The market's recent big drop is spooking investors...

The market's recent big drop is spooking investors...

With Europe tightening restrictions, the coronavirus pandemic is back in focus. Folks are worried that we could see another big sell-off like the one in March.

As we've highlighted many times before, the first indicator of a sell-off turning into a full-blown collapse is related to credit. All our credit signals are showing us reasons not to panic about this market.

Cost to borrow is low, so it's easy for corporations to refinance. Similarly, companies have done a lot already to raise significant cash to weather any storm (like the current one). So investors don't need to panic... We shouldn't expect a drop like we saw in March.

But this doesn't mean that the stock market will now reverse and immediately go straight back up. As we talked about all the way back in July, we're in the midst of a "waterfall recovery." The economy is going to take time to heal, even without a resurgence in the virus.

Earnings season kicked off earlier this month, and it also shows that the recovery is going to be a slog...

Earnings season kicked off earlier this month, and it also shows that the recovery is going to be a slog...

As usual, the financial sector was the first to report, and many of the big banks released earnings that were much better than Wall Street expected. For example, Goldman Sachs' (GS) third-quarter profit rose 93% compared with the same period last year.

One reason for the pleasant surprise was because loan-loss provisions were less than expected. These are charges banks take to prepare for late loan payments or loan defaults. Fewer loan-loss provisions usually mean a healthier economy... and healthier borrowers.

Many commentators pointed to the fewer loan-loss provisions as a positive. They saw it as a sign the economy was beginning to turn around again.

However, the management teams reporting had a different message... As Bloomberg explained, JPMorgan Chase (JPM) and Citigroup (C) had cautious outlooks on the economy.

The banks didn't sound the alarm bells like they did earlier in the year... and they now think unemployment won't be as high as they originally expected. However, they foresee a slower long-term economic recovery. Specifically, Citi CFO Mark Mason cited the uncertainty around a coronavirus vaccine and additional stimulus as two risks inherent to the economy.

And with banks concerned about a longer trudge back to normal, companies in depressed industries like hotels or restaurants will have a tougher time surviving.

This speaks to the "survive and thrive" concept that we've discussed numerous times here at Altimetry Daily Authority. As the recovery takes longer, the difference between the "haves" and "have nots" is going to grow. The companies that will survive and thrive have strong balance sheets to make it through an extended downturn. On the other hand, smaller and less liquid companies will struggle.

And if the recovery continues to drag, or even have hiccups like the market is concerned about based on yesterday's moves, the big players may even have the opportunity to purchase the struggling smaller companies that can't stay liquid... and they can buy at depressed valuations.

A prime example of a sector struggling to survive is the restaurant industry...

A prime example of a sector struggling to survive is the restaurant industry...

It's difficult to practice social distancing in a restaurant. To make a profit, sit-down establishments need to pack people in... so operating at low capacity means that these restaurants lose money. As such, these establishments have had a hard time adapting.

To make matters worse, across the country, states have restricted restaurant dining. Some cities don't allow indoor dining at all... while others have limited capacity to as low as 25%.

The warm summer months allowed many restaurants to expand outdoor dining. However, temperatures are beginning to drop as we move into fall and winter approaches. This will make it difficult for restaurants to be full enough to stay open.

Smaller establishments aren't built to survive through this level of disruption. An estimated 100,000 restaurants closed either permanently or semi-permanently between March and September.

On the other hand, larger chain restaurants have access to more liquidity to survive through this slower recovery... and one company behind many of these chains is Darden Restaurants (DRI). It owns popular brands such as Olive Garden, Longhorn Steakhouse, and Yard House.

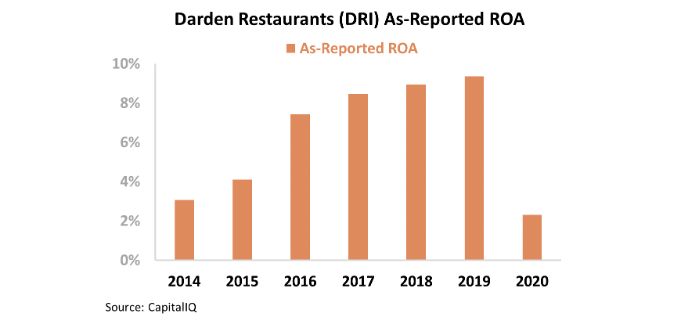

Right now, as-reported metrics appear to confirm that Darden is under pressure. Between 2014 and 2019, the company's return on assets ("ROA") improved every year. However, that growth came to a halt this year... Darden's as-reported ROA fell from 9% in 2019 to 2% in 2020.

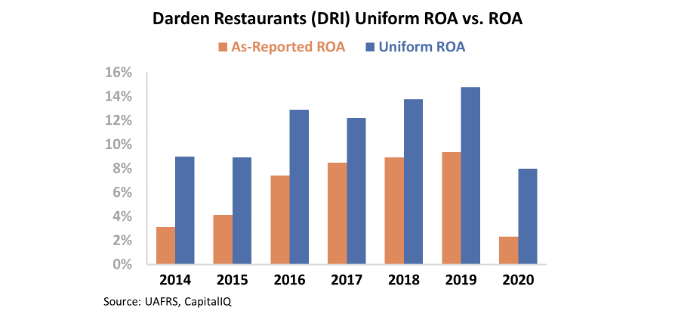

But due to GAAP's treatment of special items – among other distortions – this picture of Darden's profitability is inaccurate...

While the company's Uniform ROA also fell this year, there are two important differences between what Uniform Accounting shows and what Wall Street's metrics would have investors believe. Darden's Uniform ROA only fell by 5% this year. Additionally, profitability fell from a much higher level than as-reported metrics indicate.

In 2019, the company's Uniform ROA was 15% compared with an as-reported ROA of 9%. This year, Darden's Uniform ROA was 10% compared with an as-reported ROA of 2%.

This shows that the coronavirus pandemic has indeed hurt Darden, but not to the same extent as as-reported accounting shows... and it hasn't hit Darden as hard as smaller restaurants.

Uniform Accounting highlights how Darden has performed better during the pandemic than as-reported metrics indicate. And while as-reported metrics don't show this, the market already knows it.

However, Darden certainly isn't the only company that's operating in a fragmented and distressed market that has been laid low by the pandemic... And it's not the only company that's bigger than its peers, with a strong liquidity position to help it survive the crisis and thrive afterwards.

In Altimetry's High Alpha, we've identified two companies that are positioned for massive upside once the market catches on to their strength. You can learn more about High Alpha – and how to gain instant access to these recommendations – right here.

Regards,

Joel Litman

October 29, 2020

P.S. Do you have a company in mind that you think can benefit from the survive-and-thrive theme but the market has overlooked? Let us know by sending an e-mail to [email protected] and we might take a look from a Uniform Accounting perspective in a future Daily Authority issue.

The market's recent big drop is spooking investors...

The market's recent big drop is spooking investors...