While inflation may not be here to stay, here's how to stay one step ahead...

While inflation may not be here to stay, here's how to stay one step ahead...

Inflation seems to be the only thing people are talking about in the wake of massive federal spending to float the economy through the pandemic. The supply chain crisis, causing increases in component and logistics costs, is prompting everyone to ask when it will end...

We wrote about how inflation is driven more by supply shocks than the broad-based devaluation of currency in September. The following month, we wrote about how the healthy credit environment will maintain the economy's overall strength and prevent an inflationary spiral.

It's something we see in management earnings calls. Our analyst team uses our proprietary Earnings Call Forensics technology to dissect hundreds of earnings calls each month. The trend is clear: Management teams are nervous about the optics of how inflation can impact returns, potentially scaring off investors.

Companies like McDonald's (MCD), PepsiCo (PEP), and Procter & Gamble (PG) have been reporting inflationary pressures. But these companies also reported that they increased their prices due to those input pressures, with no demand drop off.

Despite inflationary pressures, these companies' stocks have stayed strong...

Pricing power is the name of the game...

Pricing power is the name of the game...

Looking at pricing power, areas like consumer staples, communication services, information technology, consumer discretionary, and health care all have strong pricing power.

Meanwhile, industries like energy, materials, utilities, and to a lesser extent industrials, fare much worse. On the surface, it would appear that you should reduce your exposure to stocks in these sectors during inflationary times.

Let's put that claim to the test by using Uniform Accounting to drill into the capabilities of different companies. An industry's return on assets ("ROA") is a powerful proxy for pricing power and testing its strength to weather inflationary pressures.

ROA reflects whether a company can differentiate itself from its peers competitively.

In industries with little competitive differentiation, like utilities and industrials, companies can only compete on price. That drives down their power to expand their margins, eventually leading ROA to stabilize around the cost of capital.

Industries with greater competitive differentiation like technology can attract demand using other facets of their offerings, like their unique capabilities. That adds pricing power and lifts ROA.

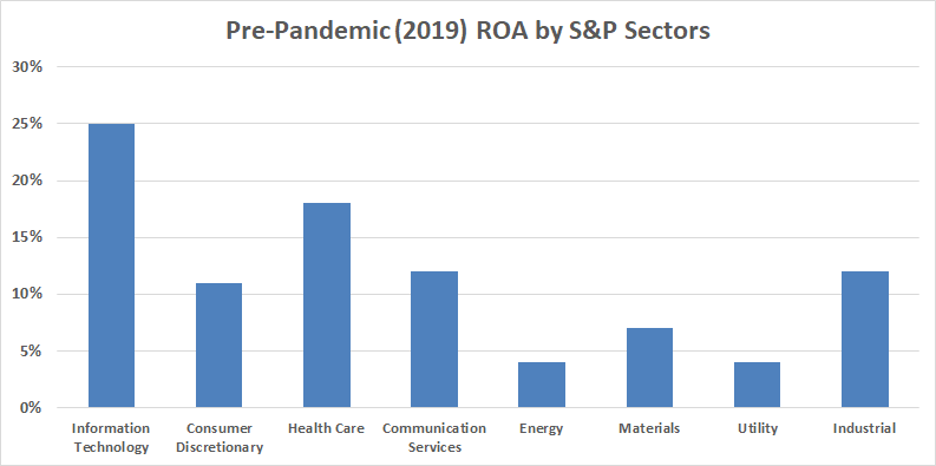

Take a look at how Uniform ROA differs by sector...

It is not surprising that sectors, such as communication services, information technology, consumer discretionary, and health care have significant pricing power and strong ROA. They will be the most resilient to inflationary pressure.

Energy, materials, and utilities are lower-return businesses, with energy and utilities failing to return more than the cost of capital.

But there is one industry being misconstrued due to as-reported data. Uniform Accounting highlights that industrials perform better with pricing pressure than investors may realize.

Now that the $1.2 trillion federal infrastructure bill has been signed into law, investors can have more confidence than ever that a massive cycle of capital expenditure ("capex") and infrastructure spending, is around the corner.

That's one of the reasons why industrials are looking particularly interesting even in this inflationary environment.

As more infrastructure projects get announced, construction and engineering companies won't need to compete as aggressively on price. A shortage of industrial development capacity could drive contract values higher.

Here at Altimetry, we will be tracking the capex cycle every step of the way, bringing our readers the latest trends informed by better Uniform Accounting data...

Here at Altimetry, we will be tracking the capex cycle every step of the way, bringing our readers the latest trends informed by better Uniform Accounting data...

As we mentioned last week, we've already identified some industrial companies with strong pricing power that we think will benefit from all that's to come.

In fact, this month's High Alpha is about a company looking to ride this capex spending wave by providing the necessary bedrock. Our latest recommendation stands to increase its stock price by about 75% from where it stands today.

Learn more about High Alpha by clicking right here.

Regards,

Joel Litman

November 29, 2021

While inflation may not be here to stay, here's how to stay one step ahead...

While inflation may not be here to stay, here's how to stay one step ahead...