Geothermal energy has gone under the radar for years...

Geothermal energy has gone under the radar for years...

Wind is a much larger market. And solar gets a lot more attention from investors.

But energy demand is growing faster than ever around the world. And extreme weather patterns have revived concerns over climate change.

Geothermal technology can tackle both issues.

Take Octavia Carbon – a startup that set up shop in Kenya's Great Rift Valley... The company is harnessing geothermal resources to remove carbon dioxide from the atmosphere.

It's one of about 150 companies using direct air capture ("DAC") technology to help clients achieve zero emissions and leverage renewable energy.

It's a vivid reminder that geothermal technology has wide applications... and is quickly becoming an investable market. At the same time, it's still a growing sector. So investors need to temper their expectations.

The technology is showing up at exactly the right time...

The technology is showing up at exactly the right time...

Data centers are gobbling up more than 4% of all the energy on the U.S. grid... Winter Storm Fern just caused natural gas prices to skyrocket 75%... And global industries produced a record 37.8 billion metric tons of carbon dioxide in 2024.

Geothermal resources can boost the world's clean-energy supply because they're far more predictable than sun or wind. In addition, power plants and heat-pump systems last for decades. That's what makes geothermal similar to nuclear power... another top energy priority.

In addition, companies like Octavia Carbon are building and scaling DAC technology to reduce carbon more quickly and efficiently.

Geothermal's steadiness, durability, and scalability make it the energy "sweet spot." And it's driving geothermal companies, big and small...

Ormat Technologies (ORA) is one of the largest pure-play geothermal operators in the world...

Ormat Technologies (ORA) is one of the largest pure-play geothermal operators in the world...

It has about 200 power plants, which cover geothermal, recovered energy generation ("REG"), and related infrastructure. (REG captures unused heat from industrial processes and converts it into electricity.)

This past year, multiple Wall Street analysts (including those at Baird and Piper Sandler) have upgraded Ormat to a "buy." That's largely because data-center operators and U.S. politicians are pushing for more geothermal capacity.

And investors have taken notice. Ormat's stock has risen sharply... 103% since February 2025. It's now approaching a double, as the market warms up to reliable clean energy and carbon reduction.

That move invites a simple narrative... Geothermal players will be big winners. And Ormat fits that script well. It also reflects opportunities in smaller players like Octavia Carbon.

However, investors may be getting ahead of themselves...

However, investors may be getting ahead of themselves...

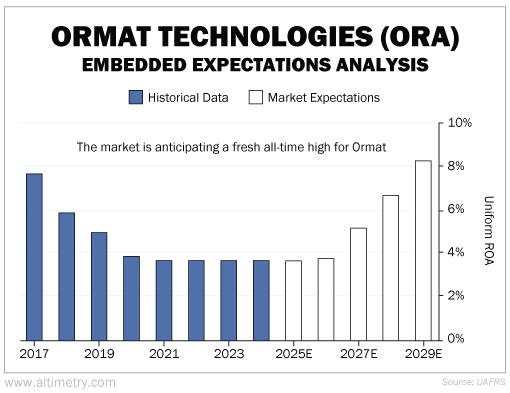

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Back in 2017, Ormat generated an all-time-high Uniform return on assets ("ROA") of 7.7%. And then returns fell to just below 4% for five years straight.

Yet, investors are pricing in a strong recovery. They expect Ormat's Uniform ROA to surge to a new high (8.3%). Take a look...

On the whole, geothermal is a healthy market with promising technologies. But Ormat itself may not be able to sustain peak levels.

It's a great geothermal operator. And companies like Octavia Carbon are making their mark in the DAC space. However, that doesn't guarantee profitability...

A clean-energy winner can still be a tough stock...

A clean-energy winner can still be a tough stock...

We know that demand for geothermal power is surging. We also know that most of the global population is worried about climate change.

We're less certain about what's happening behind closed doors...

High expectations can pressure management into business decisions that look good in the short term and wreak havoc in the long term.

In Ormat's case, prioritizing battery storage over geothermal plants might be the wrong decision. It could harm the company's competitive edge... and disappoint investors.

We'll dig into that in tomorrow's Daily Authority... and outline a risk most investors ignore when a stock is running hot.

Regards,

Joel Litman

January 29, 2026

Geothermal energy has gone under the radar for years...

Geothermal energy has gone under the radar for years...