For years, investors have credited share buybacks with aiding market rallies...

For years, investors have credited share buybacks with aiding market rallies...

However, as the Financial Times reported last month, repurchases have been cut in half for S&P 500 companies since the beginning of the coronavirus pandemic. Management teams were worried about a potential liquidity crunch in March... so to save cash, many of them paused share buybacks.

And yet, both the Nasdaq Composite Index and S&P 500 have recently reached all-time highs. Clearly, the 2020 rally has been driven by something other than share buybacks. To understand what drove the last market rally, we can turn to Uniform Accounting.

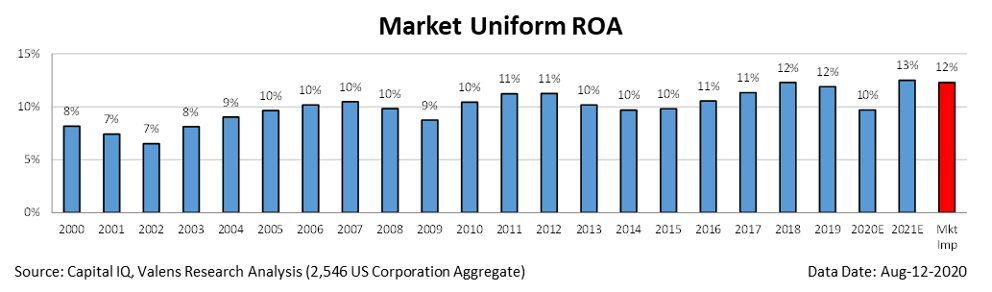

UAFRS metrics show that the market was able to achieve its 10-year bull market thanks to a consistent and improving aggregate corporate return on assets ("ROA"). The market's overall Uniform ROA fell to a low of 9% in 2009 in the wake of the financial crisis, but since then, Uniform corporate returns have sustained levels of at least 10%... and have steadily improved to 12% the past two years. Take a look...

Additionally, U.S. corporate returns are forecast for a swift recovery to a 13% ROA next year... even without buybacks.

Share buybacks clearly aren't driving the market higher – corporate fundamentals are.

Earlier this month, Altimetry Daily Authority reader Tim asked how our analysis considers share repurchases and the minting of new shares...

Earlier this month, Altimetry Daily Authority reader Tim asked how our analysis considers share repurchases and the minting of new shares...

As share buybacks are one of the most misunderstood tools in a company's "tool box," it's important to understand when they create value... and when they destroy it.

Back in November, we first addressed what share buybacks are, and how the math works out for investors. Today, let's revisit the topic to understand when management teams should undergo buyback programs.

According to the conventional thinking, share repurchases are positive for investors. However, this depends on when the underlying company buys shares back. Sadly for investors, most companies aren't good at timing...

Management teams often choose to announce large share buybacks when their companies' share prices are soaring higher. These are the times when the business usually has cash in its pocket... and management is bullish and wants to support the elevated share price, even if it isn't getting a good deal by buying.

So it feels ironic so many companies paused share buybacks in the midst of the pandemic, with so many stocks having plummeted. Much of the reason why firms would have been low on cash is because they spent much to buy their own stock at much higher prices during the boom times.

One famous executive who was able to realize this hypocrisy was Henry Singleton. Singleton co-founded Teledyne Technologies (TDY) in 1960 and served as CEO for three decades.

Warren Buffett once said Singleton had "the best capital deployment record in American business"... and one of Singleton's most important strategies was his treatment of share buybacks.

Singleton knew when to buy back his company's stock and when to use it as currency. He consistently bought back Teledyne's stock for a discount when shares were trading for depressed prices. And when the company's stock was high, instead of buying back shares, Singleton would use the stock as a currency to make acquisitions.

His story is one of the few times the phrase "share buybacks are good for investors" consistently rings true. This is because repurchases are usually only a positive when the stock is undervalued. If a management team uses $50 to buy a share of the company's stock when the inherent value is $100, it has created value for shareholders.

On the other hand, many management teams buy back shares when they're possibly overvalued. This means the management team is buying a share for $50 when it's really only worth $40. That means the company is destroying value for investors.

Deciding if share buybacks are beneficial isn't a one-size-fits-all issue... It's all about the context of the company stock valuation during a repurchase.

Either way, when the company buys back shares, this lowers the share count. Decreasing the share count of an undervalued company will mean the remaining shares are more undervalued... But decreasing the share count of an overvalued company will mean the remaining shares are more overvalued.

Another aspect of Tim's question was how our analysis deals with stock-based compensation for management...

Another aspect of Tim's question was how our analysis deals with stock-based compensation for management...

Uniform Accounting treats shares given to management differently than GAAP does.

When management is issued stock-based compensation, we create an incremental claim on the company's enterprise value ("EV"). We essentially turn that stake from management into a debt-like liability for the company, that comes before shareholders. As we've mentioned before, we always look at EV, as this is the sum of total outside claims from debt, equity, and other stakeholders. It's a holistic way of looking at corporate valuations.

We alter the EV for any stock-based compensation management received that isn't yet in diluted shares outstanding, and that currently has value because the options are "in the money." This means that the options' "strike price" – the price management has the option to buy at – is below the stock's current share price... so the options have intrinsic value.

This helps us represent a real claim on the business. It also allows us to properly reflect how high valuations actually are for a company when those claims are taken into account.

Overall, it's important to understand the positive or negative implications of share buybacks and share compensation. It's commonly taught that share buybacks are a positive and share compensation are dilutive for investors. However, context is key... and Uniform Accounting helps us see that context.

Regards,

Joel Litman

September 21, 2020

For years, investors have credited share buybacks with aiding market rallies...

For years, investors have credited share buybacks with aiding market rallies...