Here at Altimetry Daily Authority, Joel and I have recently emphasized the importance of asking questions...

Here at Altimetry Daily Authority, Joel and I have recently emphasized the importance of asking questions...

We've talked about Socrates and the dialogue, as well as John Stuart Mill and freedom of speech. As I said last Friday...

Mill believed pushing for constant dialogue was essential because the strongest opinions were often the least informed. Put another way, "The loudest voice is often the weakest."

In any decision-making process, folks can arrive at the best decision by getting all the information they can.

And the only way to do that is by forming relationships with smart and well-informed people who are comfortable sharing their opinions.

That's why you might have heard people refer to a "black hat" or "devil's advocate" in a successful investment-research process. The goal is to have someone who's comfortable asking tough questions that challenge an idea or opinion.

Sound thinkers want to avoid groupthink – whether it's in government policymaking or brainstorming a market opportunity and plan for a client project.

Having someone play devil's advocate can make a plan more resilient or prevent a costly mistake.

But truly great thinkers don't just rely on someone else to do it for them... They also try to do it themselves. They live by author F. Scott Fitzgerald's quote:

The test of a first-rate intelligence is the ability to hold two opposed ideas in mind at the same time and still retain the ability to function.

This can be especially challenging – and important – in investing...

This can be especially challenging – and important – in investing...

Investors spend most of their time strongly defending their ideas.

When you spend so much time defending an idea, if you're not careful, it can be hard to pay equal attention to when that opportunity could go sideways.

The greats avoid this by constantly re-evaluating both sides of the argument. They have conviction in their ideas, but they don't let that seal off opposing evidence.

This is also why great investors talk about risk and reward. It's not just about how much money you could make if you're right... It's also about how much money you could lose if you're wrong. Looking at both sides helps you better know if the potential reward is worth the risk.

Great investors and great decision-makers alike also plan for bad outcomes. That way, they can cut their losses before it's too late.

At Valens Research – the firm that powers Altimetry – a healthy respect for risk along with reward gave us the conviction to recommend one of our best ideas ever...

At Valens Research – the firm that powers Altimetry – a healthy respect for risk along with reward gave us the conviction to recommend one of our best ideas ever...

We started recommending shares of social media titan Facebook (FB) to corporate clients back in 2013. At the time, the stock was trading around $25 per share.

The market was pessimistic about the company. Facebook was struggling to figure out how to make money off its expanding user base.

The company was also unclear if it could successfully make the jump to mobile, as more and more of folks' time was being spent on smartphones.

Considering how dominant Facebook is now, it's strange to think back to that time when the company's platform was almost exclusively a website destination for people on their computers, as opposed to a mobile app.

We could see that if Facebook hit it out of the park on these two big changes, the stock could be a multibagger.

But we also spent an extensive amount of time understanding the downside. What was Facebook's user base worth to someone even if the company never figured out how to monetize it?

This also helped us know what to watch for if things weren't going as we anticipated...

This also helped us know what to watch for if things weren't going as we anticipated...

By evaluating the worst-case scenario along with the upside, we didn't panic when the stock dropped below $23 per share shortly after we first recommended it.

We had confidence this was close to the floor of valuations, since we had our risk and our reward analysis set in stone... And we also knew what the company was really being priced to do.

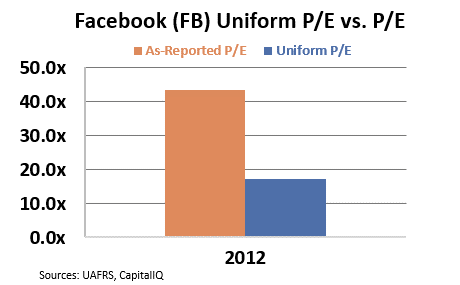

As-reported metrics showed that Facebook had a high price-to-earnings (P/E) ratio of 44 times at the end of 2012, after FB shares had fallen from $40 to $28.

Anyone looking at those numbers thought Facebook was still priced for perfection. If the company had a misstep, those investors believed the stock was set up for an even bigger collapse.

In reality, after looking through the lens of Uniform Accounting, we could see that the company's Uniform P/E ratio was less than 20 times.

The company was trading below market-average valuations. It wasn't priced for perfection at all... It was priced as if the company wouldn't see any real earnings growth. Facebook was priced to fail.

As a result, if the company did fail, we knew the stock couldn't fall much further...

As a result, if the company did fail, we knew the stock couldn't fall much further...

So when FB shares faded toward $20, we didn't panic. We knew the worst-case scenario.

And so we could wait to see if the company succeeded. If it did, like so many high-growth stocks, it warranted a high P/E multiple.

You likely know the rest of the story. Today, Facebook is a roughly $900 billion company. And FB shares currently trade around $315 – up more than 1,100% since we first pitched the stock to our corporate clients.

Because we were able to understand two opposing views at the same time during our research process, we found a more than 10-bagger.

Here at Altimetry, Facebook remains one of our favorite ideas...

Here at Altimetry, Facebook remains one of our favorite ideas...

Early last year, we saw another buying opportunity for Altimetry's Hidden Alpha readers after the stock was punished in the wake of its fourth-quarter earnings report. Our Uniform Accounting data showed the true power of Facebook's return on assets ("ROA")... and how the market was heavily mispricing the stock.

Readers who followed our advice to buy FB shares are up 56% in just over 15 months.

In Hidden Alpha, we leverage our Uniform Accounting data to identify safe stocks like Facebook that still have the opportunity for big gains due to the mispricing created by as-reported metrics. And we just found two new names that are likely to be big winners of the new Internet that's taking over the world.

To learn more about Hidden Alpha – and gain instant access to these brand-new recommendations – click here.

Regards,

Rob Spivey

May 7, 2021

Here at Altimetry Daily Authority, Joel and I have recently emphasized the importance of asking questions...

Here at Altimetry Daily Authority, Joel and I have recently emphasized the importance of asking questions...