Over the past couple weeks, we've received a number of questions about something that's becoming increasingly popular in the markets...

Over the past couple weeks, we've received a number of questions about something that's becoming increasingly popular in the markets...

As we explained in the November 11 Altimetry Daily Authority, this controversial method of capital allocation is "a battleground for politicians and economists alike."

Readers were curious not only about what it says about general economic conditions, but why companies use this strategy at all. With so much feedback, we wanted to talk more about this complex topic.

Of course, we're referring to share buybacks...

One reader brought up a common question about buybacks that many folks have echoed over the past two weeks, and it's one that our institutional clients have asked for years...

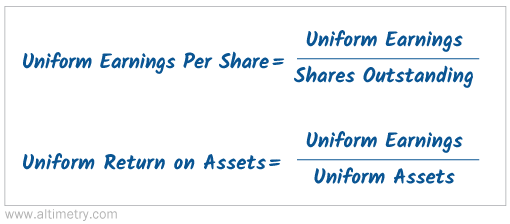

Mathematically, share buybacks will improve key financial ratios, such as return on assets ("ROA") and earnings per share ("EPS")... So why did we say the strategy doesn't raise a company's stock price over the long term?

While buybacks do improve EPS and ROA, they do not drive any improvement in operations. The cash from the buybacks has to come from somewhere... either the company's balance sheet or debt.

If it comes from the balance sheet, it probably comes from excess cash the company has beyond its operating obligations. If the cash comes from debt, that's a new obligation the company has on its cash flows... The business is just doing a leverage recapitalization instead of creating any value.

The EPS metric will improve because shares outstanding have shrunk. But operating ROA (or Uniform ROA) will only improve if the company has reduced its total operating assets to pay for the repurchasing.

If cash used to buy back shares was already higher than operating cash, the algebra makes no difference.

As you can see below, in the first metric we have definitely decreased the number of shares outstanding. In the second, we may decrease or not decrease Uniform assets. In either scenario, we leave Uniform earnings unchanged.

While many people fixate on higher EPS in a share buyback, the rise in EPS is not because of increased profitability... It is because people own a bigger piece of the same company. Similarly, ROA stays flat if the buyback was funded by non-operating cash flow, or at best it rises as operating assets are reduced. Either way, the value creation of the company hasn't changed.

So what does this all mean?

Share buybacks are a wash. While investors now own a greater share of the company after the buyback... the company's operating assets have been reduced by the same amount, or the ownership increase is offset by a decline in non-operating assets.

However, while most buybacks do not create value, this is not always the case.

If a company's stock was overvalued before the buyback, then the business has likely erased value.

But the reverse can hold true as well. A company could create value by purchasing its shares before prices moved higher. If a company repurchased shares while they were undervalued, then the stock would be worth more after a share buyback. In that scenario, a company has profited off its reinvestment in its own shares and created value for shareholders.

But this value is minuscule. Let's say Company A was to buy back a record number of shares: 10% of its shares outstanding. Let's also assume that the share price was significantly undervalued by a whopping 30%.

If Company A was going to enact this aggressive buyback, it would unlock an undervalued situation in its stock of 3%. That's 10% of the stock bought back at a 30% discount.

However, even in this situation, Company A would never see 3% appreciation automatically from the buyback. As it is buying back shares, the rapid increase in demand means the stock price will appreciate to its fair value before Company A could purchase all 10% of the shares outstanding.

As most buybacks are likely executed while the stock is at fair market price, in general there is no value created through a share repurchase. While the announcement itself might increase the share price due to positive sentiment, be wary purchasing of this stock – the underlying company has not improved.

So the next time that you hear, "You should buy this stock after the buyback because the company's EPS has gone up," you'll know what the math really says.

This company just crushed earnings, but investors weren't impressed...

This company just crushed earnings, but investors weren't impressed...

In the September 19 Daily Authority, we highlighted tax-software firm Intuit (INTU). We discussed not only how impressive the company's returns are, but how high investor expectations are, too.

On Thursday, Intuit reported impressive quarterly earnings. Analysts had expected EPS of $0.25, and the company came in with $0.41 – a massive 64% beat!

But the stock dropped like a rock on Friday, falling roughly 5%. The company didn't raise its guidance even after the strong quarter, which partially contributed to the drop.

More importantly, the drop highlights how the market was already pricing Intuit to continue to see massive improvement in its profitability. With management saying the outperformance it saw for this quarter isn't going to carry forward, the market was disappointed.

Understanding what the market is pricing a company to do is as important as understanding how good that company's performance actually is. But you can only do that if you first get the numbers right...

Regards,

Joel Litman

November 25, 2019

Over the past couple weeks, we've received a number of questions about something that's becoming increasingly popular in the markets...

Over the past couple weeks, we've received a number of questions about something that's becoming increasingly popular in the markets...