For 76 years, unemployment has followed a similar pattern...

For 76 years, unemployment has followed a similar pattern...

Once the unemployment rate was high enough, it caused the economy to spiral out of control.

We talked about this trend quite a bit last year, specifically in regard to the Sahm Rule... a recession indicator created by former Federal Reserve economist Claudia Sahm.

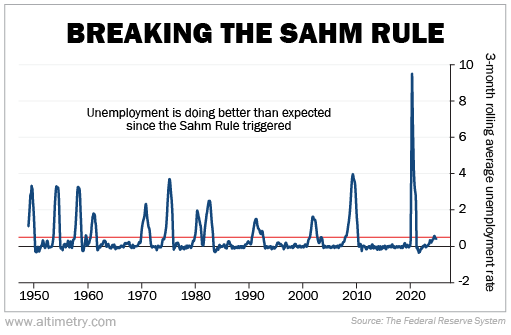

The Sahm Rule tracks the three-month rolling average unemployment rate. If that rolling average climbs 0.5 percentage points above its one-year low, it's a sign that a recession has started.

In each of the previous 12 recessions, going back to 1949, when the Sahm Rule triggered... it was just the beginning.

The rolling average surged well past 1 percentage point every time. It jumped as high as 9.5 percentage points during the pandemic.

However, Claudia Sahm herself has said her rule is meant to be broken. And that may just be what we're seeing today...

We were concerned when the Sahm Rule triggered last August... for good reason.

We were concerned when the Sahm Rule triggered last August... for good reason.

The rule had never generated a false positive or false negative signal to that point.

But six months later, the economy and the stock market still seem OK. Unemployment has stagnated instead of accelerating.

And after peaking at 0.57 percentage points in August, the Sahm Rule has "untriggered" back to 0.4 percentage points.

Take a look...

You can see on the chart that we're back to what's considered a "typical" unemployment rate.

We warned you last year that this could happen... and so did Claudia Sahm, in a Bloomberg article titled, "My Recession Rule Was Meant to Be Broken."

As we wrote at the time...

Every indicator is right every time... until the one time it isn't. So you have to look at them as part of a bigger mosaic.

During this most recent breach of the Sahm Rule, rising unemployment was the "good" kind – it was driven by more folks entering the workforce.

Claudia Sahm said this could have led the most recent breach to be a false positive, since it wasn't driven by a huge uptick in layoffs like it usually is.

Not to mention, investors don't need to worry about the Sahm Rule anyways...

Not to mention, investors don't need to worry about the Sahm Rule anyways...

We're being a bit tongue-in-cheek, of course. Everyone should pay attention to recession risk.

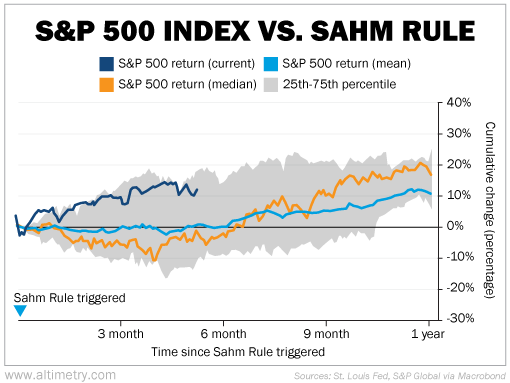

That said, the stock market tends to do pretty well after the Sahm Rule triggers. Take a look at the following chart put together by Macrobond...

As you can see, when the Sahm Rule triggers, the S&P 500 finishes the following 12 months up an average of 10%. The median is closer to 17%.

So far, the S&P 500 is up about 12% this time... well within the average range.

There's no guarantee that it will stay that way. But it's encouraging to see this trend could continue through the rest of the year, based on history.

With the latest jobs data so strong, the Fed is keeping interest rates higher than expected...

With the latest jobs data so strong, the Fed is keeping interest rates higher than expected...

Chairman Jerome Powell suggested the bank will only cut rates two times this year. High rates could continue to put pressure on companies to manage costs through layoffs.

So we still need to keep a close eye on employment trends. Just because unemployment has settled down doesn't mean we're immune to a more typical unemployment cycle. We could still end up headed for a recession.

But we're seeing plenty of positive signs for the economy, too. Banks are on the cusp of loosening lending standards. And as we'll cover on Monday, another tried-and-true recession indicator just flipped back to "normal."

One thing is certain... The Fed needs to be responsive to changes in the economy. Otherwise, it could get out of control quickly.

Regards,

Joel Litman

January 24, 2025

For 76 years, unemployment has followed a similar pattern...

For 76 years, unemployment has followed a similar pattern...