It's easy to forget that there's more to focus on than the coronavirus...

It's easy to forget that there's more to focus on than the coronavirus...

There hasn't been a slew of company-specific stories to talk about right now, because – in the language of quant investors – the only thing moving businesses right now is the "market factor." It feels like all we've been hearing about is the impact of the coronavirus on the market.

But research firm CB Insights recently published an interesting article that broke the flow of reading and reacting to all things pandemic. The piece highlights 10 key industries that Google's parent company Alphabet (GOOGL) is disrupting:

- Consumer electronics

- Health care

- Next-gen computing

- Transportation

- Energy

- Smart cities

- Travel

- Gaming

- Media

- Banking

Sometimes it can be hard to fathom how tech giants Alphabet, Apple (AAPL), Amazon (AMZN), and Microsoft (MSFT) all have at times warranted trillion-dollar valuations. But when you take into account all the industries they're impacting, disrupting, taking over, supplying, and investing in, the scope of their economic impact – and their potential – becomes more apparent.

Some of these disruptions are just beginning... Watch for Alphabet's increased presence in more and more sectors as the company seeks its next billion-dollar business.

One of my first professional roles was as an auditor in Chicago...

One of my first professional roles was as an auditor in Chicago...

In the mid-1990s, I worked for American Express (AXP) in its Tax and Business Services.

About a decade later, the division was acquired by RSM McGladrey – then a subsidiary of tax-preparation company H&R Block (HRB)... But at the time, we were a group of nearly 2,500.

Our specialty was in servicing small and medium-sized businesses in the Midwest – my office was focused in particular on firms along the shore of Lake Michigan and inland from Chicago through Wisconsin.

There were plenty of businesses represented in the area, but a large chunk of our clients happened to be small, industrial machinery firms. These companies had a unique strategy that differs from the industrial firms throughout the rest of the U.S.

While many of the large industrial firms we've previously discussed – like General Electric (GE) and Northrop Grumman (NOC) – generally focus on producing as many different product lines as they can, this stretch of the Midwest is different...

In fact, these companies aren't trying to grow to be the next General Electric. Rather, they are trying to emulate the concept of the German "Mittelstand" in the American Midwest.

This word roughly refers to the small and medium-sized enterprises that make up the vast majority of the German economy. Mittelstand firms are often associated with a set of common values and descriptors that include a smaller, more family-like structure, a focus on innovation, and the manufacture of industrial parts like automotive components and other machinery.

Given the large presence of German industrial heritage in the Midwest today, it's no surprise that many firms have copied the Mittelstand model.

The advantage of this structure is the ability to dominate a few niches rather than attempting to compete with the likes of bigger conglomerates like General Electric. By focusing on these smaller areas that would otherwise be expensive for larger companies, these Mittelstand businesses are able to make fairly strong returns.

While the areas around Lake Michigan are a hub for these Mittelstand businesses, others like them are popping up across the nation.

On the East Coast, Barnes (B) manufactures specific components for the plastic injection molding industry and a few other end markets. The company produces highly specialized products like hot runner systems and mold cavity sensors.

That said, when looking at the Barnes' financials, it doesn't appear that the company has achieved the same niche advantage as many of its Midwestern counterparts...

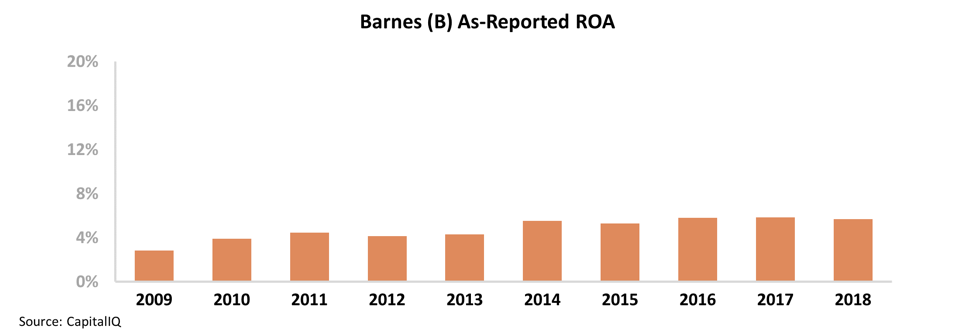

Since the Great Recession, Barnes' return on assets ("ROA") has remained at or below long-term corporate averages of 6% – indicating that the company hasn't been able to effectively differentiate itself. Take a look...

The low returns show why the larger companies try to avoid manufacturing niche products. It's both difficult and expensive to build expertise for such specific components, and it's difficult to make them profitable.

It appears that Barnes has either failed to establish itself as the dominant player or it's struggling to generate demand for its products.

But this isn't the economic reality...

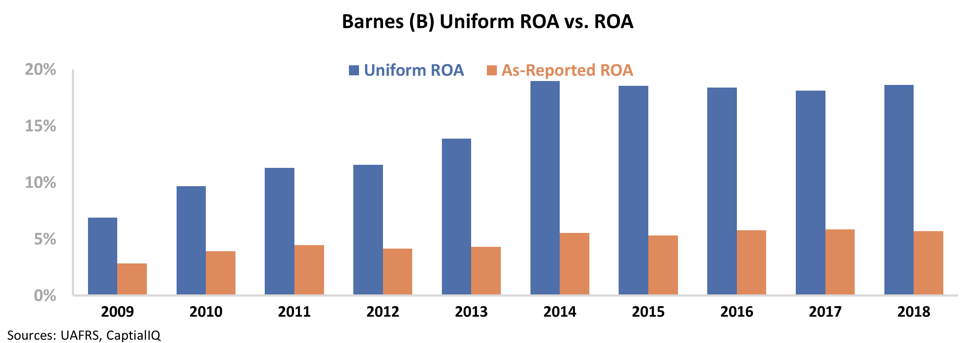

Once we apply our Uniform Accounting metrics, we can see that Barnes has established itself as an "American Mittelstand" company.

As-reported financial metrics include misleading treatment of important items like goodwill, operating leases, and non-cash stock option expenses. After making the proper adjustments under Uniform Accounting, we can see Barnes' true economic performance...

Since the Great Recession, Barnes' Uniform ROA has rebounded significantly from a low of 7% back to levels closer to 20% from 2014 to 2018.

This is more in line with what we'd expect from a Midwestern or a German Mittelstand.

After cleaning up the "noise" in traditional accounting statements, it's easy to see the value of this business model. Don't be deceived into thinking a niche business like Barnes can't generate robust returns.

Regards,

Joel Litman

March 18, 2020

It's easy to forget that there's more to focus on than the coronavirus...

It's easy to forget that there's more to focus on than the coronavirus...