The economy is coming apart at the seams...

The economy is coming apart at the seams...

To see what we're talking about, look no further than bankruptcy lawyers. As default rates rise, law firms with big restructuring practices are having a good time.

Take New York City-based White & Case. The firm's restructuring unit is on track for record revenue this year. Chicago-based Kirkland & Ellis just picked up the massive WeWork restructuring case.

According to credit-ratings agency Moody's, the global default rate for high-yield debt rose to 4.5% in September... surpassing the 4.1% average. In the U.S., the default rate is sitting at 4.9%.

Moody's thinks things are only going to get worse from here. It expects the U.S. default rate to rise to at least 5.4% by January.

That's a pretty bleak forecast. But investors haven't really caught on yet. Today, we'll examine a hidden investment opportunity as the market buries its head in the sand...

When the economy starts to falter, 'riskier' companies are the first to fall...

When the economy starts to falter, 'riskier' companies are the first to fall...

Typically, these businesses' cash flows are less predictable... they have fewer assets to offer up as collateral... or they're just smaller with less borrowing history. They tend to struggle when interest rates are high.

So far, 118 U.S. corporations have defaulted in 2023. That's almost double last year's total. And when companies are going bankrupt, the market panics.

Stocks sell off... and so do bonds.

In particular, folks sell out of high-yield bonds – debt issued by those riskier companies – in droves. They lose faith in these companies' ability to stay solvent as their peers default.

Investors are right to be worried... to an extent. A recession is on the way. But as so often happens, they're overreacting. Moody's projects that in the coming downturn, 14% of companies will default at most.

That still leaves 86% of companies alive and well.

Panic-selling is hard on the stock market... But it's great for bond investors.

Panic-selling is hard on the stock market... But it's great for bond investors.

Bonds are a legal contract. As long as the company doesn't go under, you lock in your return when you buy in.

Remember, bond prices and yields are inversely related. Investors demand extra compensation for bonds they deem more likely to default. So when the bond market dashes for the exits and prices drop... your potential yield soars.

It's an opportunity to get stock-like returns with much less risk.

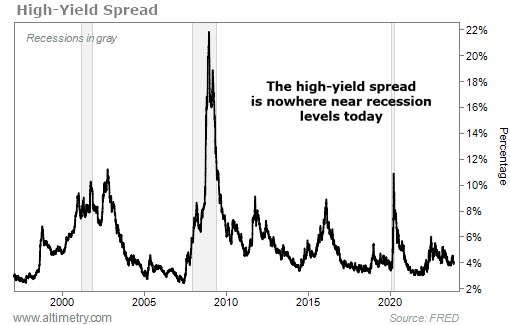

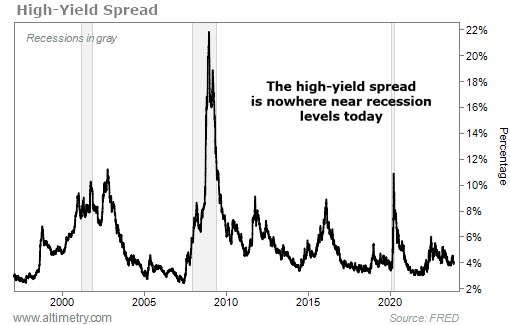

We can measure fear in the bond market using the high-yield spread. It's the difference between the yield on high-yield bonds and the yield on U.S. Treasury bonds maturing around the same time.

As you can see in the following chart, the high-yield spread spiked during the past three downturns – early in the pandemic, the Great Recession, and the dot-com bubble.

It rose to at least 7%, on average, each time...

Every time defaults rise, so does the high-yield spread. Only, that hasn't happened yet today... It's currently sitting around 4%.

We don't expect investors to remain this calm for long...

We don't expect investors to remain this calm for long...

As more high-profile companies go bankrupt, the market will be forced to face the facts. And with banks less willing to lend, more defaults will start popping up soon.

Credit investors tend to be more risk-averse than stock investors. Said another way, the credit market often acts as an early warning bell. We'll likely start seeing bonds sell off before the stock market does the same.

If all your money is in stocks right now, it's time to reconsider your approach. Equities are in for a bumpy ride... But savvy investors will use high yields in the bond market to their advantage.

Regards,

Rob Spivey

November 27, 2023

The economy is coming apart at the seams...

The economy is coming apart at the seams...