Hybrid-work plans present a new challenge for parents and caregivers...

Hybrid-work plans present a new challenge for parents and caregivers...

As the pandemic finally subsides and life regains a sense of normalcy, corporations are deciding on long-term working situations for their employees.

Companies are split across the whole spectrum.

In some industries, like investment banking, management teams expect most of their employees to return to the office full time as fast as possible. But other companies are introducing a hybrid model, allowing employees to work remotely part of the time.

Investment-services giant Vanguard and automaker Ford Motor (F) announced permanent hybrid-work schedules, and most of their workers will go into the office a few days per week on average.

According to a recent Bloomberg article featuring "work from home" expert Nicholas Bloom, more than half of workers would prefer a true "hybrid" model going forward.

WFH Research's survey data show that the preference among most Americans is to spend at least three days a week working from home.

As Bloom highlights, companies will need to pay particular attention to how parents, particularly employees with young kids, will manage the hybrid-work environment.

While days working at home will help parents save on child care costs and give them the flexibility to work and raise their families, it could also prevent many college-educated women with young children from progressing as fast as employees who show up in person.

In yesterday's Altimetry Daily Authority, we discussed how Bright Horizons Family Solutions (BFAM) could provide a solution for parents, whether they work from home a few days a week or full time.

The $9 billion child care and education company provides a service for those who want to succeed at work without sacrificing their children's developmental needs. And most of this national chain's daycare centers are open now.

Essential workers and those returning to full-time, in-person work may see the returns on investing in child care – such as greater educational development and more time to advance in their careers – far exceeding the costs.

Bright Horizons is not priced for this changing work landscape...

Bright Horizons is not priced for this changing work landscape...

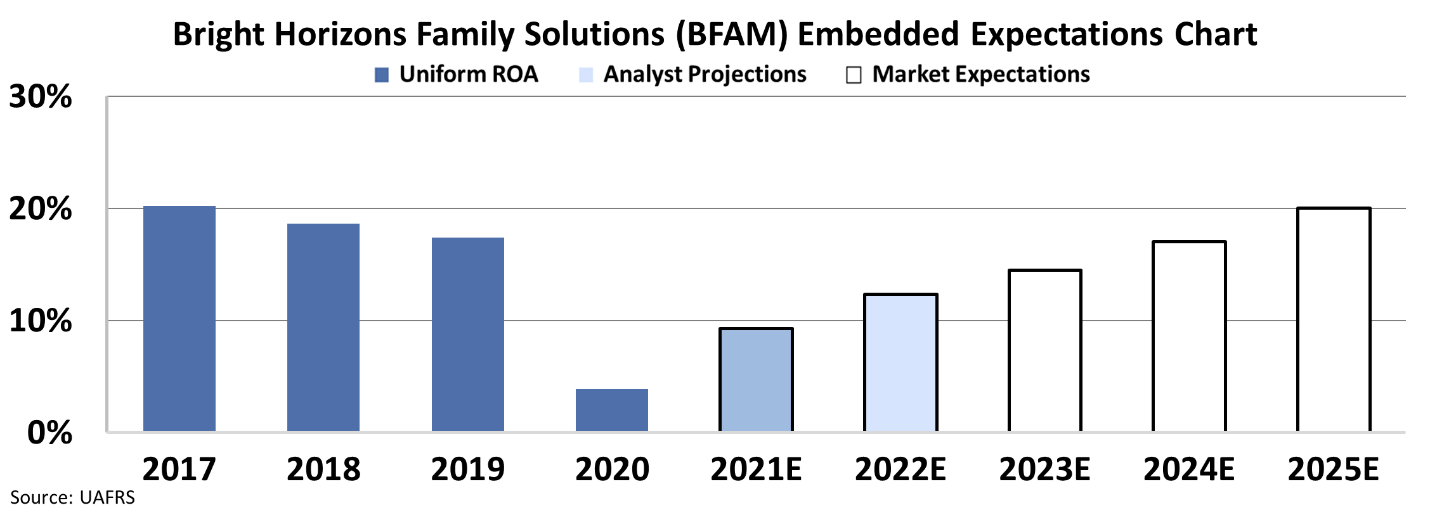

To understand if a stock is a buy or not, we need to understand what market expectations are for the company's prospects.

