The pandemic is accelerating the freelance independent contractor movement...

The pandemic is accelerating the freelance independent contractor movement...

Each year, freelancing site UpWork publishes its Freelancing in America report. We recently came across it while researching how the pandemic is affecting workers.

It's similar to MBO Partners' annual State of Independence in America... We work with and respect MBO, so it's good to get some additional perspective.

MBO is an independent contractor platform that, similar to UpWork, helps match supply and demand for workers, generally for higher-end consulting-style work.

Taking a look at both reports, a couple of key trends jump out...

Freelancing income is approaching $1 trillion in the U.S., and more than 35% of the American workforce did some freelancing this year. Eighty-two percent of full-time independents say they're happier doing freelance work.

And as more millennials join the workforce, more of them are doing so as independents rather than full-time employees.

This shift to independent contracting is important, because it dovetails with something else we talk about regularly here at Altimetry – the "At-Home Revolution." As more people work independently, they're often turning their homes into offices. And they're not alone – full-time workers across the country are increasingly shifting to working from home in the wake of the coronavirus pandemic.

And as more people work remotely, they'll invest more in their homes. It goes beyond just working... Across the country, more folks will be entertaining themselves at home, supplying their home, and protecting their home. This is a massive societal shift, and it's unlikely to go away even after the coronavirus pandemic recedes.

It also means that certain businesses are poised to be big winners as this trend plays out. And in our Altimetry's Hidden Alpha newsletter, we've identified 12 of these companies for readers. You can gain instant access to the list with a Hidden Alpha subscription – learn more here.

Today, it would be impossible to imagine a world without money...

Today, it would be impossible to imagine a world without money...

Our society functions on the backbone of transferring goods or services through currency. Yet despite money being such an intrinsic part of our lives, like all human inventions, we still got by without it...

More than 10,000 years ago, humans began to domesticate animals and move away from the barter system. To barter, two people needed to have exactly what the other one wanted, or no one would be happy.

However, as civilizations emerged, people chose to assign wealth to rare pieces of metal. This metal could be traded for anything, which was the birth of commodity money.

Then, around 600 B.C., electrum was used to create the first purpose-built coins. Instead of an ingot of a rare metal having value, a standardized coin now helped facilitate commerce. This was a startling development – electrum is a much more common material than gold or silver.

Over the past 2,000 years, currency has continued to evolve to be further disconnected from the barter system to better serve society's needs.

Most recently, two developments have caused this to evolve even further: the separation of the U.S. dollar from the gold standard in 1971, and today's revolution in digital currency.

However, the U.S. dollar functions in a similar way to the electrum coins of 600 B.C. – as a store of value rather than a commodity.

Investors love trying to figure out where the next step of the currency revolution will be... This is why digital-payments firms such as Square (SQ) and PayPal (PYPL) are exciting. Here at Altimetry, we've also written about two companies which support the "cashless" revolution: Mastercard (MA) and FIS (FIS). A few of the businesses we highlight when discussing the At-Home Revolution also are exposed to the world of cashless payments.

Thanks to this excitement for the future, companies like Euronet (EEFT) have been left behind. Euronet is a payment-processing firm that focuses on ATMs. And with the rise of cashless payments, Euronet seems to be a commodity business whose commodity is swiftly losing value...

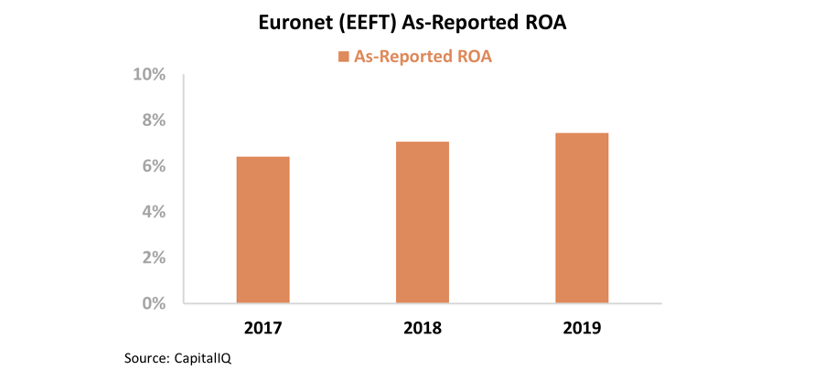

Looking at the company's as-reported return on assets ("ROA"), these figures have sat near cost-of-capitals levels over the past three years. Take a look...

