China spent last year on the verge of apparent economic collapse...

China spent last year on the verge of apparent economic collapse...

The real estate market weakened. Unemployment ticked higher, particularly among young people.

Despite the warning signs... that's about as far as it went. The Chinese economy kept chugging along.

But under the hood, things haven't improved. Real estate prices have collapsed 40% from their peak. And citizens still aren't spending the way the government wants.

China's economic engine keeps getting shakier. And now, Beijing is trying to revive the struggling economy by targeting a different kind of growth... one powered by domestic demand.

The property hangover still looms over China's economy...

The property hangover still looms over China's economy...

As we mentioned, one estimate claims nationwide home prices are down around 40% from the peak. But China has billions of square meters' worth of new housing supply... enough to cover years of demand.

That kind of oversupply doesn't fade quickly. Said another way, home prices aren't likely to recover anytime soon.

Property is one of the largest sectors of China's economy. So if it's performing poorly, there will be widespread negative consequences.

Since real estate is tied to individual wealth, people often spend more freely when they feel their biggest asset – their home – is rising in value.

In China, the opposite dynamic has taken hold... Falling property values are turning spending into caution. Folks want to preserve their money in case home prices plummet even lower.

Beijing is well aware of this problem...

Beijing is well aware of this problem...

Chinese planners have started describing the imbalance as "strong supply and weak demand."

That's a polite way of saying factories can produce, exporters can ship, and builders can build... but the real estate market is stagnant.

The Chinese government plans to issue a 500-billion-yuan (about $72 billion) government-backed loan guarantee facility to support private-sector borrowing. It's designed to help companies upgrade their technology and assets.

China is pairing this with other incentives, like subsidized rates on certain loans and extensions of consumer-loan discounts through the rest of 2026.

All these moves suggest the government is trying to compensate for a lack of private spending.

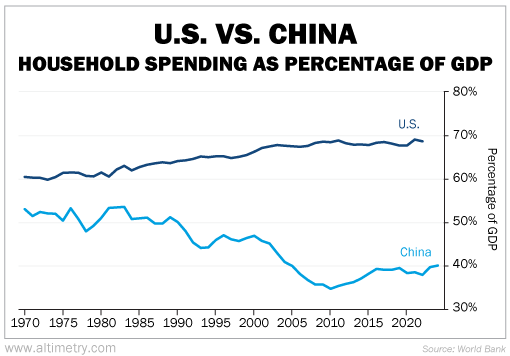

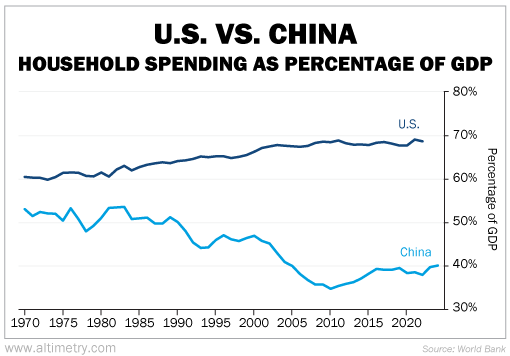

Just take a look at the chart below. It shows the difference between Chinese and American household spending as a percentage of GDP.

Since 1970, the two countries have moved in opposite directions. Take a look...

As it stands, U.S. households are strong enough to spend roughly two-thirds of the nation's GDP.

China, on the other hand, is struggling to crack 40%.

Chinese households aren't spending. So the government has to pick up the slack.

And that stimulus can only go on for so long.

The loan-guarantee program and consumer subsidies are supposed to get activity going inside China...

The loan-guarantee program and consumer subsidies are supposed to get activity going inside China...

That's because exports won't help with domestic real estate prices.

But if these programs go on for too long – or if they're unable to change consumer behavior – the efforts could backfire. Government stimulus can only lift activity in the short term.

It can also create an army of zombies... "walking dead" companies and consumers that tie up resources and capital.

China's policymakers are trying to buy time for a consumer revival. But that revival is still nowhere to be seen.

There's no end in sight to China's economic problems. In the meantime, the Chinese market isn't safe for your money.

Regards,

Joel Litman

February 3, 2026

China spent last year on the verge of apparent economic collapse...

China spent last year on the verge of apparent economic collapse...