Our favorite 'visionary' billionaire is back with some insights on the world of artificial intelligence ('AI')...

Our favorite 'visionary' billionaire is back with some insights on the world of artificial intelligence ('AI')...

The last time we mentioned Japanese tech investor Masayoshi Son, we poked fun at him for lucking his way into becoming a billionaire.

Son's one claim to fame was his early jump on Chinese retail giant Alibaba (BABA). That later helped his venture-capital ("VC") fund, the Softbank Vision Fund, become somewhat of a household name...

As we covered back in May, it writes huge checks at inflated valuations to struggling tech companies. And it has been a massive failure over the past few years. It posted a $27.4 billion loss in 2022... and then topped that with a record $32 billion loss in 2023.

For obvious reasons, we don't trust Son's "vision." However, he does have valuable data on tech companies through his Vision Fund – and, in turn, a "pulse" on the tech universe.

You see, each year, the Vision Fund surveys leaders from its portfolio companies (i.e., its VC investments) and reports its findings to the public. The results offer a lot of insight into companies' sentiment on emerging technologies... including AI.

Today, we'll explain what the most recent survey tells us about the current AI outlook... and investors' misleading expectations.

The AI hype isn't translating to increased investment...

The AI hype isn't translating to increased investment...

Last year, companies spent more time talking about AI than they did actually investing in it.

And heading into 2024, it doesn't look like much will change...

The Vision Fund's latest survey suggests that many companies plan to spend the same amount on AI as they did in 2023.

According to the results, 39% of CEOs plan to invest roughly the same on AI this year. Another 32% plan on investing up to 50% more. And only 28% expect to grow their investments more than that.

All told, if the majority of CEOs say they'll spend between the same amount and up to 50% more, it's likely that the real growth number is right in the middle... at around 25%.

That's not a whole lot when you consider investors' optimism around AI.

In fact, it may be a rude awakening for some folks...

In fact, it may be a rude awakening for some folks...

See, we can use that 25% estimate to figure out if certain AI stocks are priced for too much growth... or not enough.

Nvidia (NVDA), for example, is one of the companies that has benefited the most from the AI craze. It has become the go-to chipmaker for AI companies, accounting for more than 70% of AI chip sales.

And it gets a ton of love from investors, too... Its stock is up more than 330% since the beginning of 2023.

Its closest peer, Advanced Micro Devices (AMD), isn't starved for attention either. It's up more than 160% over the same span.

That's fantastic performance for both stocks. Yet, it's clear that investors are overhyping Nvidia compared with AMD...

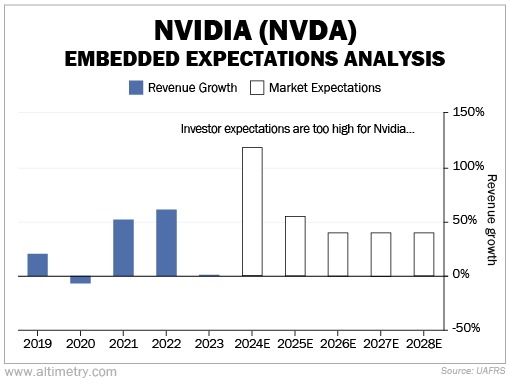

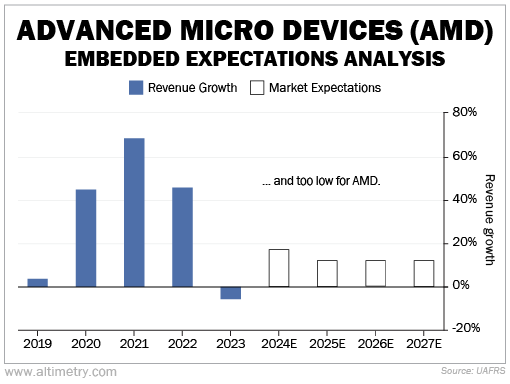

We can see this through our Embedded Expectations Analysis ("EEA").

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

While we normally show our EEA framework in terms of Uniform return on assets, we can do the same analysis based on expected revenue growth.

Essentially, if companies are expected to increase their AI spending by about 25%, revenues for the AI industry should also grow by about 25%. We can then use that as a baseline to compare each company's growth against.

As you can see below, there's a large discrepancy between what investors are pricing in for Nvidia and AMD.

At its current price, investors expect stellar revenue growth of 118% for Nvidia in its fiscal year 2024 and then around 40% revenue growth after...

Meanwhile, AMD is only expected to grow revenue by about 15% per year...

Both of these chipmakers should benefit from increased AI spending.

Remember, as a baseline, the whole industry looks set to grow by around 25%. However, the market expects Nvidia to grow much more than that...

While Nvidia is the top chipmaker for the AI industry, these expectations suggest the company will continue to snatch up market share from other big players – and fast.

They aren't taking into account chipmakers like AMD that are investing in their own AI chips as fast as they can.

If the Vision Fund survey is correct, investors expect too much growth for Nvidia... and not enough growth for AMD.

This may be a good opportunity to buck one of the common AI bets.

Regards,

Joel Litman

February 6, 2024

Our favorite 'visionary' billionaire is back with some insights on the world of artificial intelligence ('AI')...

Our favorite 'visionary' billionaire is back with some insights on the world of artificial intelligence ('AI')...