The real estate market has permanently shifted, and not just for business...

The real estate market has permanently shifted, and not just for business...

The shelter-in-place orders have led to vastly different experiences for folks across the country. For those who live in outdoor meccas – such as Boulder, Colorado – their experience is distinct from those living in major urban areas.

Residents of a city like Boulder who choose to socially distance can bike, hike, or enjoy other outdoor activities. Across the U.S., for those who live in suburbs, their freedom to enjoy a wide variety of indoor and outdoor activity may be narrower... but they can always step out and enjoy their backyard.

On the other hand, residents of the big cities have seen some of the most dramatic changes from the current crisis. Some are forced to spend their time within 800-square foot apartments. For those living in cities such as New York or San Francisco, apartments can be as small as 400 or 500 square feet. It can be stressful to just venture out of the city, and residents in some buildings are forced to share the same elevator whenever they step outside for groceries or fresh air.

As many employees are realizing the sustainability of working from home, it's no wonder an exodus from the city has begun. Earlier this month, Bloomberg highlighted the severity of this movement out of the cities...

The median rent for an apartment in New York has fallen for the first time in 18 months. Furthermore, apartment inventory has more than doubled over the past three months.

At the same time, demand for homes in suburban centers outside the city is soaring. With a new morning commute of the distance between your bed and your desk, more people are starting to appreciate the ability to enjoy the outdoors.

Scarsdale, a wealthy New York suburb, has seen average sale time fall from 105 days to 60 days. Meanwhile, the Manhattan vacancy rate climbed to 3.67% – a new record for a city that has never seen a rate greater than 3%.

This complete shift of housing demand is yet another example of how the "At-Home Revolution" has disrupted the global economy.

As society changes, certain businesses will be major winners... and that means big upside for their stocks in the months and years ahead. In our Altimetry's Hidden Alpha newsletter, we've identified the companies that are primed to win from this massive shift.

You can gain instant access with a subscription to Hidden Alpha... Learn more here.

Have you changed your living situation since the pandemic started, either for the short term or permanently? Send an e-mail to [email protected] to let us know.

'Asset light' business models have become increasingly popular over the past few years...

'Asset light' business models have become increasingly popular over the past few years...

Venture capitalists and angel investors love the asset-light model. There's a small initial investment needed before finding out if a business is profitable. Plus, asset-light businesses can grow at a faster pace, since they don't need to get access to as much capital as they scale because of the nature of the business.

Fast-food giant McDonald's (MCD) is the poster child for a successful asset-light business model. It keeps the intellectual property with the parent company and pushes expansion to its franchisees. This model has allowed McDonald's to grow to more than 38,000 stores worldwide.

In the ride-sharing industry, companies like Uber (UBER) or Lyft (LYFT) also have few assets on the books, as drivers with their own cars are considered independent contractors. Uber's and Lyft's low asset base allowed for expansion to new cities at a breakneck pace.

Venture capital firms pour money into asset-light startups. They bet on the expansion potential and the idea that an asset-light strategy would drive these companies to reach economies of scale.

The hotel industry is also moving towards this asset-light franchising model, with large parent companies outsourcing the daily operations to franchise owners. As discussed last week, Marriott (MAR) was the pioneer of this business strategy and currently has more than 7,000 hotels worldwide – many of them franchised.

But some industries are inherently asset-intensive... with returns that tend to regress back to cost-of-capital levels. Steel mills, real estate investment trusts ("REITs"), and utilities are all asset-intensive businesses that are difficult to differentiate from each other. The hospital industry is another example of this type of industry, as these operations offer the same acute care options with little variation.

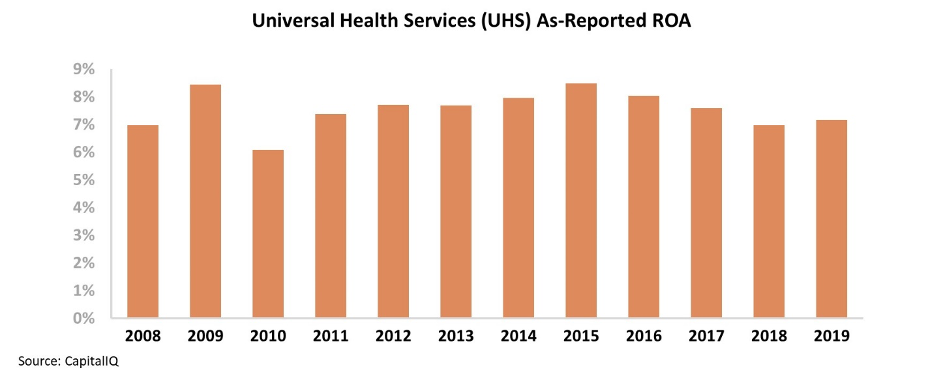

There's little a company can do to stand out that will actually lead it to returns in excess of industry averages. For example, by only looking at as-reported metrics, Universal Health Services (UHS) is a hospital that appears to suffer the same fate as other asset-intensive businesses. The company's as-reported metrics show returns just barely above cost of capital.

