Investors anticipated this big 'earnings miss'...

Investors anticipated this big 'earnings miss'...

Goldman Sachs (GS) was expecting an ugly quarter... and that's exactly what it got.

The financial-services giant missed earnings estimates in its second-quarter report, posting earnings per share of $3.08, versus the expected $3.18.

Now, CEO David Solomon did publicly warn investors... Back in June, he indicated that the bank would take impairments on its real estate loans and investments.

You see, rising interest rates and mounting pressure on the real estate industry forced the bank to mark down some of those assets, which reduced their value.

Even Goldman President John Waldron came right out and said that equities and fixed-income trading volumes would fall by 25%.

And as expected, the outcome was far from pretty...

The company's net income plummeted by two-thirds compared with the prior year.

Goldman's fintech business GreenSky was largely responsible for this poor performance... Goldman disclosed a $500 million write-down after seeking to unload the lending unit. (I’ll expand on this later.)

But these ugly results might actually benefit this leading global bank.

As we'll explain today, Goldman's dismal quarter may set up a big future opportunity for investors...

The first step in bouncing back is admitting defeat...

The first step in bouncing back is admitting defeat...

When Goldman first entered the consumer-banking space in 2016, it turned some heads.

Goldman thought it could leverage its technology and risk-management strengths to gain a market advantage... It launched the Marcus mobile banking app that year and then acquired GreenSky in 2022.

But investors remained skeptical about these moves, given Goldman's longstanding success in commercial banking. And over time, the consumer-banking business dragged down company earnings.

The good news is, Goldman seems willing to admit defeat.

That means Goldman could be gearing up for a "big bath"... That's when management anticipates disappointing results and opts to make the quarter look as bad as possible.

Ironically, that strategy can also set the stage for improved future earnings...

A big bath can reset expectations from the market and provide a conservative benchmark to beat going forward.

In other words, if this quarter marks rock bottom, it would be easier for Goldman to crush those new, low expectations in future quarters.

On top of that, Solomon remains "fully confident" that Goldman will be able to deliver on its return targets and "create significant value for shareholders."

Management is clearly taking responsibility for past setbacks and refocusing on generating profit.

Yet the market doesn't see the big profits behind the 'big bath'...

Yet the market doesn't see the big profits behind the 'big bath'...

The market isn't giving Goldman enough credit for this crafty business strategy.

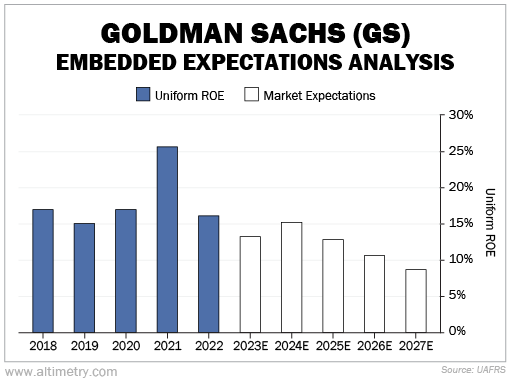

And we can see this through our Embedded Expectations Analysis ("EEA") framework...

We begin by looking at a company's current stock price and calculate what the market expects from the company's future cash flows. We then compare that figure with our own cash-flow projections.

In short, the EEA tells us how well a company has to perform in the future to justify what the market is paying for it today.

Let's take a look at Goldman's profitability in relation to equity...

The company's Uniform return on equity ("ROE") has ranged from 15% to about 25% for the past five years. And yet, investors expect Uniform ROE to drop below 10%...

That would be Goldman Sachs' worst Uniform ROE in the past decade.

However, we have reason to believe this investment-banking giant is poised for a turnaround...

One poor quarter won't erase future success...

One poor quarter won't erase future success...

Few investors can tell the difference between a big-bath quarter and a single bad quarter...

And even those who can often get spooked by bad results, so they miss hidden opportunities for future profits.

The truth is, companies are quite intentional, and strategic, when it comes to big-bath accounting practices, especially when they have a chance to rebound quickly.

That's certainly the case for a world-class bank like Goldman... given its renewed focus on earnings targets and shareholder value.

If we look beyond the surface of this one bad quarter, we have a chance to profit from Goldman's recovery right when management starts turning the business around.

Regards,

Rob Spivey

August 1, 2023

P.S. We recently published a special report discussing the "big bath" concept. In that report, we identified four other companies that are gearing up for big baths, which could lead to massive gains in upcoming quarters. Find out how to access that report here.

Investors anticipated this big 'earnings miss'...

Investors anticipated this big 'earnings miss'...