The U.S. Federal Reserve realized the need for a finance SWAT team as it reassessed its role in the economy following the financial crisis...

The U.S. Federal Reserve realized the need for a finance SWAT team as it reassessed its role in the economy following the financial crisis...

In the buildup to the Great Recession, the Fed suffered from the oversight of disaster myopia and wasn't properly prepared for the crisis. Former Chairman Alan Greenspan and others made the common mistake of assuming an event wouldn't occur because the probability of it happening was small. When the housing bubble popped, the whole global economy suffered from their lack of preparedness.

To get ahead of possible events like this one in the future, the Fed created the Division of Financial Stability, colloquially known as "FS." Late last month, Bloomberg highlighted the team and its leader, Andreas Lehnert.

The FS team is tasked with identifying all the ways the economy could melt down, with a focus on the most fragile parts of the broader economy. The 50 economists working for the FS team need to be creative when thinking of possible scenarios, so that the Fed is able to respond to any crisis. In addition to thinking of possible fragilities, the FS team considers how the Fed should respond to each crisis.

In the interview with Bloomberg, Lehnert talked about how 99% of the scenarios will never play out. However, if one of them does, the Fed will now be prepared.

Fortunately, the FS team had a plan for a pandemic on file. Due to the team's forward thinking, the Fed was able to spend more time responding to the crisis and less time fighting over which course of action to take.

The Fed used the playbook drafted by the FS team to stabilize the economy. The Federal Open Markets Committee ("FOMC") – the central bank's monetary policymaking body – quickly lowered interest rates to zero. This action encouraged households and businesses to continue borrowing money and kept money flowing throughout the economy.

The Fed also helped stabilize financial markets by purchasing government debt securities. When the coronavirus pandemic initially hit, asset prices became volatile and it was difficult for sellers to find buyers. The Fed stepped in and became a "buyer of last resort" for many sellers.

Additionally, the Fed supported the flow of credit in the economy. Seeing potential signs that the money market was starting to seize up in March, the Fed pushed for creating many temporary facilities to support credit markets and businesses of all sizes. The Main Street Lending Program and the U.S. Treasury's Paycheck Protection Program Liquidity Facility established support for both small and medium-sized businesses, allowing many to survive through stay-at-home orders.

Overall, the Fed took nine different programs from the FS team. Without a prewritten plan, the central bank wouldn't have been able to react as quickly to the pandemic. However, the Fed was able to prevent a total seizure of credit markets... and so far, the central bank hasn't allowed the pandemic to balloon into a credit crisis.

The Fed took such aggressive actions in March because it understood the importance of credit cycles...

The Fed took such aggressive actions in March because it understood the importance of credit cycles...

Here at Altimetry Daily Authority, we've discussed the importance of credit cycles. We focus on it as a big part of our macro analysis, as well as our Market Phase Cycle report for Valens Research's – the firm that powers Altimetry – institutional clients. This is because credit cycles drive economic and equity market cycles.

Without access to credit, liquidity begins to dry up and can bring the economy to a halt. Short-term downturns can become catastrophic for companies if they can't borrow money to cover fixed costs. The pandemic created one of the worst short-term economic downturns in history, with real gross domestic product ("GDP") falling almost 35% in the second quarter.

The only way for companies to survive a drought in demand was through the use of credit.

Now that we're more than six months removed from the trough in the stock market, it's important to take another look at credit market signals. One way we can measure the health of the credit market is by looking at the corporate cost to borrow. This way, we can see if corporate credit is frozen or free-flowing.

For this, we can turn to credit default swap ("CDS") levels and the "risk-free rate." A CDS is an agreement in which the seller of the CDS compensates the buyer in the event of a default. The risk-free rate is the rate of return of a safe investment. U.S. Treasurys are usually used because the risk of default on these securities is minuscule.

Combined, the CDS and risk-free rate equal the total risk of a bond. The higher the combined value is, the more expensive it is for a company to obtain debt.

Looking at CDS levels today sends us the same signals we highlighted back in April: corporations still have easy access to credit and low costs to borrow – which incentivizes them not to hold back on borrowing if they need to do so.

This means the risk of corporate defaults is low. With CDS rates low, companies are aided by easy access to refinancing and low debt servicing costs. This is because bonds themselves pay a lower interest rate, which means less payment to investors and more money saved for companies.

