Warren Buffett and the Federal Trade Commission ('FTC') see eye to eye on Amazon (AMZN), but not like you'd expect...

Warren Buffett and the Federal Trade Commission ('FTC') see eye to eye on Amazon (AMZN), but not like you'd expect...

As we highlighted in the December 4 Altimetry Daily Authority, the legendary investor built a sizable position in Amazon earlier this year. He recognizes what Uniform Accounting data also highlights: Amazon is a company with robust profitability, big competitive moats, and huge opportunities for growth.

And the FTC is also looking at Amazon's big competitive moats. The agency is broadening its antitrust investigation on Amazon beyond the company's retail operations and into the cloud-computing business.

Buffett has made a name for himself by investing in companies that have significant competitive advantages that help them sustain high returns over time. This might be one time where a company's economic moats end up making it a less compelling investment than he has anticipated.

We recently discussed Amazon – along with the other "FAANG" stocks that have powered this bull market's run higher – in a weekly issue for our Altimeter tool. We highlighted the grades of the FAANGs and how these companies will likely perform in the years ahead. Altimeter subscribers can read it right here.

If you're not already a subscriber, this is an issue you don't want to miss. To learn more about the Altimeter – and how to gain instant access to our write-up on the FAANGs – click here.

A few years ago, I was teaching an MBA class in Chicago...

A few years ago, I was teaching an MBA class in Chicago...

I was telling a story about a good friend of mine who is also a senior partner at accounting firm Deloitte.

I described the best stock pick he ever made: chipmaker Qualcomm (QCOM).

Once I finished telling the story, my teaching assistant stood up in front of the class and asked a simple question. He surveyed the room and asked if anybody had heard of the company.

He was met with mixed responses – a few nods and several head shakes. But his next question was much more telling...

He asked if anybody in the room owned a Qualcomm product. Dead silence.

After the room fell quiet, my assistant told the students they were all wrong – that they all owned Qualcomm products. He said if anybody owned an iPhone, they had a Qualcomm chip.

Some students protested, exclaiming they used Samsung, Google, or some other Android-based phone. As it turned out, each of their phones used a Qualcomm chip... and they didn't even know it.

During the smartphone boom at the beginning of the decade, Qualcomm slowly and secretly began dominating the chip market for these phones.

This was a great investment opportunity if you caught on early enough. My friend made more than 60% on his position in just a few months.

And this same phenomenon is happening today with the next technological boom. The keywords here are connectivity and the Internet of Things ("IoT").

You may not be fully aware of it, but one of the largest trends in technology today is connecting previously disconnected devices.

Of course, there are the obvious ones – like connecting your smartphone to your car's operating system and the widespread "smart home" movement.

There are also a number of sillier examples, like refrigerators and coffee makers connected to your W-Fi network.

But all of these technologies fall under the IoT umbrella... and the companies supplying this trend are going unnoticed like Qualcomm did six years ago.

One of the leading IoT suppliers is NXP Semiconductors (NXPI). The company produces an array of chips, controllers, and other components used to connect different devices. NXP supplies IoT components to some of the world's leading companies, including Apple (AAPL), Amazon (AMZN), Lear (LEA), Samsung, and Bosch.

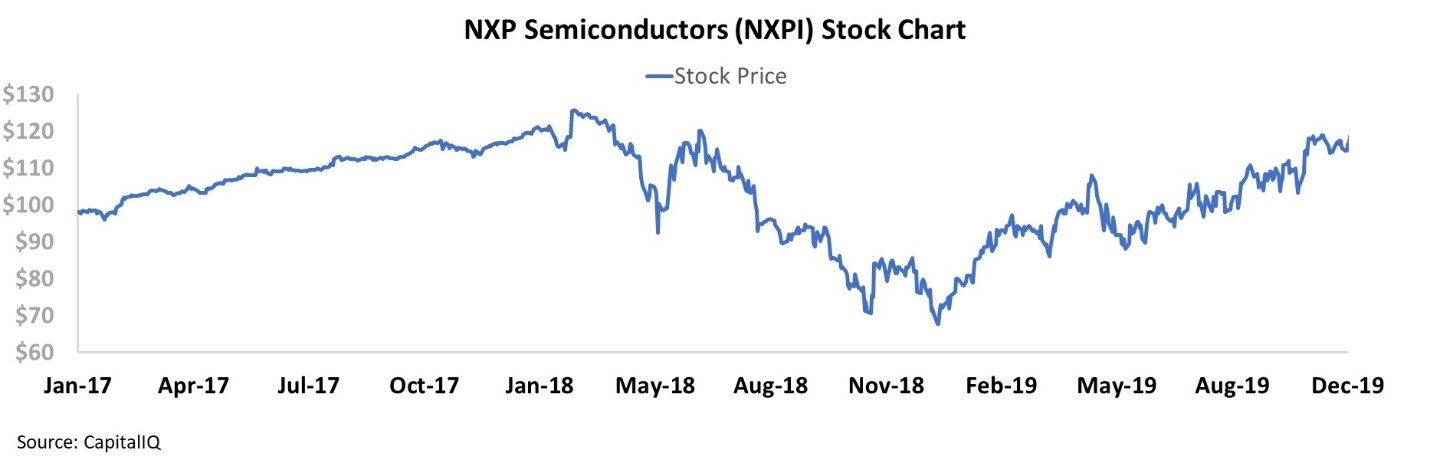

The number of IoT devices is expected to explode to 43 billion by 2023 – nearly triple the number of these devices today. And yet, NXP's stock has been roughly flat for the past few years...

