Many positive habits have been built during the coronavirus pandemic... but some negative ones have managed to slip through the cracks.

Many positive habits have been built during the coronavirus pandemic... but some negative ones have managed to slip through the cracks.

It has been almost a full year since many folks went regularly into the office for work. Given this extended length of time, new habits from the pandemic have had the opportunity to become entrenched.

Many folks have established positive and healthy habits during this time, such as getting additional sleep. However, a few bad habits have become the norm as well...

As The Economist recently explained, reports of employees working significantly beyond their normal work hours have doubled over the past year. Additionally, the amount of time spent in digital meetings has become a significant suck on both employee and management workload.

Of course, some positives have come about from the work-at-home environment. The most obvious is the mental health benefit of avoiding longer commutes to work.

Another positive is the new level of flexibility that businesses allow their workers.

It's no longer necessary to have employees working from 9 a.m. to 5 p.m. every day. Companies have become more accepting of folks who are dealing with obligations outside of work, such as tending to their families and kids for a portion of the day. Now, the baseline revolves around if an employee is still able to get their work done on time, not their "face time."

One big part of the "At-Home Revolution" is the fact that working at home for a least a part-time "hybrid" schedule will be here to stay long after the pandemic recedes.

As how and where we work changes, folks can only hope we do a better job of keeping up the positive habits that have emerged... while we learn to mitigate some of the bad ones going forward.

Positive habits from the pandemic have translated to increased importance for one company's product...

Positive habits from the pandemic have translated to increased importance for one company's product...

Chat tools have been one method for folks to keep communication lines open without perpetual Zoom calls. This is helping employees keep in touch with co-workers as people may not all be at their desks at the same time, given the more flexible work environment.

One of the most popular platforms used for this type of communication is Slack (WORK). Back in November, we explained how the company has been able to turn increased demand for its product into higher levels of profitability.

Then, in December, software giant Salesforce (CRM) announced plans to acquire Slack.

Salesforce recognized that in a more remote-intensive world, Slack's value proposition of helping folks balance communication and gain immediate access to co-workers online has become critical.

This platform's ability to facilitate quick contact with colleagues – as opposed to scheduling 30-minute blocks on a calendar – can help Salesforce solve the communication puzzle companies are struggling with.

Considering how significant the acquisition is, it's useful to understand what Salesforce believes Slack is capable of...

Considering how significant the acquisition is, it's useful to understand what Salesforce believes Slack is capable of...

Even though the transaction hasn't officially closed yet, Salesforce has agreed to pay $28 billion, or $46 per share for Slack. That's a big investment.

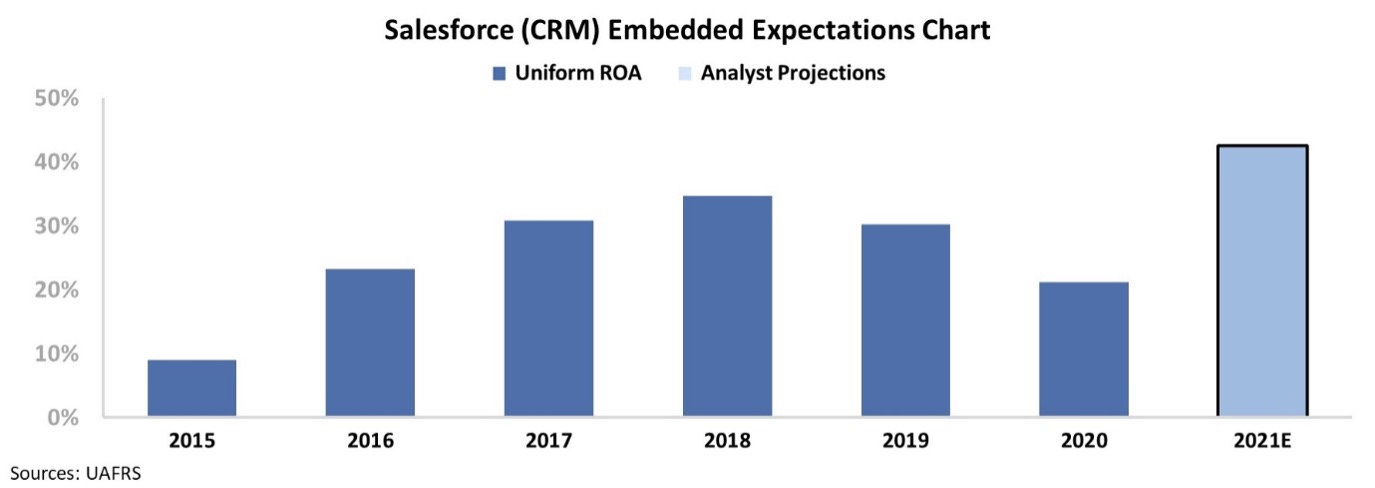

For Salesforce, the company has a Uniform return on assets ("ROA") of 21%. This figure is lower than it has been the previous few years... But returns are expected to recover strongly in 2021 – jumping to 43%.

