Renowned activist investor Carl Icahn has been waging a war against food staples...

Renowned activist investor Carl Icahn has been waging a war against food staples...

Icahn sometimes uses intense strategies to get what he wants. Usually he's fighting for money. But recently, he has had other goals in mind.

He started using his investment sway to help the planet.

We covered Icahn's activism against McDonald's (MCD) a few months ago. After years of pushing to improve shareholder returns, he changed focus. In short, Icahn's granddaughter convinced him to fight for better treatment of pigs before they're slaughtered.

McDonald's suppliers currently use gestation crates. The crates are so small that pigs can't even turn around.

Despite Icahn's noble cause, the battle was short-lived. He gave up after losing a proxy fight and board nomination with McDonald's.

But Icahn didn't stop at the golden arches...

But Icahn didn't stop at the golden arches...

Next, he set his sights on another major meat seller – grocery chain Kroger (KR). He recently stood up a proxy fight against the company.

Icahn pushed Kroger's management to source its meat products from more humane farms. Just like with McDonald's, he didn't ask the company to completely overhaul operations. Rather, he pushed to improve this one segment.

But the Kroger campaign met a similar fate. Icahn gave up early this month, saying he doesn't think investors will back his efforts thanks to Kroger's strong performance.

Icahn noted his pig-saving crusade was an uphill battle from the beginning. Since both McDonald's and Kroger are performing well financially, they're resistant to change.

It seems like shareholders have little reason to back Icahn's ideas.

But perhaps Icahn gave up on Kroger too quickly...

But perhaps Icahn gave up on Kroger too quickly...

A look at Uniform Accounting shows us that unlike with McDonald's, Icahn might have been able to gain traction in his fight against the grocery-store chain.

Uniform return on assets ("ROA") for McDonald's is typically around 15%. That's above U.S. averages, which are closer to 12%.

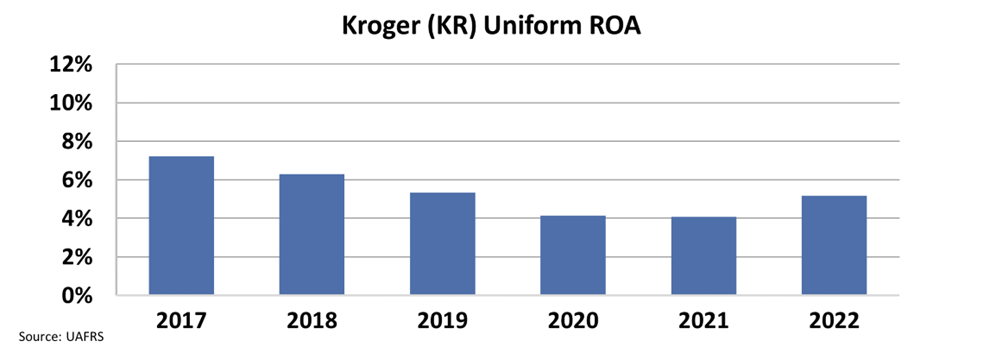

Kroger is a different story. Its Uniform ROA was a measly 5% last year. And it's only expected to grow to 6% this year.

This isn't just a blip in the company's profitability, either. ROA has been consistently mediocre – barely at cost-of-capital levels – for years.

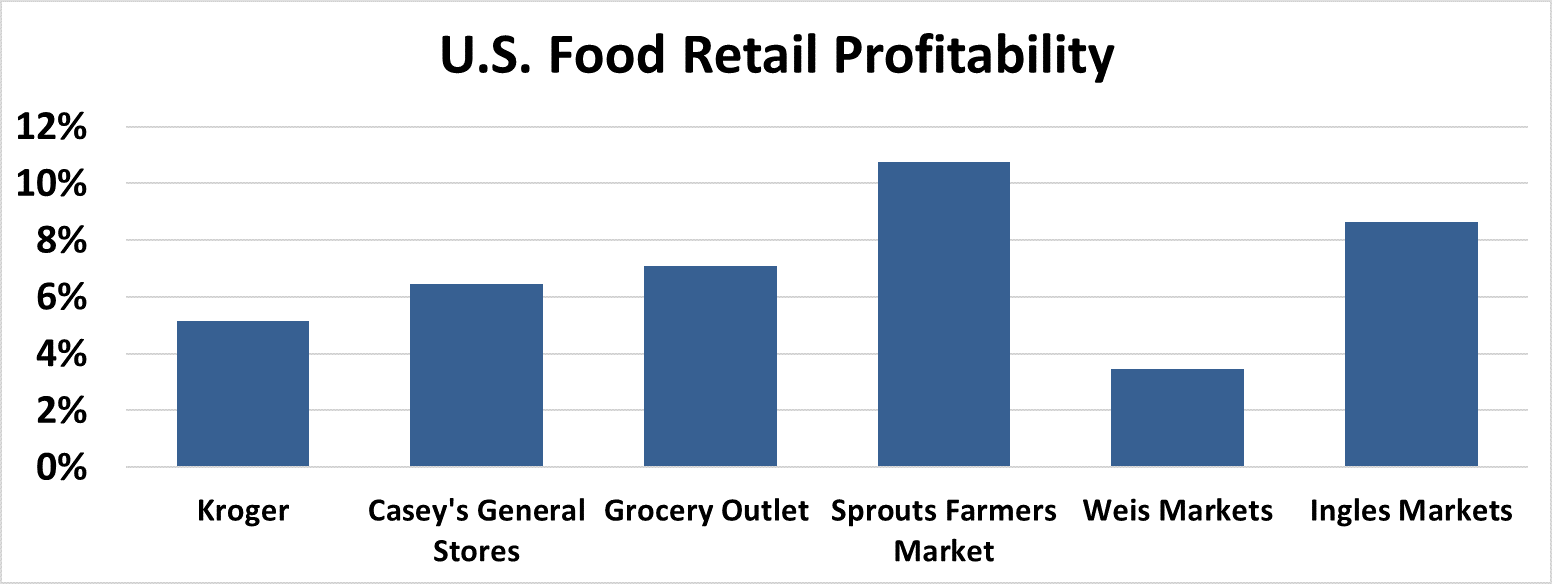

The market generally views grocery stores as low-return businesses. But even so, Kroger still stands out as a loser.

Kroger's returns are in the bottom half of performance when compared to its peers. Take a look...

Kroger hasn't produced strong returns in years. That could be Icahn's angle...

The grocery chain's disappointing performance might not be directly linked to how its suppliers treat farm animals. But if Icahn combines his push with operational changes for investors to support, he might have a leg to stand on.

In the meantime, Icahn has learned the hard way that animal rights aren't likely to move the needle for strong performers.

Best,

Joel Litman,

June 21, 2022

Renowned activist investor Carl Icahn has been waging a war against food staples...

Renowned activist investor Carl Icahn has been waging a war against food staples...