Activism is back in the markets...

Activism is back in the markets...

When everything is going right, activists don't have much to do. Investors don't have much to complain about when everything is going up. So in the stock market, the years before 2022 were quiet on the activist front.

However, when markets turn sour – like they did last year – that's when activist investors thrive.

These folks work by taking a sizable position in a company they'd like to change. They need to put in enough money to get voting rights, a seat on the board, or the ear of other investors.

Rather than hope management does the right thing, activist investors take matters into their own hands. Their campaigns often turn messy. However, they can also help transform companies for the better.

Of course, not all activist campaigns play out the way these folks hope. So today, we'll detail some of the signs that can tell you if they stand a shot at success.

Activist investors have been busy since 2022...

Activist investors have been busy since 2022...

Late last year, activist investor Nelson Peltz set his sights on media giant Disney (DIS). His hedge fund, Trian Fund Management, bought an $800 million stake in the company.

Since then, he has been gearing up to launch a proxy fight in order to secure a seat on the board.

Analysts suspected Peltz wanted to swap then-CEO Bob Chapek for someone else. If that was his goal, he didn't have to wait long... One week later, longtime CEO Bob Iger stepped back into the role.

That's just the tip of the activist iceberg. Other giants like investment manager BlackRock (BLK), body-care chain Bath & Body Works (BBWI), and software company Salesforce (CRM) have become targets in the past few months.

Activist investors often make headlines for going after massive companies like these...

Activist investors often make headlines for going after massive companies like these...

However, that doesn't make them good choices. Big companies tend to have more investors who need convincing. Plus, buying a seat at the table can be expensive.

These folks have a better shot when they find companies with execution woes.

That's exactly what lesser-known activist Impactive Capital did when it launched a campaign on fintech company Envestnet (ENV) last November.

Envestnet has a good business. It sells software and solutions to registered investment advisers. Its software is like a one-stop shop to help advisers digitize their businesses.

Envestnet isn't being destroyed by the current macroeconomic environment. Even though financial advisers had a tough year, their businesses rely on Envestnet's software to run properly.

Rather, poor execution has hurt the business.

Impactive wrote a letter to management questioning its spending habits. The company's expenses swelled more than $180 million since 2020. Plus, it spent more than $100 million on acquisitions that brought in just $12 million in annual revenue.

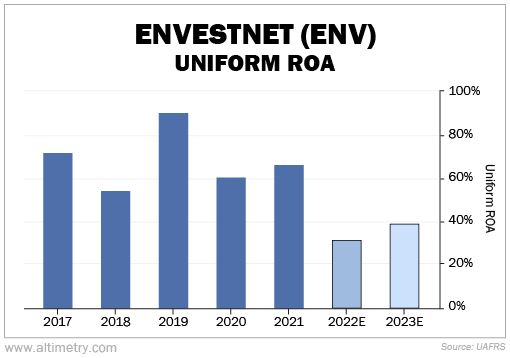

Envestnet's Uniform return on assets ("ROA") was 91% in 2019. Just two years later, it dropped to 67%... And it's expected to fall by more than half in 2022, to just 32%.

Take a look...

That's why, in early January, Impactive Capital nominated four directors to Envestnet's board. The fund is hoping to improve its financial performance.

Historically, Envestnet's returns have been sky-high... well above the 12% corporate average. That's not a fluke. Software dealers in the financial-management industry make a lot of money.

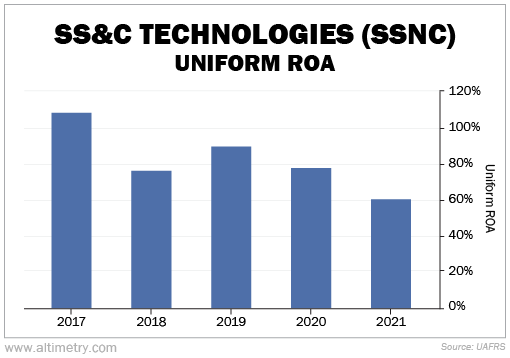

Just take a look at its closest peer, SS&C Technologies (SSNC). SS&C's business looks similar to Envestnet's. And it has returned at least 60% in each of the past five years.

Check it out...

Envestnet clearly has the ability to generate strong returns. It has done so in the past... and so has one of its closest peers.

Impactive Capital knows this, and it's trying to get the company back on track.

That alone gives us half the information we need to understand this activist campaign. We have plenty of reason to believe the company can turn things around. The numbers prove that it has gotten there before.

The company has the potential for strong returns. What we don't know is what the market thinks...

If investors already expect big things from Envestnet, the stock likely doesn't have much room to run. It doesn't matter how many changes Impactive makes to the business... If expectations are too high, it puts a cap on Envestnet's upside potential.

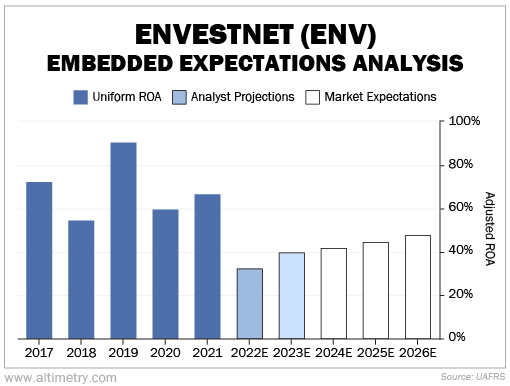

We can see this through our Embedded Expectations Analysis ("EEA") framework. It uses Uniform Accounting to determine what investors expect from a company based on its current stock price.

Right now, the market expects Envestnet's Uniform ROA to recover a bit from its 2022 low – to about 43%.

Take a look...

Envestnet's EEA tells us that the market thinks the business will stay weaker than it has been in recent history. It isn't expecting Impactive Capital's activist campaign to succeed.

However, that also means Impactive has an incentive to succeed. It owns about 7.5% of Envestnet. And with low market expectations, Impactive is looking at huge upside if the campaign is successful.

It's easier for activists to make big changes at small companies like Envestnet...

It's easier for activists to make big changes at small companies like Envestnet...

Household names like Disney and Salesforce are so big that they're tougher to transform.

These huge companies have all kinds of options to fight off activists. They can afford the best lawyers... use their public exposure to put pressure on activists... and as we mentioned, it's expensive to buy large stakes.

(Plus, as we covered in December, investors already expect strong performance from Salesforce. There's a lot of room for disappointment with this company.)

It can pay to bet on good activist investors. At the same time, you have to understand the market's expectations.

The best turnaround in the world won't help your portfolio if investors aren't impressed by what they see.

Regards,

Joel Litman

February 2, 2023

Activism is back in the markets...

Activism is back in the markets...