Today's suggestion for treating cabin fever takes advantage of our digital world...

Today's suggestion for treating cabin fever takes advantage of our digital world...

So far, as part of Cabin Fever Week here at Altimetry, we've discussed three ways to fight feeling cooped-up as we spend more time at home: exercise, going outside for fresh air, and getting sunlight.

This brings us to our next tip from the Mayo Clinic: Make a point of being social.

The less people feel like they're locked away by themselves and the more they feel connected to the world... the easier it is to make it through physical isolation.

While we understand being social is difficult in today's environment, even phone calls and Zoom (ZM) chats can be an effective step.

Humans are social creatures. We like to communicate and collaborate with one another. The more we can stay connected, the less our mental health is negatively affected by the challenging time we're currently living through.

We all may be a bit tired of Zoom calls or other online forms of communication. However, we need to ensure that – whether it's through the phone, socially distanced physical interaction, or other means – we make the effort to interact with those close to us.

Despite the inconvenience, now is the time to connect with people you care about. Building up relationships is another way to avoid the feeling of cabin fever... and to help other folks do the same.

Traditionally, going out for drinks or a meal is the most natural way for friends and family to catch up and be social...

Traditionally, going out for drinks or a meal is the most natural way for friends and family to catch up and be social...

Restaurants and bars are suffering as much as socially starved patrons are. Altimetry's home state of Massachusetts has nearly 16,000 of these establishments. They make up around 10% of the jobs in the state – many of which the coronavirus pandemic has suspended.

For chains like Yard House, LongHorn Steakhouse, Capital Grille, and Olive Garden, the pandemic has been an unprecedented time of contraction... and all of these brands fall under the umbrella of Darden Restaurants (DRI).

Darden is one of the biggest players in the full-service dining industry, which is hurting during the pandemic. However, the current market conditions may actually end up being a boon for Darden over the longer term.

Once the world opens back up, restaurants and bars will be surging in popularity as patrons flood back in for food and drinks. As Darden is a large player with a strong balance sheet, the company is set up to be a big winner in the space after the dust settles. It's primed to "survive and thrive."

Many restaurants will likely close their doors permanently due to the pandemic. But companies who can survive – such as Darden, with its bulletproof balance sheet – could see a stronger recovery coming out of the pandemic.

To understand Darden's current difficulties and the potential for a turnaround, we can turn to The Altimeter...

To understand Darden's current difficulties and the potential for a turnaround, we can turn to The Altimeter...

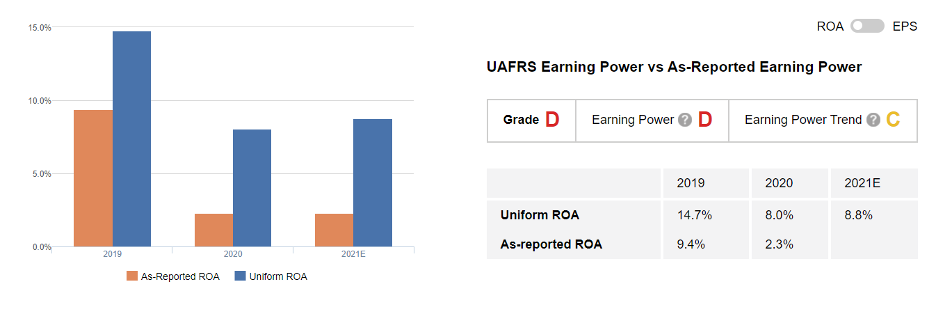

It's no surprise that Darden has seen its profitability dip during the pandemic... although returns haven't fallen as low as some consumer companies have experienced.

Darden's Uniform return on assets ("ROA") has slid from 15% in 2019 to 9% last year. This earns the company a "D" grade for Earning Power. With minimal improvement expected through 2021 as the coronavirus vaccine continues to be distributed, Darden earns a "C" grade for Earning Power Trend.

However, the picture starts to improve when we turn to valuations...

However, the picture starts to improve when we turn to valuations...

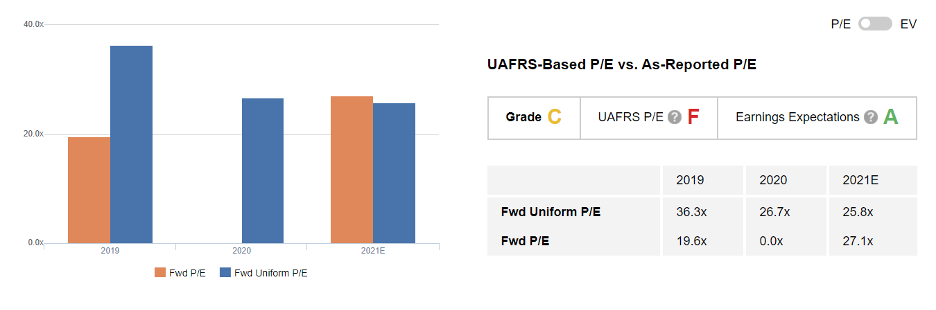

The Altimeter gives Darden Restaurants an "A" grade for Earning Expectations... And that's because the market is pricing this company like it is going to lag behind forever.

Darden trades at an above-average Uniform price-to-earnings (P/E) ratio, but this is well below historical levels. The market doesn't expect Darden's earning power to make a comeback when our world returns to normal.

Through the power of Uniform Accounting, The Altimeter is able to provide a snapshot of Darden's performance. While the company's ROA has fallen due to the pandemic, the market has failed to price in any potential recovery in the next few years.

It may be a long road for Darden... but folks will eventually flock back to restaurants and bars after the crisis. Thanks to the company's ability to "Survive and Thrive" past the pandemic, investors should keep an eye on the name.

Regards,

Rob Spivey

January 28, 2021

P.S. By using The Altimeter, you can see how more than 3,400 stocks grade out based on their true fundamentals and the market's misleading valuation. Alongside the grade, you can see exactly how distorted the as-reported numbers are compared to the real, Uniform metrics.

This can help identify which stocks could soon skyrocket and which ones could be primed to collapse... and they could be sitting in your portfolio right now. Learn more right here.

Today's suggestion for treating cabin fever takes advantage of our digital world...

Today's suggestion for treating cabin fever takes advantage of our digital world...