It's part of the dark underbelly of the 'At-Home Revolution'...

It's part of the dark underbelly of the 'At-Home Revolution'...

Over the past few months, we've consistently highlighted the power of the massive societal shift in the wake of the coronavirus pandemic. As folks have shifted their consumption to the home, many industries have seen a renaissance in spending.

However, this trend has left behind the vulnerable demographic of young students, who have struggled to pivot learning to the home.

A few weeks ago, The Economist explored the disparity between at-home education for different income groups. For students in high-income households, engagement with learning materials since the pandemic started have maintained previous levels.

However, students in middle class households saw engagement fall by 30%. Even more dramatic, students in low-income households have seen a staggering drop of more than 50% in engagement with education materials.

Children from disadvantaged backgrounds have also scored disproportionately worse on their online exams than they had before the pandemic. In many cases, these disadvantaged students don't have consistent access to a computer or a reliable Internet connection.

Any form of remote learning requires self-discipline and a natural inquisitiveness that many younger students lack by nature, no matter where they come from. However well-to-do parents are more likely to be able to foster and prioritize a positive learning environment within the home, which can become another advantage for students in wealthier households.

The disparity is a significant risk of the learn at-home environment.

Some experts have said that even when students are allowed back in classrooms, less well-off families may be more hesitant to immediately send their children back to in-person education. This may be due to the fiscal necessity for these children to support the family in this severe economic contraction. It may also be because of greater concerns over health care implications, for both the child and the family as a whole.

It's naturally exciting to see a dynamic, changing market environment as a buying opportunity. During any huge shift, savvy investors can leverage market inefficiencies for big gains.

However, it's also crucial to think about the uneven effects of moving services to the home, and how it may disenfranchise and entrench certain groups. For those without the same means to learn at home, the At-Home Revolution will be a slower, more painful process to adopt.

Many readers have found some new examples of the 'illusion of choice'...

Many readers have found some new examples of the 'illusion of choice'...

In the August 4 Altimetry Daily Authority, we explained how advertising companies were benefitting from this powerful phenomenon.

Since the big firms own many different agencies, clients believe they have a choice in their advertising agency... when they really don't.

We asked if readers could think an illusion of choice they'd seen in their daily lives, and we received some great examples. Steve wrote:

Candy Bars. Dozens of choices but probably only 3, maybe 4 different companies making them all.

Between Hershey (HSY), Mondelez (MDLZ), and Nestlé (NSRGY) alone, many of the brands we love for chocolate and snacks in general are all consolidated in the industry. And yet we go to the store and get excited about our options.

It's no surprise that the illusion of choice has helped these companies generate massive profitability. Nestle saw a 21% Uniform return on assets ("ROA") last year, Hershey's was an impressive 30%, and Mondelez boasted 36%.

On the other hand, reader Gerald wrote:

In the 1960s American automobile corporations GM and Ford offered cars on the same chassis with different "trim packages" and name plates, that often were manufactured in the same plants, with the same parts, by the same workers, on the same days, sold at different prices, by different brand dealers, marketed as middle class and upper middle class symbols of American prosperity and wealth status. While Ford offered two brands Ford and Mercury, GM offered 3 brands of family sedans at slightly different prices: Pontiac, Buick, and Oldsmobile and differentiated from its entry level Chevrolet brand.

Although these were once independent companies acquired by GM in its early days of auto industry expansion in the 20th [century], their brands were reduced to manufacturing very similar products as the decades rolled by to save money and achieve economies of scale on parts and process while maintaining an illusion of choice based on superficial differences in style and the name plates. Real American consumer choice of auto brands came with foreign auto manufacturer imports for luxury and entry brands: European and Japanese later South Korean makes.

As General Motors' (GM) bankruptcy and Ford Motor's (F) poor performance over the past 10-plus years can attest, these automakers haven't had as much success with the illusion of choice. That's because the phenomenon only really works to unlock significant value for companies if it creates the appearance of competition, without there actually being any.

The moment real competition enters the market, and starts maneuvering for cost, quality, and differentiation, among other factors, the benefits of the "illusion" of choice to customers vanishes. They actually have options... and all of a sudden, a non-competitive field becomes highly competitive.

In future Daily Authority issues, when we get interesting responses to our questions, we'll highlight them. We recently asked readers for companies they might like us to review from a Uniform Accounting framework. This week, we'll take a look at a few of these requests. This first one comes from Kirk...

Peter Drucker has been described as the 'founder of modern management'...

Peter Drucker has been described as the 'founder of modern management'...

He grew up in Austria-Hungary, exposed to titans of the Austrian School of Economics such as Joseph Schumpeter, Friedrich Hayek, and Ludwig von Mises.

After sitting at the feet of economic giants, Drucker spent most of his life examining relationships amongst people to understand economics, compared to the more common practice of crunching numbers.

He became a CEO-whisperer for the likes of Jack Welch at General Electric (GE) as well as senior executives at GM, Sears, and IBM (IBM), among others.

One of his key pieces of advice was, "make sure your back room is their front room." Essentially, this means a firm should focus on what it does best, and outsource the rest.

Many tasks in running a business are unrelated to the genuine assets that some businesses possess. Most companies have no expertise in payroll management, so they outsource to firms like Automatic Data Processing (ADP) or Paychex (PAYX).

Businesses also have no core competency in accounting software development, instead shipping these tasks off to Oracle (ORCL) or SAP (SAP).

Similarly, many companies have offices and factories they need to clean and keep running, but lack the expertise or manpower to do so. This is where a company like ABM Industries (ABM) comes into play...