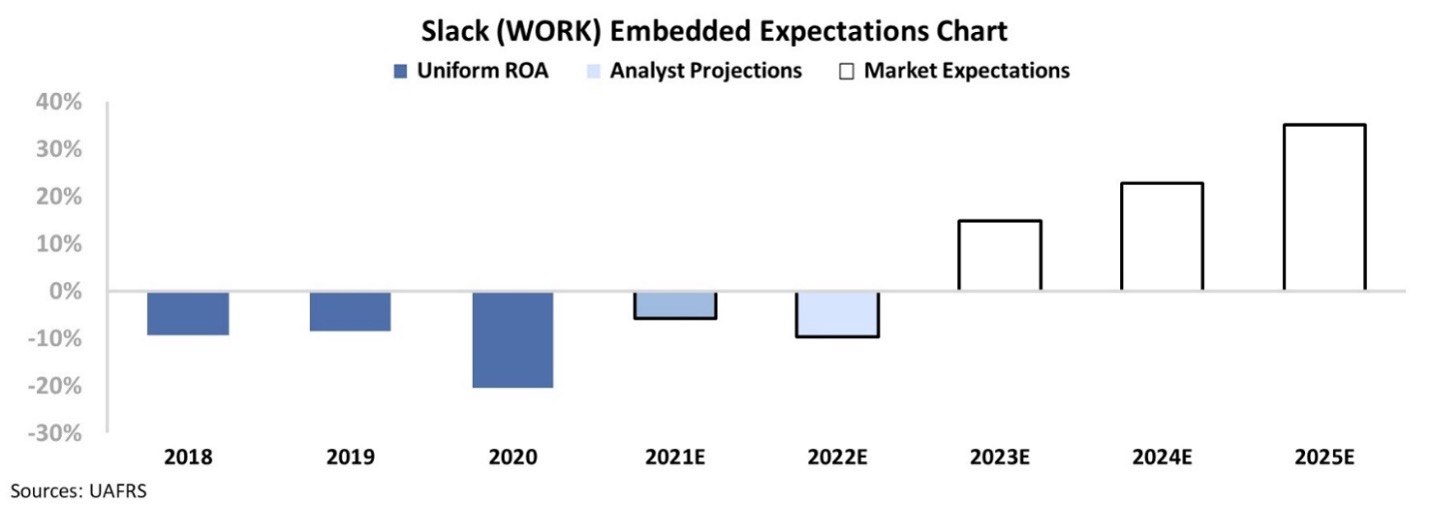

For Slack, we need to start understanding what the company would have to do to justify a $46-per-share valuation. Using our Embedded Expectations framework, we can see how Slack has performed and what the market is pricing it to do.

At $46 per share, Slack needs to see its ROA expand to 35%, which would be well above normal historical levels for Salesforce. It would also be record profitability for Slack, with the firm not having seen positive returns since its initial public offering ("IPO").

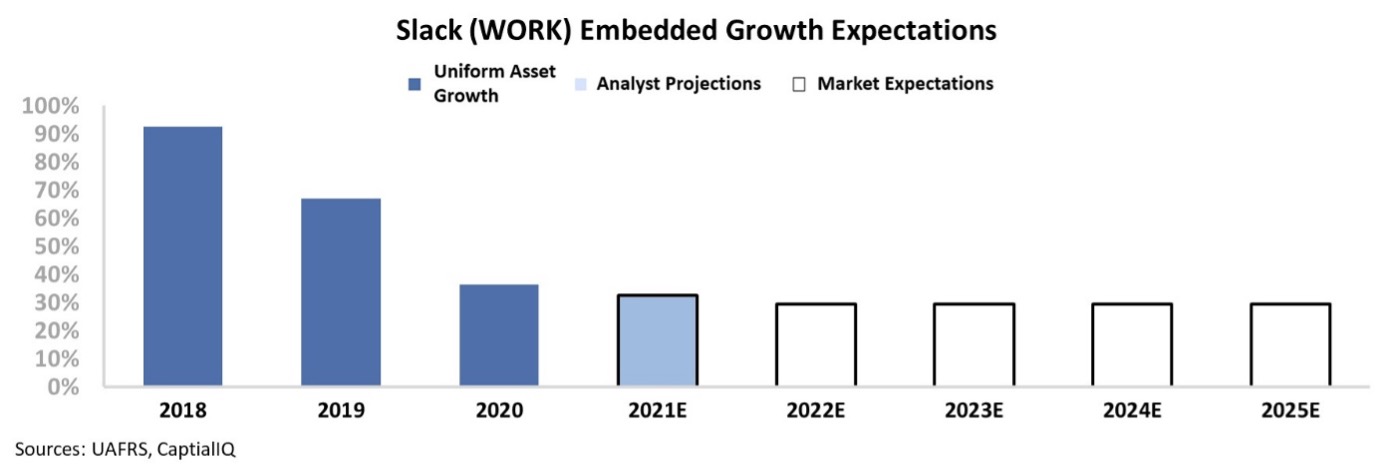

Additionally, Slack would need to match these returns with 30% asset growth annually. This means that Slack would double in size approximately every two years.

This is an aggressive expectation, as companies traditionally see growth slow down as they keep selling to more and more of their total addressable market ("TAM"). Right now, the market is pricing growth to remain steady, even as it becomes harder for Slack to grow at the same pace...

Altogether, to get its money's worth in the upcoming acquisition, Salesforce is betting that the continued surge in the At-Home Revolution will be a huge boon for Slack's growth and that the societal shift will revolutionize the platform's profitability.

Without Uniform Accounting, it would be impossible to determine whether Salesforce is paying a reasonable price for Slack. Now, we can understand the high hurdle Salesforce is expecting Slack to jump over to make back its initial investment... and consider that Salesforce might be expecting too much.

Regards,

Rob Spivey

February 10, 2021