Why the New York Times Bought Wordle

As Wordle took over, the New York Times took notice...

As Wordle took over, the New York Times took notice...

Wordle is the most recent game to sweep the nation.

Once a day, players get six chances to try and guess a five-letter word. If a letter is in the right spot, it turns green, and it turns yellow when it's in the word but not in the right location. It's easy to share your score and attempts with friends, it's competitive, and the opportunity to only play once a day makes it addictive.

Wordle was created in October by Josh Wardle. It was a gift to his wife, who liked word games and is a pun on his last name. In November, the Internet's latest game had a mere 90 daily active users ("DAUs").

As recently as early January, it had 300,000 DAUs. Wordle has taken off in recent months, with upward of 3 million people checking in each day to make their guesses.

Its popularity is what drew the New York Times (NYT) to purchase it a few weeks ago for more than seven figures to add to its repertoire of other word games, crossword puzzles, and current event articles.

But considering the high cost paid for one simple game, many analysts wonder if the brand name was worth it.

It's hard to tell if the New York Times' shift to a subscription model is working... without Uniform Accounting...

It's hard to tell if the New York Times' shift to a subscription model is working... without Uniform Accounting...

As we discussed on January 19, companies that can provide a recurring subscription service see returns soar. While pioneered by Adobe (ADBE) and SalesForce (CRM) as Software as a Service ("SaaS"), the model is being applied to other businesses as well to supercharge returns.

The New York Times is trying to take advantage of that successful business model. It has historically relied on advertising revenue, supplemented by subscriptions as a smaller part of its business.

But it is now working to drive up subscribers through adding value, such as word games, to pursue more of that SaaS business model. The New York Times had a goal of 10 million subscribers by 2025 but hit it a few years early in 2022. It recently upped that goal, aiming for 15 million by the end of 2027, showing that subscription customers are not lacking.

Considering that the New York Times has been actively pursuing this strategy, it should have already started to see positive returns.

Recently added segments like "Games" and "Cooking" each added about 1 million subscribers, so the purchase of Wordle shows promise for adopting a recurring revenue model.

But as-reported metrics lead us to believe that is not the case.

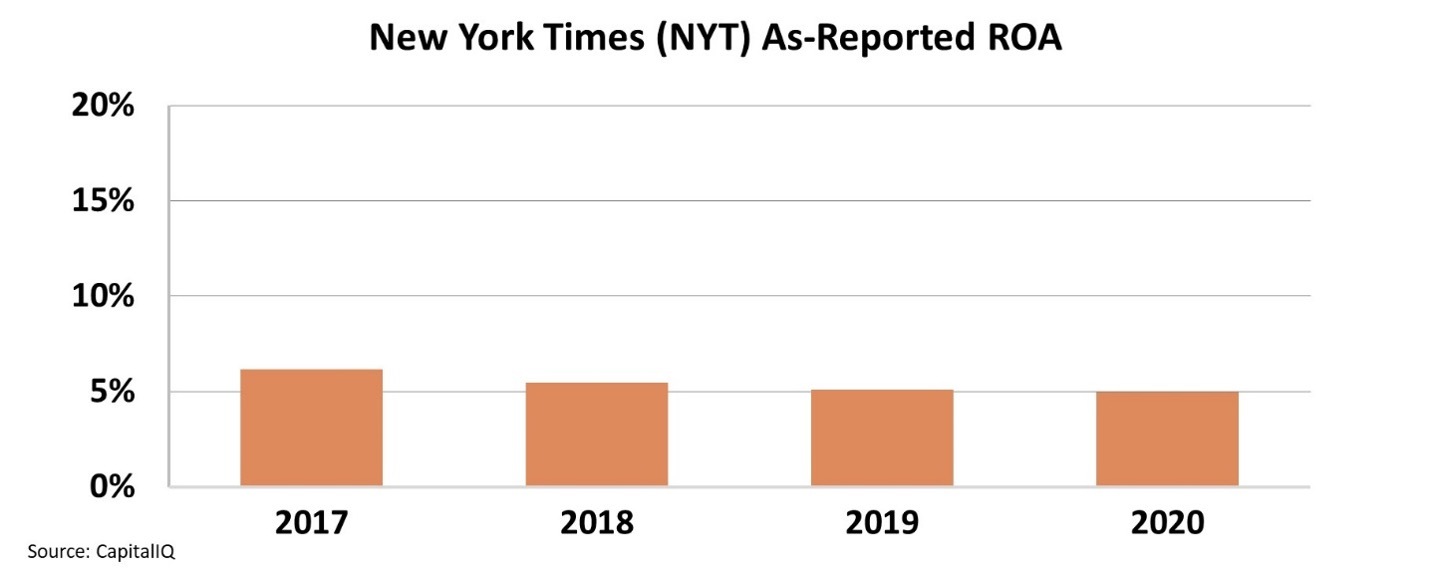

Returns seem to have been stagnant since 2016, sitting at just 5% return on assets ("ROA") for the past three years. Despite expanding and reaching millions of more people, the New York Times' performance doesn't seem to be doing much.