ABM provides a range of offerings for companies including janitorial services, parking and transportation solutions, mechanical and electrical services, HVAC management, and mail solutions, among other services.

It serves as a background operator for some of the world's biggest companies... ABM is literally keeping the lights on.

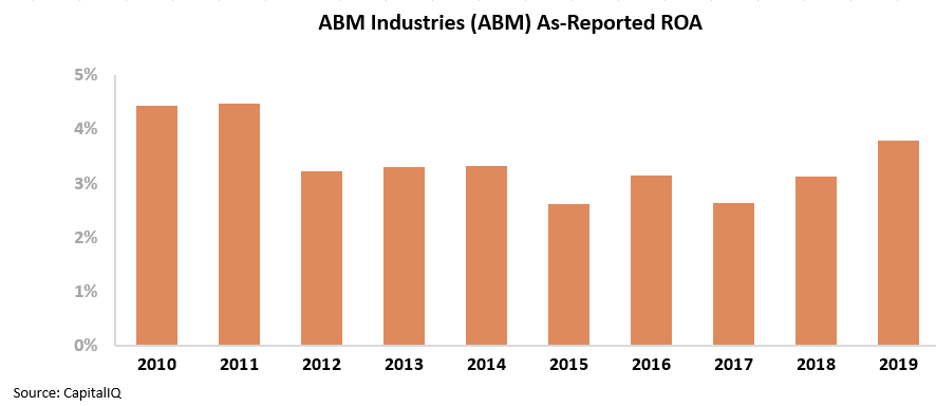

These services sound like a generic business, so it's no wonder the company has generated returns below cost-of-capital levels over the past 10 years.

ABM's as-reported ROAs have settled between 3% to 4% since 2010. Investors think the company is unable to profit from fulfilling menial services.

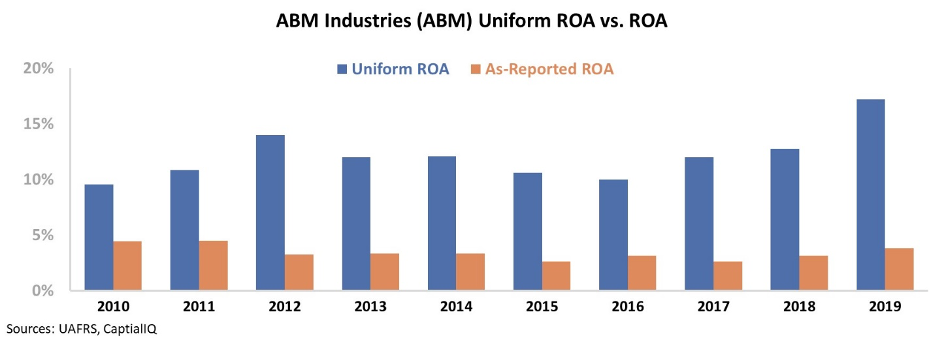

However, this picture of ABM's performance is inaccurate... pulled down by distortions in as-reported accounting. Due to the GAAP treatment of goodwill, the market has missed the mark on ABM's success.

The company has managed to create an essential service for a massive market – one that's capable of weathering economic downturns.

In fact, ABM's Uniform ROA was more than double its as-reported returns from 2010 to 2019... growing from 10% to 17%.

By excelling at the tasks that nobody else wants to do, ABM can create sustained value as companies continue to outsource their operations.

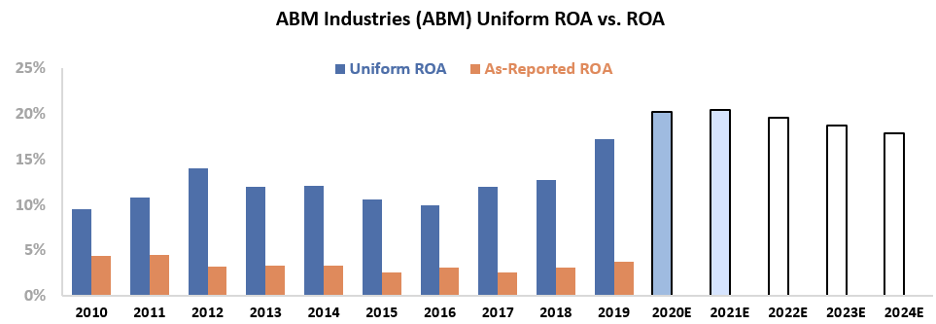

To understand if the market thinks ABM can continue to create this value for shareholders, we can use the Embedded Expectations Framework to easily understand valuations...

The chart below explains the company's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, both analysts and the market expect ABM's returns to grow beyond current levels. This is despite the economic uncertainty due to the current pandemic.

Ultimately, Uniform Accounting shows ABM's true strength and the market's bullish outlook for the company.

ABM has an incredibly resilient business and is forecast to improve returns even in the midst of the pandemic. And as businesses re-occupy factories and offices as economies reopen, the demand for clean workspaces will only increase.

Without Uniform Accounting, investors would miss this high-return company providing essential work to keep companies running. ABM is a strong business that warrants a premium valuation.

Regards,

Joel Litman

August 11, 2020

P.S. Did you have a "dirty" job – either early on in your career or one that you made a long-term career out of – that led to success because no one else wanted to do it? Tell us by sending an e-mail to [email protected].

It's part of the dark underbelly of the 'At-Home Revolution'...

It's part of the dark underbelly of the 'At-Home Revolution'...