Universal Health Services' return on assets ("ROA") has remained relatively stagnant since 2008 – implying that the company is simply another boring, acute care hospital.

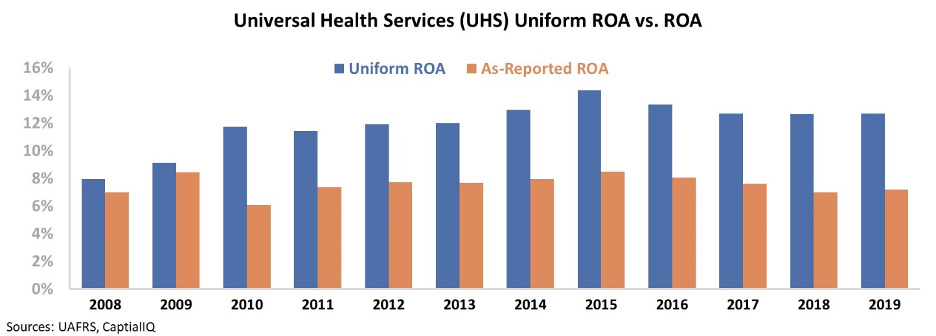

However, this picture of Universal Health Services' performance is only an illusion, propped up by the distortions in as-reported accounting. Due to the GAAP treatment of acquisitions and other accounting issues, the market has missed an important shift...

In 2010, Universal Health Services made a $3 billion acquisition of Psychiatric Solutions to fully dive into the behavioral health segment.

This means that Universal Health Services has managed to differentiate itself from its peers, as it focuses on behavioral health care as opposed to the standard acute care. By focusing on a less populated area of the market – and in a less asset-intensive business – Universal Health Services has been able to generate higher returns.

In reality, Universal Health Services' Uniform ROA has grown from 8% in 2008 to 13% last year, as the company continued to invest and profit from its differentiated business model. Take a look...

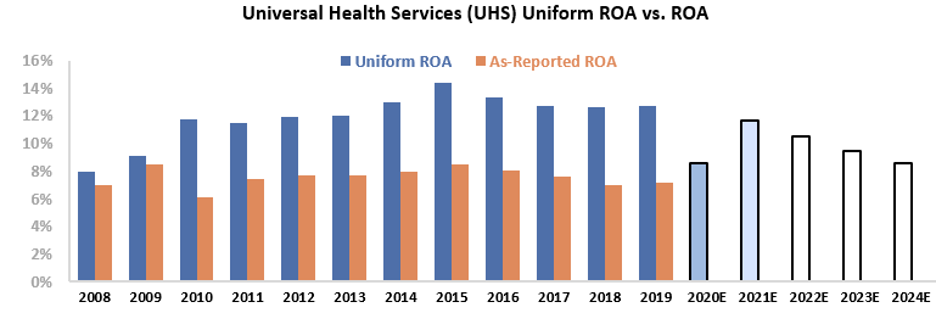

Due to this distortion, the market has unreasonably bearish expectations for Universal Health Services going forward. We can measure the market's expectations by using our Embedded Expectations framework.

The chart below shows Universal Health Services' historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, while analysts expect returns to remain near current levels in 2021, the market expects returns to slide back to 9% by 2024.

Market expectations are pricing returns to regress to the average asset-intensive hospital level, because as-reported metrics have missed Universal Health Services' transformation. With a change in strategy, the company is no longer a normal hospital business.

Uniform Accounting shows the strength of Universal Health Services' returns since focusing on this new strategy – highlighting how the company is a more sustainable business than as-reported metrics show.

Once the market catches up with the reality, Universal Health Services will likely then be priced above an average hospital.

Regards,

Joel Litman

July 30, 2020

The real estate market has permanently shifted, and not just for business...

The real estate market has permanently shifted, and not just for business...