It's early January, and that means winter storm season is upon us...

It's early January, and that means winter storm season is upon us...

For a time, this was really only true for the Midwest, the Northeast, and the Rockies. The rest of the U.S. usually avoided major winter storms.

But weather conditions have gotten worse in recent years. Now, blizzards and deep freezes are extending to other parts of the country.

One of the most memorable is Winter Storm Uri in 2021. Freezing temperatures, ice, and snow paralyzed Texas for days. The storm brought the state's power grid to its knees. An estimated 246 people died and many more endured days without heat.

The Texas storm was an extreme example. But as recently as last month, weather conditions took a turn for the worse.

If you were stateside during Christmas, you may have been caught in the historic storm and cold front that swept across most of the U.S.

Freezing temperatures pummeled states like Texas, Florida, and Georgia. The Midwest got hit with several feet of snow. Once again, 6.3 million households ended up without power.

These events remind us of how fragile our utility infrastructure is. And as I'll explain today, one company in particular can help us prepare for the next major deep freeze...

The U.S. – and the world – can't afford to deny the reality of extreme weather conditions...

The U.S. – and the world – can't afford to deny the reality of extreme weather conditions...

Places that used to get away with not being prepared don't have that luxury anymore. We saw it in Texas, when hundreds of people died from inadequate power infrastructure. If something doesn't change, we'll undoubtedly see it again.

But we still lack a lot of investments where they're needed most. The U.S. neglected necessary maintenance and development for at least a decade. Now, we're paying for it.

It's going to take time before governments and corporations catch back up. That's why a lot of people are taking matters into their own hands... with home-generator systems from companies like Generac (GNRC).

Back when the pandemic began, the backup-generator market took off. Folks were spending a lot of time at home. They realized how important it was to keep the lights on (and the heat running).

Generac has a dominant 80% market share in the household backup-generators market. Without much competition, the company has been the go-to for folks who want to make sure they always have power.

We first recommended Generac to our Altimetry's Hidden Alpha subscribers in July 2020. Since then, we're up 49% on the combined position.

But the market has soured on this stock recently...

But the market has soured on this stock recently...

Investors are treating it like a busted pandemic darling... not the future of extreme-weather preparedness. Shares are down 60% since we featured the company last August.

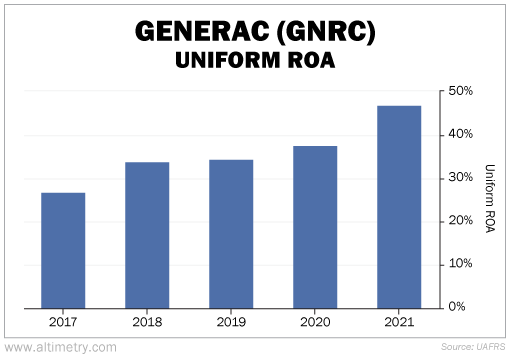

The company's strong market position unlocked high profitability for years. Generac's Uniform return on assets ("ROA") surged from 27% in 2017 to 47% in 2021. Take a look...

Demand is booming... Generac's market dominance is unshaken... And it still has a huge untapped market for growth in the home-generator space.

Investors are missing all of this.

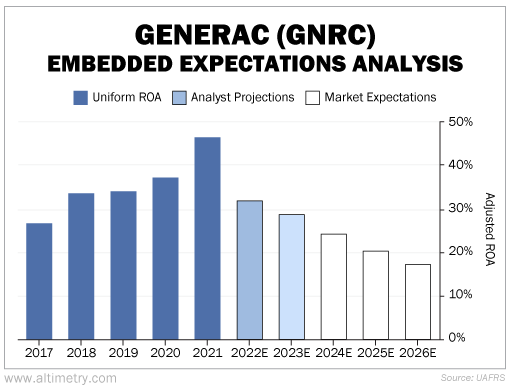

We can see this through our Embedded Expectations Analysis ("EEA") framework. It uses Uniform Accounting to determine what the market expects from a company based on the current stock price.

Investors think Generac's Uniform ROA will plummet to an all-time low of 17% by 2026. And Wall Street is only slightly better... Analysts expect Uniform ROA to drop to 29%, or pre-pandemic levels, this year.

Check it out...

We think that's way too low. Extreme weather isn't going anywhere. On the contrary, it's getting worse. Generac is going to see far more demand in the future.

Investors seem to believe Generac's success was tied to the pandemic...

Investors seem to believe Generac's success was tied to the pandemic...

They're wrong.

COVID-19 accelerated some purchases. People realized they couldn't rely on aging infrastructure to keep things running at home.

But the trend didn't stop there. Extreme weather events aren't just limited to certain parts of the country anymore. Everyone has to be prepared... And that means a lot more business for Generac in the years to come.

If Generac's business continues to outperform investor expectations, the stock should have plenty of room to run.

Regards,

Rob Spivey

January 5, 2023

It's early January, and that means winter storm season is upon us...

It's early January, and that means winter storm season is upon us...