate LIBOR by providing false information when surveyed – the index longer serves as an interest rate benchmark.

This has led to a scramble to replace LIBOR, with the U.S.-based Secured Overnight Financing Rate ("SOFR") being its most likely successor. The SOFR measures the cost of borrowing cash overnight backed by U.S. Treasurys.

But SOFR has issues of its own, such as not providing insight into future interest rate market conditions.

In fact, the issue of pricing the true "risk free" rate – which flows into everything from mortgages, bank debt to hedge fund margin loans – is a recurring one.

There seems to be a lack of confidence about whether interest rates capture the actual risk-free rate correctly.

And it's no surprise given the massive interventions of monetary authorities in recent years.

With government debt hovering at all-time highs across the developed world, central banks are under direct and indirect political pressure to keep interest rates as low as possible. This way, governments are spending less of their budget on servicing the debt.

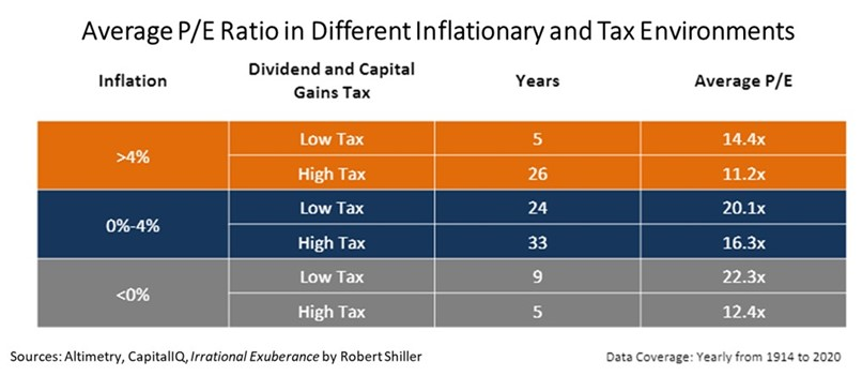

A desire to manage rates means the valuation of the market – its price-to-earnings ("P/E") ratio – will see bigger swings in economic factors, such as inflation.

This is a big reason why we focus on inflation levels when we think about an investor's cost of capital or what drives a required P/E ratio today. In fact, we discussed the current inflation cycle in the Altimetry Daily Authority earlier this month and why we think the rate should return to normal after 2021.

A change in the prime interest rate does have a rippling effect across all borrowing markets. It can tweak at what level investors are willing to pay for a stock.

However, inflation or taxes have a much broader effect, sending P/E ratios soaring... or collapsing.

If inflation rates persist above 4%, P/E ratios will come down from their current levels above 20 times to around 14 times.

Since inflation levels are the data that the risk-free interest rate is built on, they're the real driver of movements across financial markets.

The data points to inflation this year being a transitory bump, not a sustained devaluation of the dollar.

As we said earlier this month, investors shouldn't be panicking over inflation just yet.

When analyzing the economy, or even buying a stock, know that there's always more to the story...

When analyzing the economy, or even buying a stock, know that there's always more to the story...

If you're looking for monthly insights pulling together the facts of the market – and exactly how you should be adjusting your investment strategy – our Altimeter service has the answers...

Along with giving Altimeter subscribers access to the Uniform Accounting data for more than 4,400 companies, we break down important economic trends in our monthly Timetable Investor feature. This tells you exactly how to navigate concerns like government spending and stimulus, management sentiment, and more.

If you aren't an Altimeter subscriber, click here to find out how to gain instant access to the rest of the Uniform data.

Regards,

Rob Spivey

July 26, 2021

What is LIBOR... and what is it used for?

What is LIBOR... and what is it used for?