We're already midway through a recession... at least, according to one indicator.

We're already midway through a recession... at least, according to one indicator.

But the reality might not be so clear.

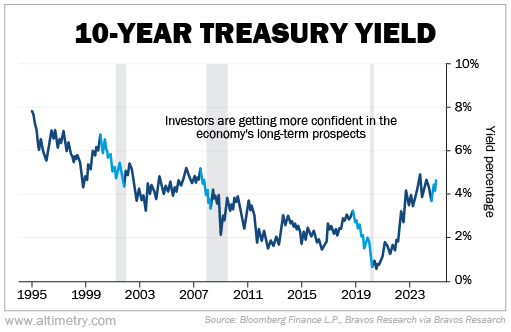

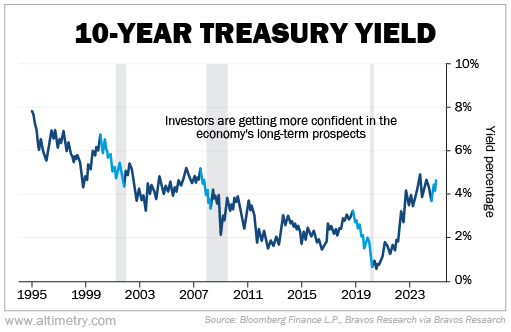

Earlier this month, the 10-year/three-month spread finally normalized for the first time since late 2022.

It's a good sign for many reasons. It's also a surprising sign.

That's because this yield curve "uninversion" looks different from the past three... which took place during the dot-com bubble, the Great Recession, and the pandemic.

And the difference could mean a big boost for the economy in 2025.

If you need a refresher, the yield curve measures interest rates of U.S. Treasury bonds over various time horizons...

If you need a refresher, the yield curve measures interest rates of U.S. Treasury bonds over various time horizons...

Normally, longer-dated bonds have higher rates because there's more uncertainty that far out. A normal yield curve means that investors are optimistic about the immediate future.

An inverted yield curve is when short-term bond interest rates climb above long-term interest rates. It shows the market believes the economy will be worse in the short term than in the long term. That's why it tends to indicate a looming recession.

And when it uninverts, it's usually because the three-month Treasury yield plunges faster than the 10-year yield. Said another way, it's because investors are betting on the economy slowing down.

This time, though, the yield curve uninverted for a unique reason. The 10-year Treasury yield is rising instead of falling.

Take a look...

Investors aren't simply less pessimistic about the economy's long-term prospects than its short-term prospects. They're regaining confidence.

That should translate to economic growth.

As is so often the case in the economy... it all comes down to credit.

As is so often the case in the economy... it all comes down to credit.

You see, banks make money by lending long and borrowing short. When they borrow money – typically in the form of deposits from individuals and businesses – those depositors can take out their money immediately. In exchange, banks only have to pay a tiny amount of interest.

And they lend that money out by issuing loans that typically last multiple years. By taking on the risk of not getting that money for years, they're able to charge higher interest rates.

This works as long as banks can make more money on interest than they have to give out. But when the yield curve is inverted, like it has been for more than two straight years, the story changes. It costs more to borrow short than to lend long.

Put simply, banks can't make money.

So they close up shop and wait for better conditions to make loans. This starves the economy of credit... which slows it down, exactly as the market predicted in the first place.

Now that the 10-year yield is rising, banks can once again borrow short and lend long...

Now that the 10-year yield is rising, banks can once again borrow short and lend long...

That means a lot more money for banks... which means they can issue a lot more loans... which means companies can once again invest in their operations.

Folks, back in December, we covered how banks are on the cusp of loosening lending standards. With the 10-year yield moving higher, the economy has even more reason to keep growing for the foreseeable future.

Increased bank lending should help support investment in areas like supply chains and AI innovation.

Barring a negative catalyst, this is the recipe for a great year in 2025... turbocharged by all that bank lending.

Regards,

Rob Spivey

January 27, 2025

We're already midway through a recession... at least, according to one indicator.

We're already midway through a recession... at least, according to one indicator.