When expectations rise, incentives take over...

When expectations rise, incentives take over...

Geothermal is in the spotlight again. And Ormat Technologies (ORA) has become a clean-power favorite.

As we discussed yesterday, investors expect the company's profitability to double by 2029... An 8.3% Uniform return on assets ("ROA") would also mark a new all-time high.

Now, management needs to make it happen. But that's easier said than done... given Ormat's compensation structure.

Analysts are watching management's every move. And right now, we don't think it's prioritizing geothermal enough. As we'll explain, that's a risky setup for long-term investors.

Management shows us how 'incentives dictate behavior'…

Management shows us how 'incentives dictate behavior'…

The concept is simple... Management does exactly what it's paid to do.

Unlike most salaried employees, executives of public companies have multiple sources of compensation. (The Definitive Proxy Statement, or DEF 14A, breaks all of this down.)

These folks have an annual salary, but they also get performance-based pay. Some of these cash awards are based on annual performance targets. The largest payouts usually come from long-term stock compensation.

For Ormat's executive team, stock awards formed at least half of each director's compensation in 2024.

The company's board of directors – specifically the compensation committee – decides what management must do to receive extra compensation.

Short-term awards are based on revenue and adjusted earnings before interest, taxes, depreciation, and amortization ("EBITDA"). Both metrics encourage management to grow the business.

That's not a bad strategy when energy demand is sky-high...

That's not a bad strategy when energy demand is sky-high...

However, in the long term, Ormat's management is paid for two things: stock performance and new megawatts ("MW") of power.

Every manager wants their company's stock to perform well. And it would seem like adding MW is a good thing... no matter where the power comes from.

But there's a big difference between batteries and geothermal plants... It only takes a few days to install batteries, while it takes years to build geothermal plants.

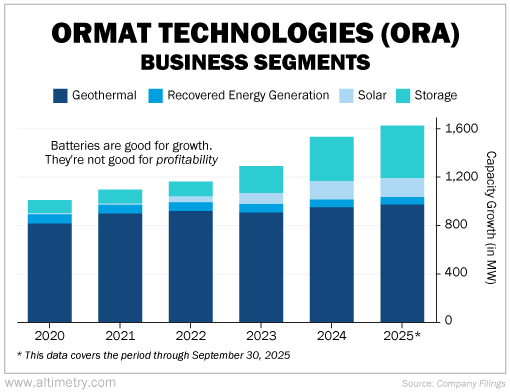

For Ormat's management, the choice is obvious. And since 2024, battery storage has been its biggest growth driver. Take a look...

As battery storage ramps up, though, Ormat risks losing its competitive edge...

You see, there are only a few major geothermal players out there. Yet there are plenty of battery-storage initiatives. Everyone from energy-storage provider Fluence Energy (FLNC) to electric-vehicle giant Tesla (TSLA) has a battery segment.

Ormat currently has 350 MW of installed battery-storage capacity. NextEra Energy (NEE) – the world's largest electric utility holding company – manages over 3,600 MW of battery storage... That's more than 10 times the size of Ormat's fleet.

This level of competition means battery storage is less profitable than geothermal. That's part of why Ormat's Uniform ROA has fallen in recent years.

Yet management will continue installing batteries...

Yet management will continue installing batteries...

As long as MW are part of the company's compensation plan.

Ormat will reap short-term rewards as it racks up more MW. But a focus on battery storage will limit returns in the long run.

Investors would realize this if they took the time to look at Ormat's DEF 14A... It details how management is paid... and whether the compensation focuses on the right issues.

Geothermal is clearly the better future bet. But the market still expects returns to skyrocket via battery storage.

You can beat the market by focusing on Ormat's compensation plan... to distinguish between growth and profitability. And that can put you light-years ahead of other investors in any industry.

Regards,

Joel Litman

January 30, 2026

When expectations rise, incentives take over...

When expectations rise, incentives take over...