We often say that Uniform Accounting is all about making earnings more accurate...

We often say that Uniform Accounting is all about making earnings more accurate...

So we weren't surprised when a subscriber pointed out what seems like a big discrepancy in our research methods.

For the past two days, we've featured a "refresher course" on how we analyze stock opportunities. We've been using hedge fund Engaged Capital's interest in burger chain Shake Shack (SHAK) as a proxy for our own analysis.

The Shake Shack example has helped us answer subscriber Anthony H.'s questions about our Embedded Expectations Analysis ("EEA") framework. Specifically, we explained how we calculate the EEA... and how it helps us tell if a stock is worth our time.

Anthony noticed something critical, though. Our strategy is all about removing the "noise" from corporate earnings. And yet, most of the time, we rely on an entirely different metric – return on assets ("ROA").

In part three of our refresher-course series, we'll tie everything together by revealing how we evaluate a company's profitability. And we'll wrap up our analysis of Engaged Capital and Shake Shack.

ROA allows us to look at a company's profitability in a way that's comparable with its peers...

ROA allows us to look at a company's profitability in a way that's comparable with its peers...

When a company grows or shrinks, its earnings change. You need assets to generate money, so it stands to reason that larger companies should be able to earn more money.

However, just because a company is growing earnings doesn't guarantee it's becoming a better business. The business model dictates a lot of factors... like how much earnings grow relative to assets and how fast the company can grow overall.

For instance, utility companies can grow their earnings by building new power plants. But utilities are heavily regulated. Their profits are capped by the government to make sure energy is affordable. So no matter how many power plants a utility company builds, earnings are going to grow in proportion to assets.

On the other hand, software companies can grow their earnings faster than they grow their asset bases. Software is a digital product. Selling 10 million copies of software doesn't take 10 times more assets than selling 1 million copies... So as software companies grow their earnings, they tend to get more profitable.

If we start our analysis of a company with Uniform ROA and asset growth, we can see how the business model impacts its profits and growth. That's powerful context when modeling future returns.

Yesterday, we flagged comparable-peer profitability as one of the best indicators for future performance. That's one of the reasons Uniform ROA is so important. We know the corporate average Uniform ROA is 12%. So we understand what reasonable profitability is.

In short, Uniform ROA "evens the playing field"... letting us compare a company with its peers, even if they're a lot larger or a lot smaller.

That being said, it still boils down to cash flows at the end of the day...

That being said, it still boils down to cash flows at the end of the day...

We're just using Uniform ROA and asset growth to calculate cash flows. When we combine the two key drivers, cash flow reveals itself.

We break down thousands of companies based on key metrics. One of those is our Short-Term EEA, which translates Uniform ROA and asset growth into Uniform Earnings. Without getting too in the weeds, we multiply Uniform ROA by Uniform assets to calculate the company's returns... also called "earnings" or "cash flows."

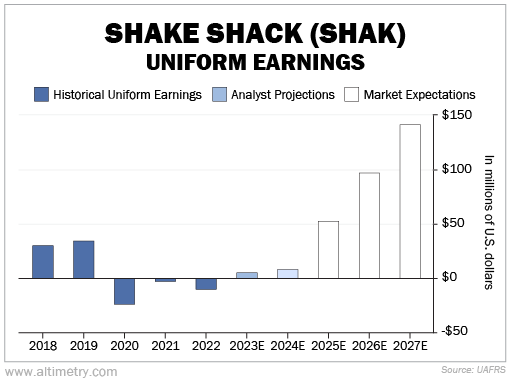

Here's what that looks like for Shake Shack...

If you've read parts one and two of our refresher course, you know the market expects Shake Shack to reach 10% Uniform ROA in five years, with 12.5% annual Uniform asset growth. That means its assets will be $1.5 billion by 2027.

(We've rounded these numbers slightly in the interest of keeping things simple.)

Said another way, investors think earnings will reach about $150 million (10% multiplied by $1.5 billion). So Shake Shack – whose Uniform earnings capped out at $40 million historically – has to grow its earnings to roughly $150 million just to be fairly valued.

That's a steep acceleration, to put it mildly. The company will have to step up its game quickly to justify these valuations.

That's exactly what Engaged Capital is betting on...

That's exactly what Engaged Capital is betting on...

Yesterday, we explained that Shake Shack's peers have far outstripped it in terms of Uniform ROA. If it just gets back to pre-pandemic levels, it will be in much better shape.

That is why Engaged Capital began its activist campaign. It thinks it can get Shake Shack back on track... and push the company to grow earnings like never before. It has the chance to meet (or even beat) investors' expectations.

As Anthony pointed out, this analysis absolutely has to end with cleaned-up cash flows. It's the bedrock of our analysis.

That's what makes the EEA such a powerful framework. We can understand what the market expects a company to do. More important, we can determine if those forecasts are reasonable.

Uniform ROA and asset growth help us get there... turbocharging our ability to understand this cash-flow analysis.

Regards,

Joel Litman

May 25, 2023

We often say that Uniform Accounting is all about making earnings more accurate...

We often say that Uniform Accounting is all about making earnings more accurate...