This low level of returns leaves analysts wondering why the New York Times would make this huge purchase for a simple word game.

More than $1 million seems to be a big gamble and a waste of money for a company that isn't doing anything extraordinary.

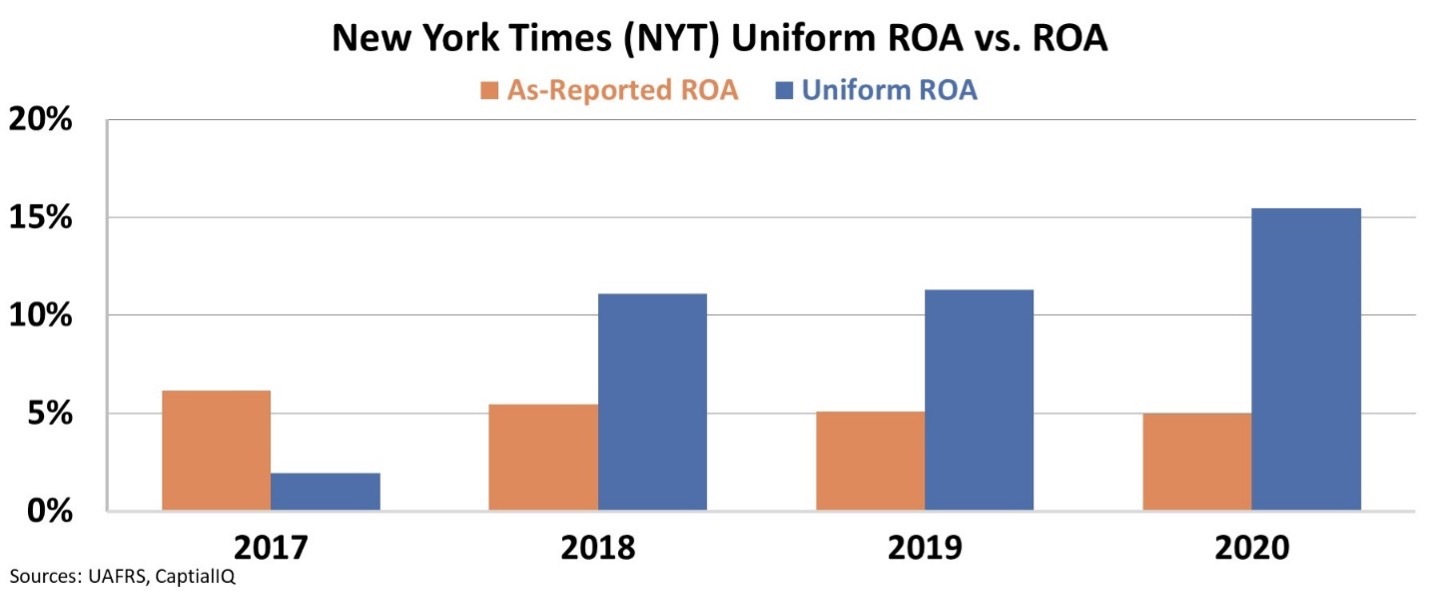

However, Uniform Accounting tells us why the New York Times purchased the Internet's latest phenomenon so quickly.

Uniform metrics show that the New York Times returns have soared from less than the cost of capital levels, at 2% in 2017, to 16% in 2020. Pursuing this subscription model for news and puzzle games has made the New York Times an above-average company.

While analysts might be scratching their heads on why the New York Times would pay so much for Wordle, its subscription-based model of paying for games like this is turning the company around. Thanks to Uniform Accounting, we can see that clearly.

The market is not only missing the New York Times' turnaround, but it's also overlooking several stocks primed for performance this year...

The market is not only missing the New York Times' turnaround, but it's also overlooking several stocks primed for performance this year...

At Altimetry, we comb through thousands of publicly traded stocks to identify "under-the-radar" stocks.

From running the numbers on 25,000-plus stocks, I uncovered a trend that's currently underway... One that's about to turn a $12 trillion industry on its head.

Our proprietary method has identified five stocks with the potential to skyrocket this year and deliver gains as high as 1,000% over the long term.

Click here to learn about these stocks.

Regards,

Joel Litman

February 22, 2022