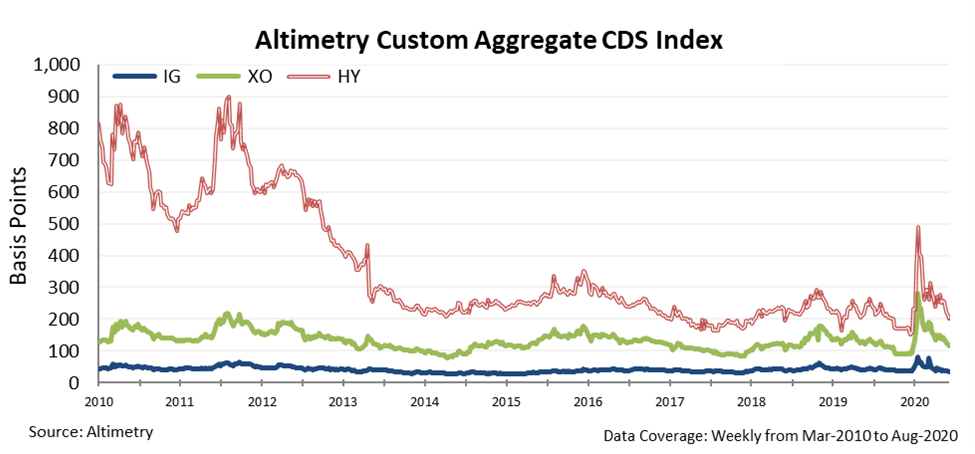

The chart below shows the three "buckets" of companies – investment grade ("IG"), crossover ("XO"), and high yield ("HY"). As you can see, across all three groups, total costs for corporations to borrow has also fallen since the spike in late March...

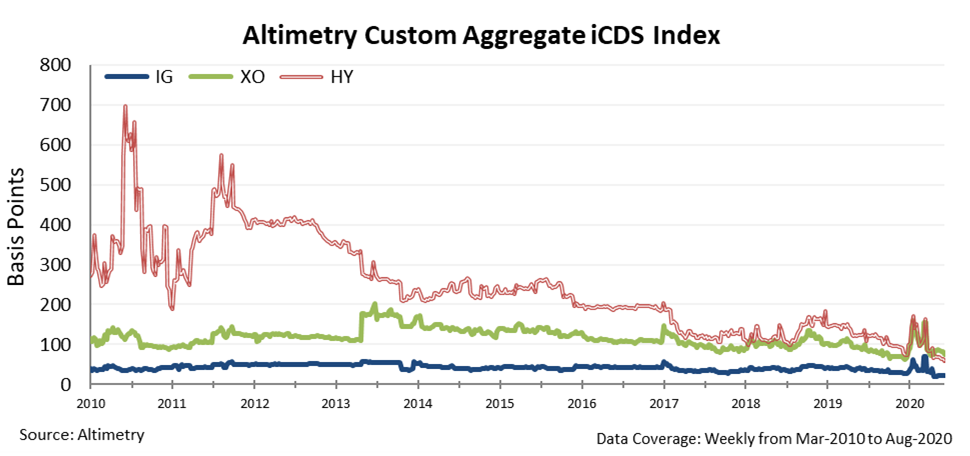

Even more telling for investors, our "Intrinsic CDS" ("iCDS") shows that this drop is backed by economic reality. Our iCDS calculation is able to show the fair value of credit and quantifies what investors should be paying to have their risk covered. As the chart below shows, iCDS levels are even lower than CDS levels – justifying the level they currently float at.

These data points should give investors confidence in the current state of credit markets. With debt so inexpensive, the risk of mass default from companies dragging down the economy is negligible... and therefore the risk of the market dropping significantly is minimal as well.

Companies have few barriers to entering the credit markets, implying they can access the liquidity they need. Clearly, the FS team's task of preparing for any potential challenge has worked.

Regards,

Joel Litman

October 5, 2020

The U.S. Federal Reserve realized the need for a finance SWAT team as it reassessed its role in the economy following the financial crisis...

The U.S. Federal Reserve realized the need for a finance SWAT team as it reassessed its role in the economy following the financial crisis...