We knew WeWork's (WE) days were numbered when the free beer disappeared...

We knew WeWork's (WE) days were numbered when the free beer disappeared...

When Adam Neumann co-founded the real estate company in 2010, he didn't call it a real estate company. He called it a tech business.

For years, Neumann treated WeWork like a high-profile startup. And for years, people bought what he was selling. WeWork's co-working spaces offered everything from yoga and kickboxing to foosball... and yes, even beer on tap.

The company filed to go public in 2019 at a whopping $47 billion valuation. Its filing mentioned "technology" 110 times.

However, the more investors dug in... the less appealing the financials became. WeWork was losing about $1 billion per year. Neumann hadn't offered any sort of concrete turnaround plan. Investors started to ask questions about his business dealings and behavior.

By the time the company actually went public in 2021, its valuation had dropped to $9 billion. It had already cut almost 20% of its global staff.

And of course, most important of all, it had scrapped its free beer and wine offerings.

All jokes aside, regular readers know we've been following WeWork's downward plunge for a long time. Now, two years after going public, the company has finally filed for bankruptcy.

WeWork never figured out how to structure itself like an actual tech company... and it wasn't great at real estate, either. So this bankruptcy doesn't come as a huge surprise. In fact, we're surprised the company hung on for as long as it did.

The problem isn't that a business living on borrowed time finally fell apart. WeWork's demise is likely the first in a string of real estate bankruptcies. And as we'll explain, that should have investors concerned for the broader economy.

WeWork wanted tech valuations with a real estate business model...

WeWork wanted tech valuations with a real estate business model...

The larger tech companies get, the more profitable they tend to become. Software and hardware cost a lot up front... and a lot less for each unit sold down the line.

For instance, it costs almost nothing for software giant Microsoft (MSFT) to sell another license for its Microsoft 365 suite. It has already developed the programs and established the necessary infrastructure.

Real estate companies don't have that luxury. For each new property they acquire, they have to pay more in rental or interest expenses.

That's why tech companies get way higher valuations. The average tech company's Uniform price-to-earnings (P/E) ratio is about 20 times – right in line with the corporate average. Real estate companies trade for around 15 times earnings, on average.

And it didn't matter how hard Neumann pushed the fun tech-firm atmosphere... WeWork was nothing but a real estate business.

Its income statement didn't show a single dollar spent on research and development. Instead, its two biggest costs were rental expenses and interest.

That's why its initial attempt at going public failed miserably. Once investors realized WeWork was nothing but a puffed-up real estate business, nobody was interested in buying it at a $47 billion valuation.

Like many other real estate companies, rising interest rates made it much harder for WeWork to operate...

Like many other real estate companies, rising interest rates made it much harder for WeWork to operate...

Its interest expenses exploded from $100 million in 2019 to more than $500 million last year... and its revenue fell by about $200 million.

That was enough to doom the business.

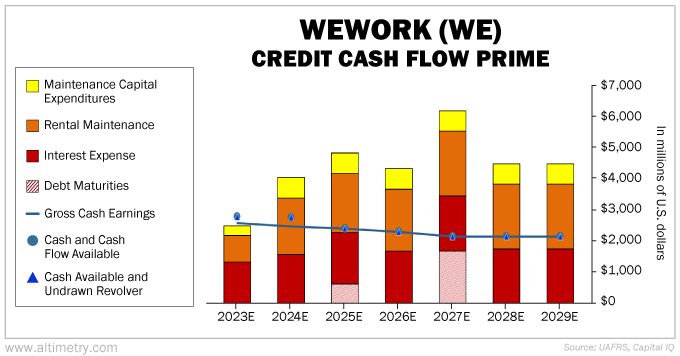

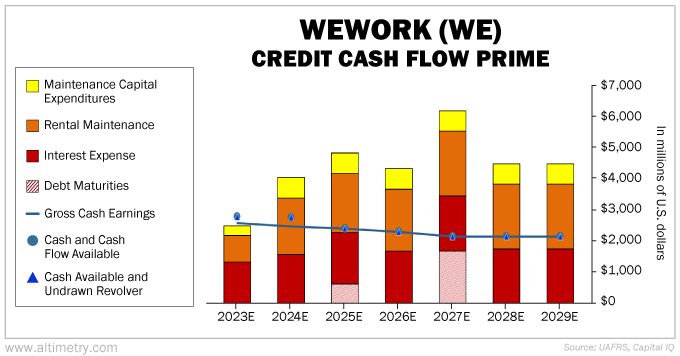

We can get a better look at WeWork's troubling debt picture through our Credit Cash Flow Prime ("CCFP") analysis.

The CCFP gives us a more accurate sense of a company's overall health. It compares financial obligations against cash position and expected cash earnings.

In the chart below, the stacked bars represent WeWork's obligations through 2029. This is what it would have needed to pay in order to keep the lights on... to prevent the company from collapsing.

We compare these obligations with cash flow (the blue line) and cash on hand at the beginning of each period (the blue dots).

Starting next year, WeWork wouldn't have been able to afford rent on a good portion of its properties. Take a look...

Rental maintenance isn't a flexible expense. If WeWork doesn't pay its rent, it loses its real estate – and its revenue.

That would only make it harder to generate enough cash to pay down its debt, interest, and other rental expenses.

Said another way, WeWork had no clear path forward...

Said another way, WeWork had no clear path forward...

And unfortunately, it's not alone.

Just yesterday, we mentioned that a lot of companies won't have enough cash for all their obligations starting next year.

That's going to lead to a rise in bankruptcies... and we believe the real estate sector could lead the charge.

As you might expect, plenty of real estate companies look like WeWork. Now that one major bankruptcy has been announced, investors will start looking at the rest of the sector under a magnifying glass.

We warned back in September that Hudson Pacific Properties (HPP) could struggle to pay its debts next year. The stock is down 27% since then. If the company doesn't get help fast, it could be next.

So don't write off WeWork as a one-off failure. It will likely be the first of many real estate companies to throw in the towel in the coming quarters.

Stay far away from the sector for now – each new bankruptcy announcement will put more strain on valuations.

Regards,

Joel Litman

November 14, 2023

We knew WeWork's (WE) days were numbered when the free beer disappeared...

We knew WeWork's (WE) days were numbered when the free beer disappeared...