As our Embedded Expectations analysis highlights, coming out of the pandemic, the market is only pricing Bright Horizons to see its Uniform return on assets ("ROA") recover to 20%, levels last seen in 2017.

While a full recovery is likely for a child care company, that could be a conservative estimate for what Bright Horizons could do in a permanent hybrid-work environment.

This could provide a major opportunity for Bright Horizons to take advantage of the current environment as the demand for full- or part-time child care rises sharply.

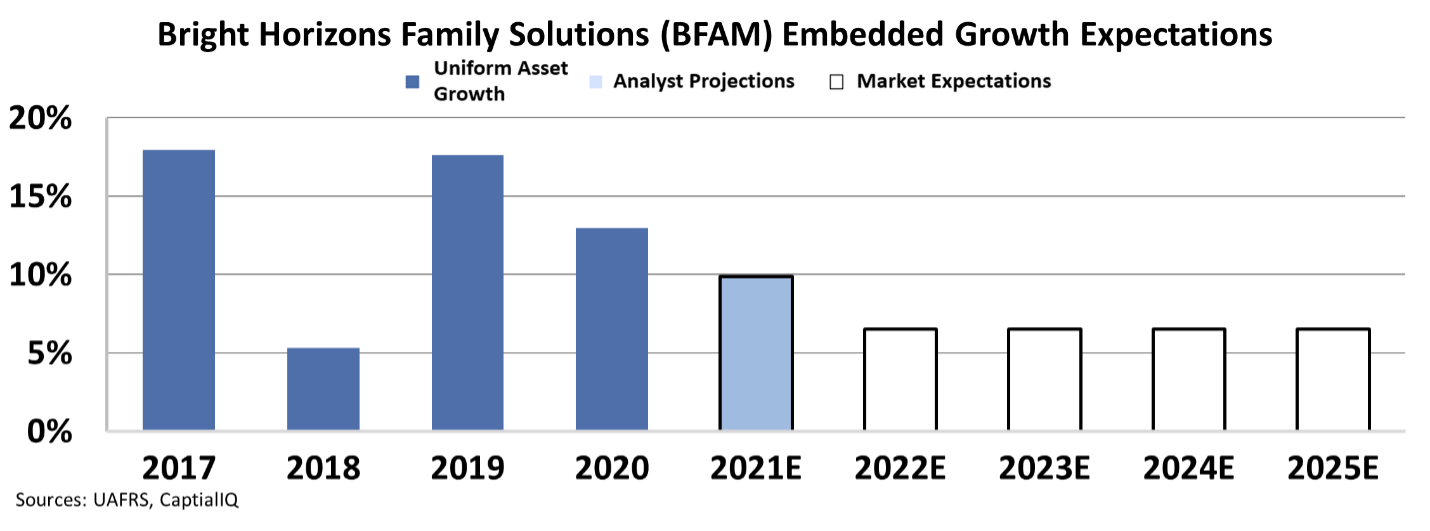

At the same time, the market also expects growth to be lower than it has been historically for the company...

Bright Horizons can take advantage of market conditions to roll up smaller competitors. In that case, while also riding the tailwinds of stronger child care demand from hybrid work – it could surprise market expectations with higher levels of growth and revenue.

Expectations are what markets are all about... Don't forget to keep an eye out for when they may be mispriced.

In our Altimetry's Hidden Alpha newsletter, we use our Uniform Accounting analysis to identify companies that are primed for big upside ahead due to these market mispricings...

In our Altimetry's Hidden Alpha newsletter, we use our Uniform Accounting analysis to identify companies that are primed for big upside ahead due to these market mispricings...

Readers who followed our advice have doubled their money with five different recommendations... and are currently sitting on double-digit gains with 17 open positions.

Learn more about Hidden Alpha – and find out how to gain instant access to the full portfolio of open stock recommendations – by clicking here.

Regards,

Rob Spivey

July 7, 2021

Hybrid-work plans present a new challenge for parents and caregivers...

Hybrid-work plans present a new challenge for parents and caregivers...