In a quiet corner of Hanzhong, China, a 69-year-old liquor plant is clinging to life...

In a quiet corner of Hanzhong, China, a 69-year-old liquor plant is clinging to life...

At Shaanxi Qinyang Changsheng Brewing, workers hand-label bottles of baijiu, a fiery Chinese spirit. The company hasn't posted a profit since 2020, yet it's still operating.

This isn't unusual... China is flooded with unprofitable businesses. The number of "zombie" companies has steadily risen over the past decade.

And they can't survive without state support. As we explained a year ago, they drain capital, distort competition, and clog economic growth.

President Xi Jinping is doing this to create the illusion of stability. In reality, entire provinces are propping up failing firms.

Today, we'll explain why this policy is stifling China's growth... and why investors betting on a turnaround will likely be disappointed.

China has abandoned the old economic playbook...

China has abandoned the old economic playbook...

In the 1990s, China set the stage for breakneck growth. It closed more than 60,000 state-owned businesses and laid off about 40 million workers.

These sweeping reforms, led by Premier Zhu Rongji, slashed inefficiency. They also opened the door to private enterprise and attracted massive foreign investment.

The short-term pain paved the way for long-term competition and industrial expansion. Now, that mindset is gone.

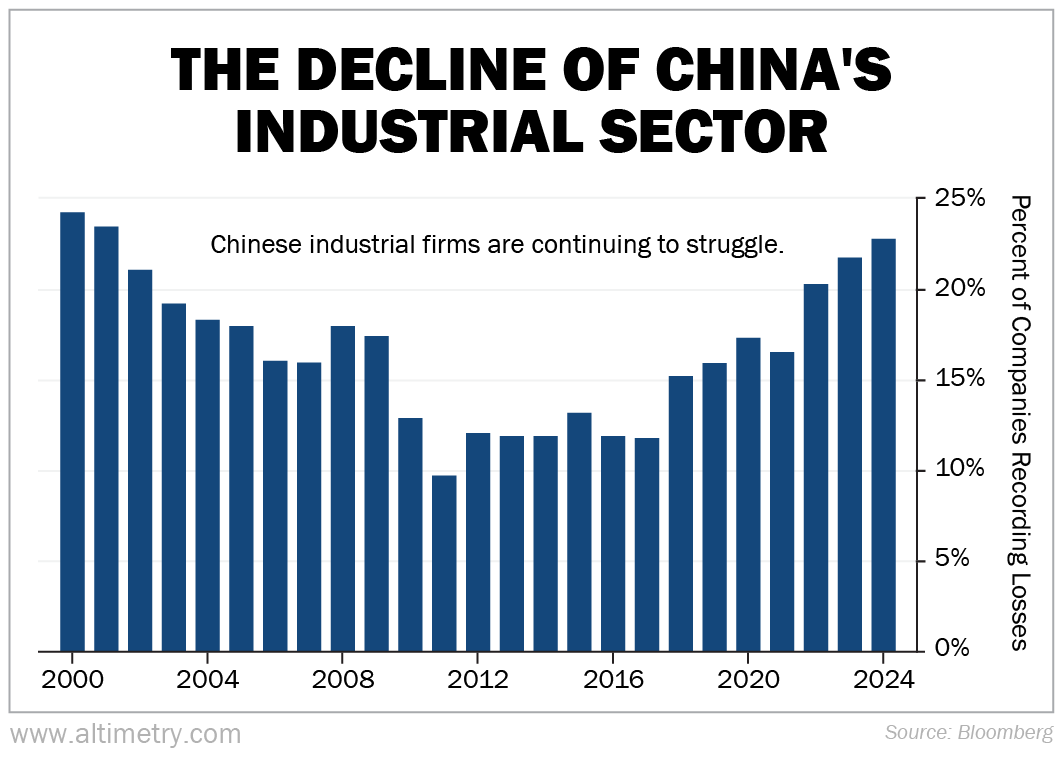

We can see this by looking at the overall share of struggling firms in China's industrial sector. The percent of companies recording losses has reached its highest level since 2001...

Shanxi province in northeast China has been hit particularly hard. It's now trying to reinvent itself as a high-tech manufacturing hub.

But nearly 40% of its industrial companies posted a loss in 2024 – almost double the national average.

With current policies in place, the zombie trend will likely continue...

With current policies in place, the zombie trend will likely continue...

Dayun Automobile is a perfect example of that. Once a major Chinese truck manufacturer, it pivoted into electric vehicles and then failed to compete.

The company received tax breaks, subsidies, and even highway toll exemptions to boost sales. But that wasn't enough... Chinese consumers are weak, and it couldn't convince them to buy its cars.

Dayun is now in the middle of court-ordered restructuring. Yet it continues churning out trucks.

You see, Chinese courts are reluctant to approve bankruptcies. Mass layoffs are politically dangerous, especially as U.S.-China tension and declining exports threaten national stability. Judges even visit protesters' homes to prevent unrest.

All of this makes meaningful reform nearly impossible.

Tough talk on reform, but inertia on the ground...

Tough talk on reform, but inertia on the ground...

China is unwilling to let businesses fail. And as long as zombie firms continue limping along, the economy will continue slowing down.

Already, Chinese stocks are tumbling. They might seem like a bargain, but it only reflects a broken system.

The bottom line is, China's government is funneling too many resources into failing businesses. And profits are taking a hit.

For investors, the U.S. remains a much better bet than China when it comes to long-term growth.

Regards,

Joel Litman

July 2, 2025

In a quiet corner of Hanzhong, China, a 69-year-old liquor plant is clinging to life...

In a quiet corner of Hanzhong, China, a 69-year-old liquor plant is clinging to life...