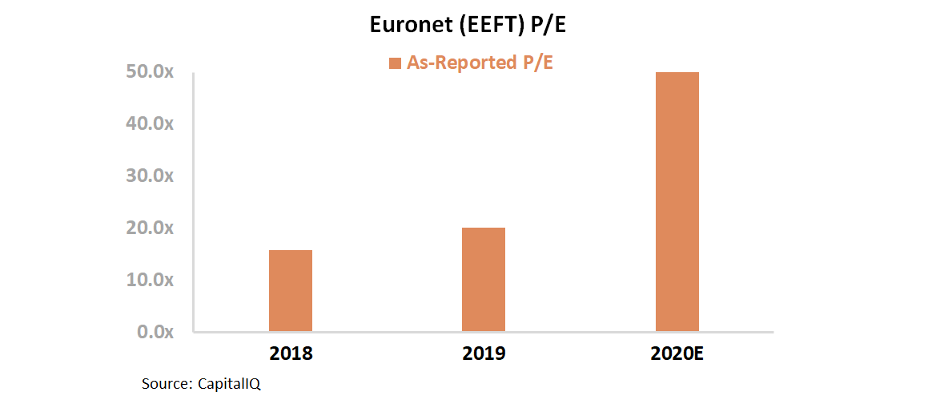

At such low returns, Euronet should be trading at a discount compared to the market. However, the company trades at a premium instead...

Right now, Euronet's price-to-earnings (P/E) ratio of 47 is more than twice market averages of 20 times.

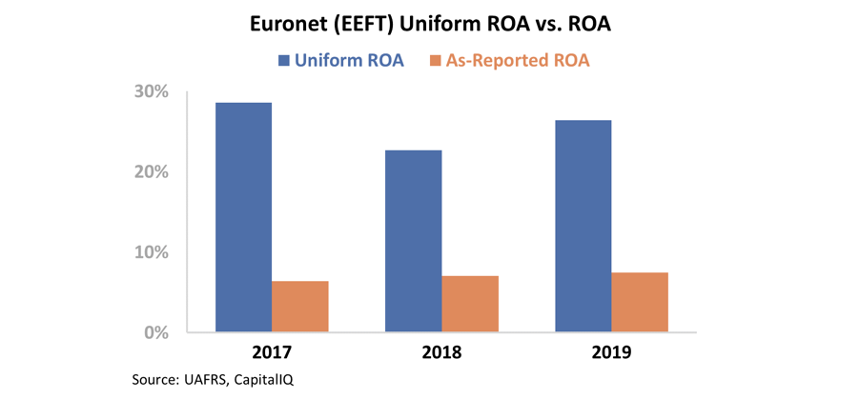

Using GAAP accounting metrics, the future looks bleak for this low-return, overpriced company that produces old technology. However, this image couldn't be further from the truth...

After making adjustments to excess cash and goodwill, Euronet's performance makes a complete 180-degree turn. Instead of returns near cost-of-capital levels, the company has in fact seen ROAs in excess of 23% over the past three years...

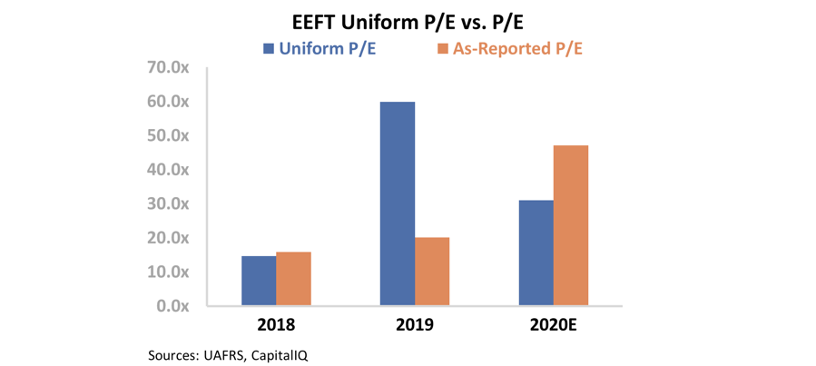

Not only does Euronet realize a much higher ROA than the as-reported numbers would have you believe, but its P/E ratio is much more in line with the market. As you can see, Euronet has a Uniform P/E ratio of 31 instead of 47...

In the steady march of progress, it's all too easy to look at the next exciting investment and forget the backbone of our current system. However, ATMs (and access to cash) aren't commodity products that are losing value – they're an essential service to facilitate exchange.

Cold, hard cash is not going anywhere yet... even though it's more than 2,500 years old. And with the GAAP mistreatment of Euronet's assets, it's easy for investors to jump to the wrong conclusion and ignore this key player in the use of currency.

Regards,

Joel Litman

June 17, 2020

The pandemic is accelerating the freelance independent contractor movement...

The pandemic is accelerating the freelance independent contractor movement...