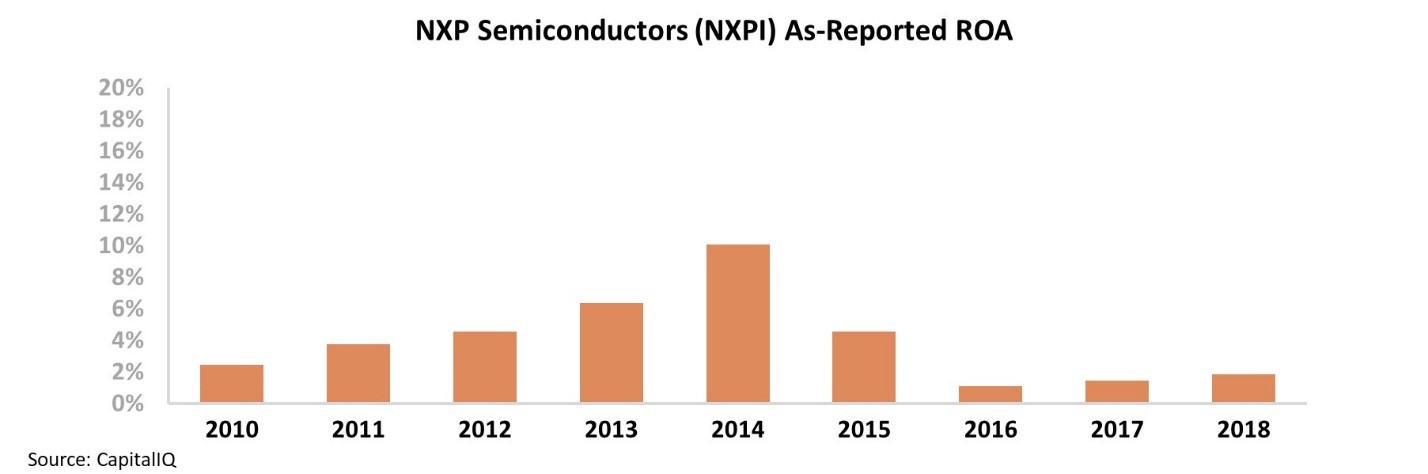

This largely coincides with the company's recent returns. On an as-reported basis, NXP has had fairly weak return on assets ("ROA") for the past decade – briefly reaching corporate-average 10% levels in 2014, but mostly in the 2% to 4% range.

You can't blame investors for looking at these returns and concluding that even with massive growth in IoT, NXP hasn't figured out how to profit from it. That said, when we look at the company using our Uniform Accounting metrics, we can see why NXP might be poised to be the next Qualcomm.

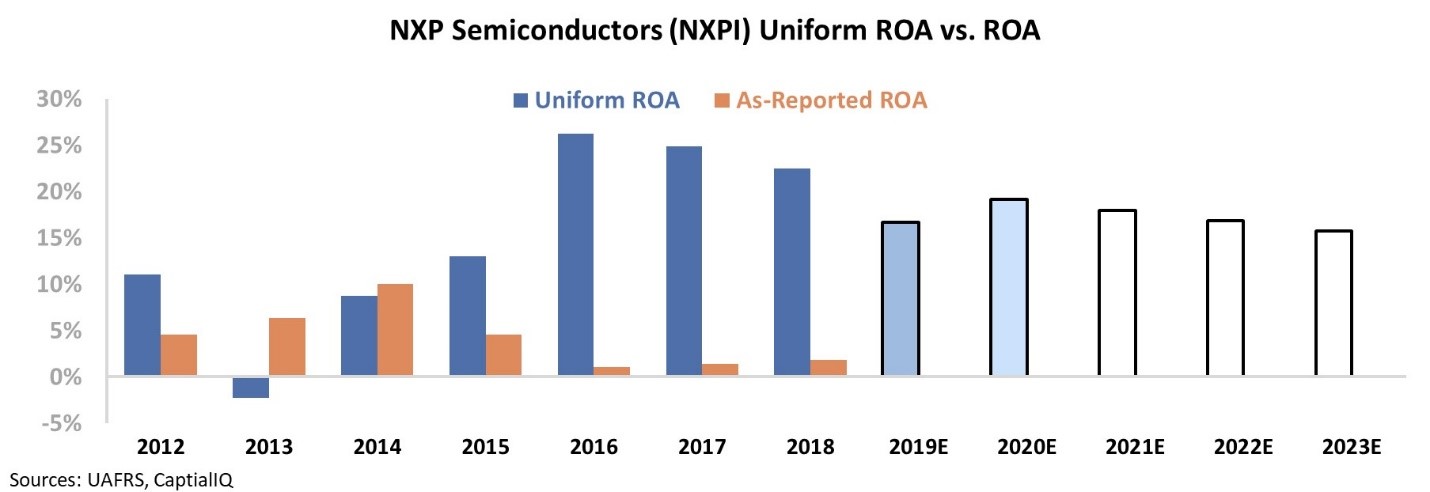

After making several adjustments to NXP's financial statements – accounting for mistreatment of items like goodwill, research and development, and stock option expense – we can see the company's true profitability...

The chart below highlights NXP's historical corporate performance levels in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

Not only is NXP far more profitable than as-reported metrics suggest, but market expectations for the company don't seem to grasp this. Since the IoT revolution picked up, NXP has seen its ROA expand from 10% to 20%-plus in each of the past three years.

At current valuations, the market expects to see ROA fall back to 15% levels – contrary to what current IoT trends would suggest.

Investors seem to be ignoring the IoT suppliers, just like they ignored the smartphone chipmakers... until it was too late.

Regards,

Joel Litman

December 11, 2019

Warren Buffett and the Federal Trade Commission ('FTC') see eye to eye on Amazon (AMZN), but not like you'd expect...

Warren Buffett and the Federal Trade Commission ('FTC') see eye to eye on Amazon (AMZN), but not like you'd expect...